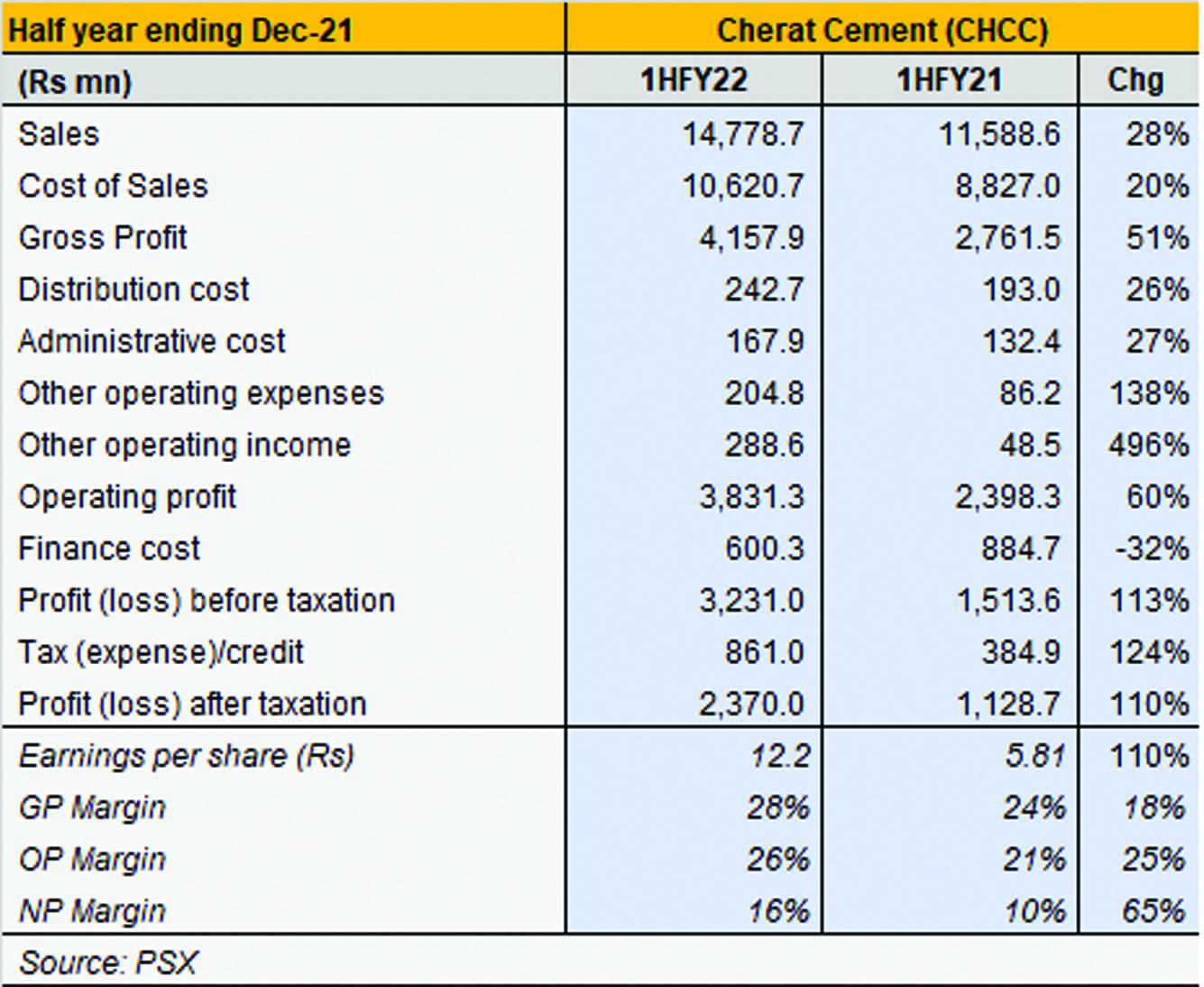

Despite a considerable increase in costs of production, where global coal prices somersaulted to new peaks, a marked slowdown in exports and a lull in domestic cement offtake, cement maker Cherat (PSX: CHCC) has doubled its profitability in 1HFY22. The main driver of this is strong price retention and cost containment through prudent coal buying. Other income also supported the bottom-line with exchange gains—in 1HFY22, other income was 9 percent of before-tax profits against 3 percent this period last year.

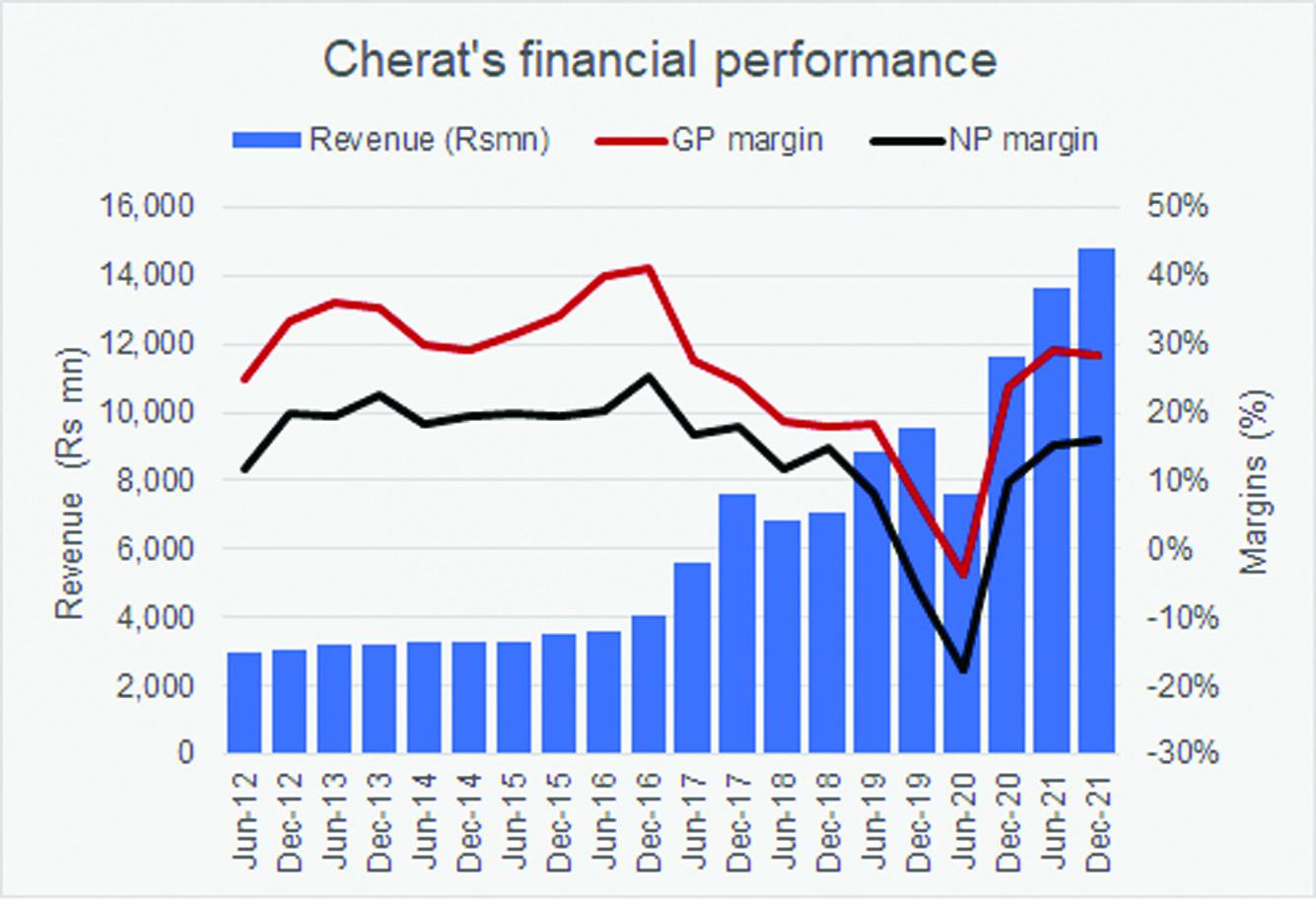

Retention prices have improved considerably for cement makers. For Cherat, based on estimated sales for the period, revenue per ton sold grew 36 percent year on year. This is despite an almost 6 percent drop in estimated offtake. Much like the rest of the cement sector, margins are rebounding from their lows of FY20. Despite higher coal prices, Cherat’s cost per unit sold grew less than the revenue at 28 percent. This allowed for a margin improvement. Last year, Cherat was using about 50-60 percent of coal originating from Afghanistan which is about 10-15 percent cheaper. Though Afghan supplies are short and prices are also increasing, it is likely that Cherat benefitted from the more affordable Afghan coal during the current observation period.

Cherat also benefitted from reduced borrowing costs where as a share of revenue, financial costs came down from 7 percent in 1HFY21 to 4 percent now. Expenses and overheads sustained at 4 percent of revenue. As a result, the net affect of higher other income component together with reduced borrowing costs and sustained overheads were really favourable toward earnings.

Over the next quarters, the real determinant for the company’s profitability will be domestic cement offtake. Frequent increase in prices can only be sustained to a certain degree after which demand begins to subside. Even though, demand is coming back into construction after a serious slowdown, consistently rising construction costs may push demand of construction materials down, instead of forward. In a scenario where exports have been declining, this would not bode well for cement makers. With costs under considerable control, for Cherat and others, the delicate play over prices and demand will determine upcoming earnings.

Comments

Comments are closed.