Mayhem. Bloodbath. Crash. Adjectives were aplenty yesterday at the benchmark KSE-100 index at the Pakistan Stock Exchange lost 1447 points or 3.23 percent in the day’s trading. The index has lost 6 percent in the last five trading sessions, either side of Eid holidays. But that should not have come as a surprise. Looking at the reaction from some market participants, there appears an element of surprise. There should not have been.

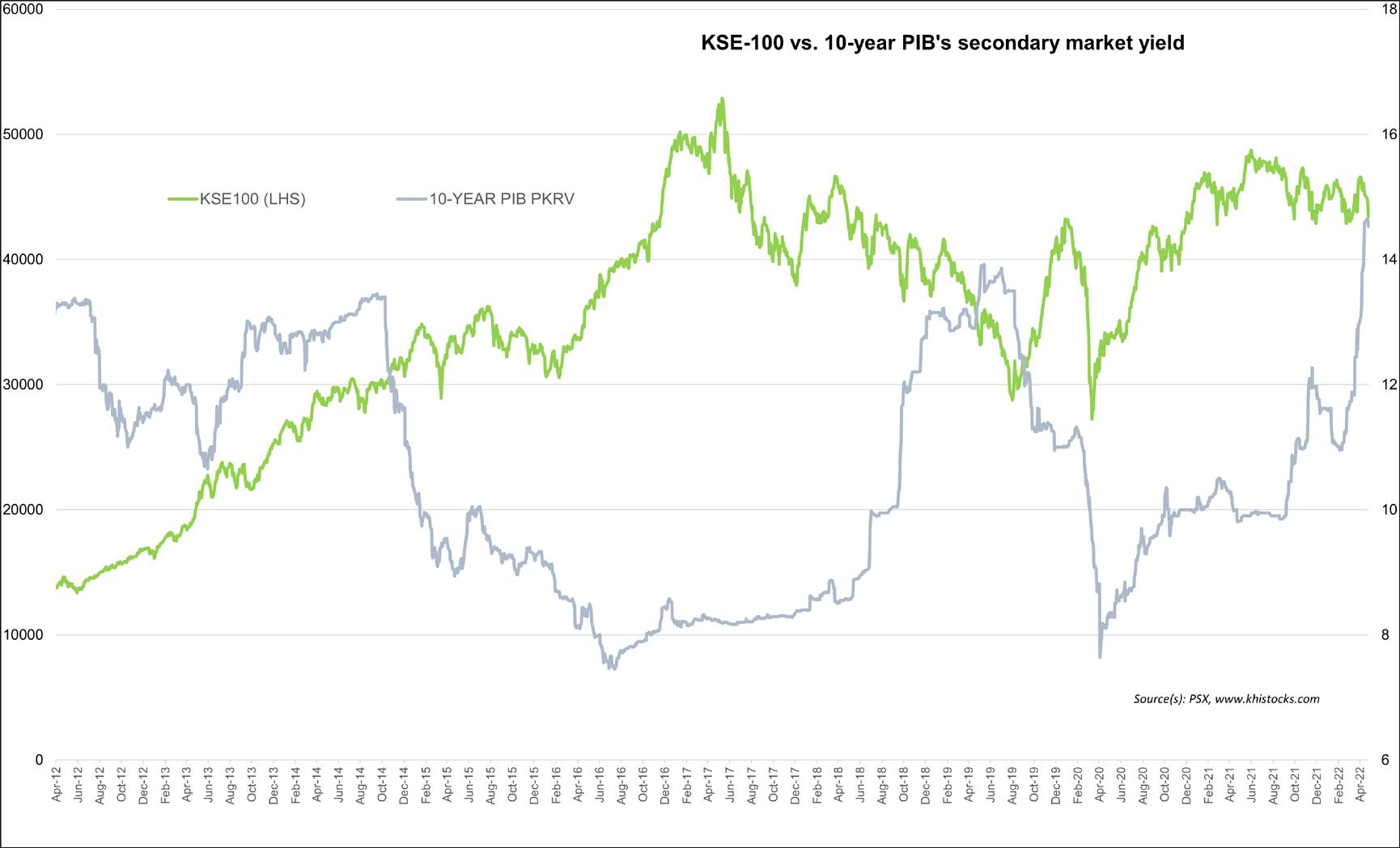

Here is why. The 10-year PIB yields in the secondary market have gone up from 12 percent at the start of April to 14.65 percent – in a matter of 22 trading sessions. And the market kept heading north for three consecutive days, right when the PTI government was ousted – climbing 6 percent in three days. And that is when everybody (literally) thought, this is the beginning of something new.

Only that, 25 years of daily data will always be rich enough for all theories to be laid to rest. If there is anything that the stock market has responded to almost religiously (minus the peak Covid induced rate cuts), is the secondary market yield. So, when the PIB yields were inching up, there was only one way the KSE-100 index was destined to go. Down. And down it went. And there may well be more to it.

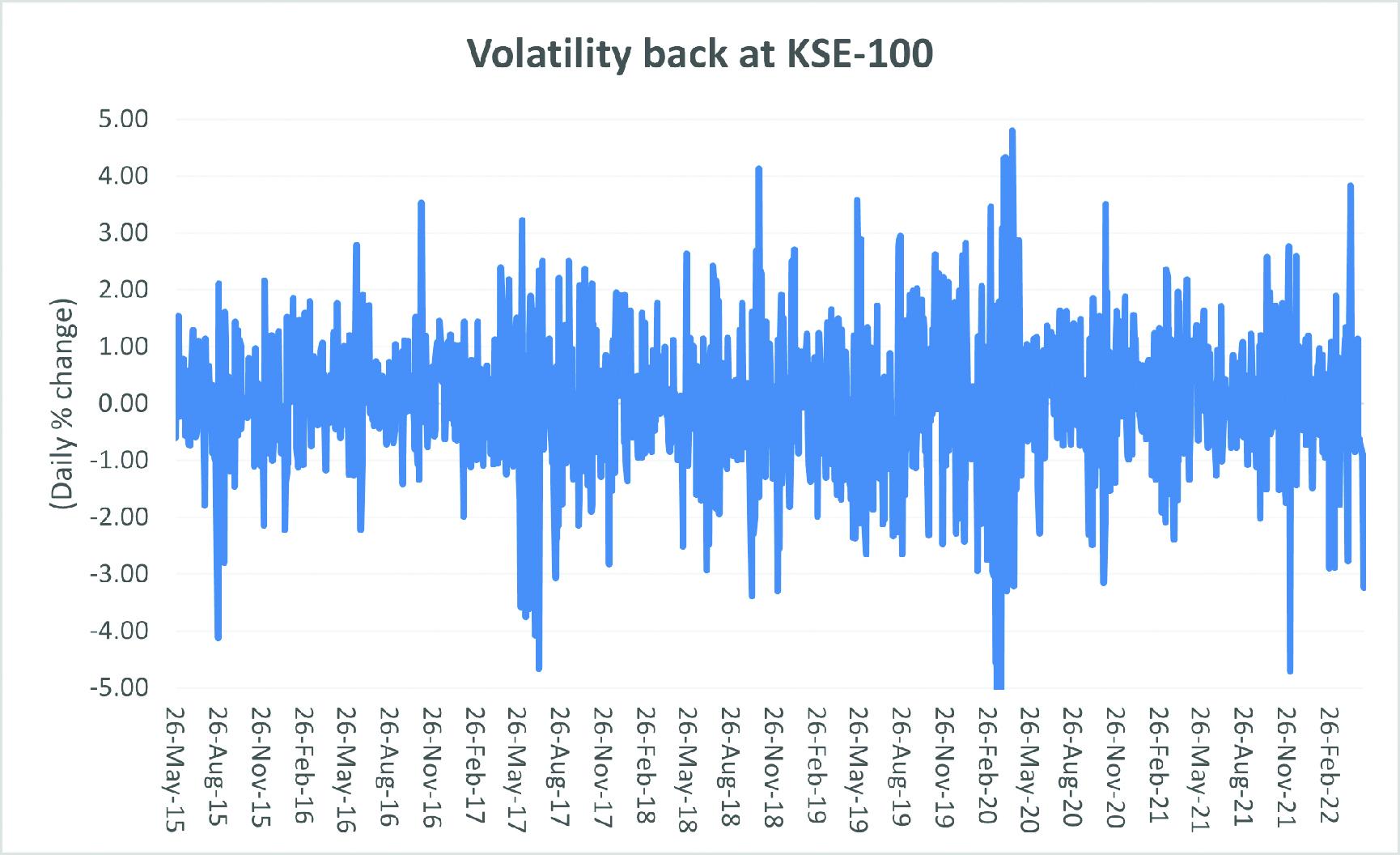

Yes, uncertainty is playing its part. But that is adding more to the volatility than sense of direction. There is just too much going around for the stock market to absorb. From the political heat rising every day as PTI’s Islamabad call nears, to not-so-fruitful returns from Saudi Arabia and UAE. And from the inaction and mixed signaling on fuel subsidies to uncertainty around IMF talks – unknowns are just too much for the market to handle. The volatility in the past few sessions was this high during Covid in 2020, and before that, during 2018 elections and PM Nawaz Sharif’s ouster in 2017.

The central bank will almost certainly raise the policy rate to catch up with the secondary market. And with the global commodity super cycle showing no signs of going away anytime soon, the inflation outlook will continue to be adjusted upwards, keeping chances of further rate hike very real. No IMF deal, quick fiscal fix, or cooled political temperature will lead to an immediate direction reversal at the PSX. The market yields will continue to dictate which way the index goes.

Comments

Comments are closed.