Nishat Mills Limited (NML), the flagship company of Nishat Group was established in 1951. Being one of the largest vertically integrated companies in Pakistan, the company is engaged in spinning, weaving, printing, dyeing, bleaching, and stitching and apparel business. NML deals in yarn, linen, and other products made from raw cotton and synthetic fiber. The company is also in the business of generating and supplying electricity.

Pattern of Shareholding

As of June 30, 2022, Nishat Mills Limited has an outstanding share capital of 351.599 million shares held by 13,345 diverse shareholders. The local general public holds the major chunk of NML’s share capital i.e. 28.48 percent, followed by directors, CEOs, their spouses, and minor children representing 25.22 percent of the company’s shareholding. Associated companies, undertakings, and related parties grab the next spot with a stake of 8.82 percent in NML. Then come Modarbas and Mutual funds owning 8.02 percent shares of NML. Foreign companies have a stake of 6.09 percent in NML followed by joint stock companies and provident funds representing 5.65 percent and 4.12 percent respectively. The remaining shares are held by other shareholders such as insurance companies, NIT and ICP, foreign public, investment companies, etc.

Historical Performance (FY18-22)

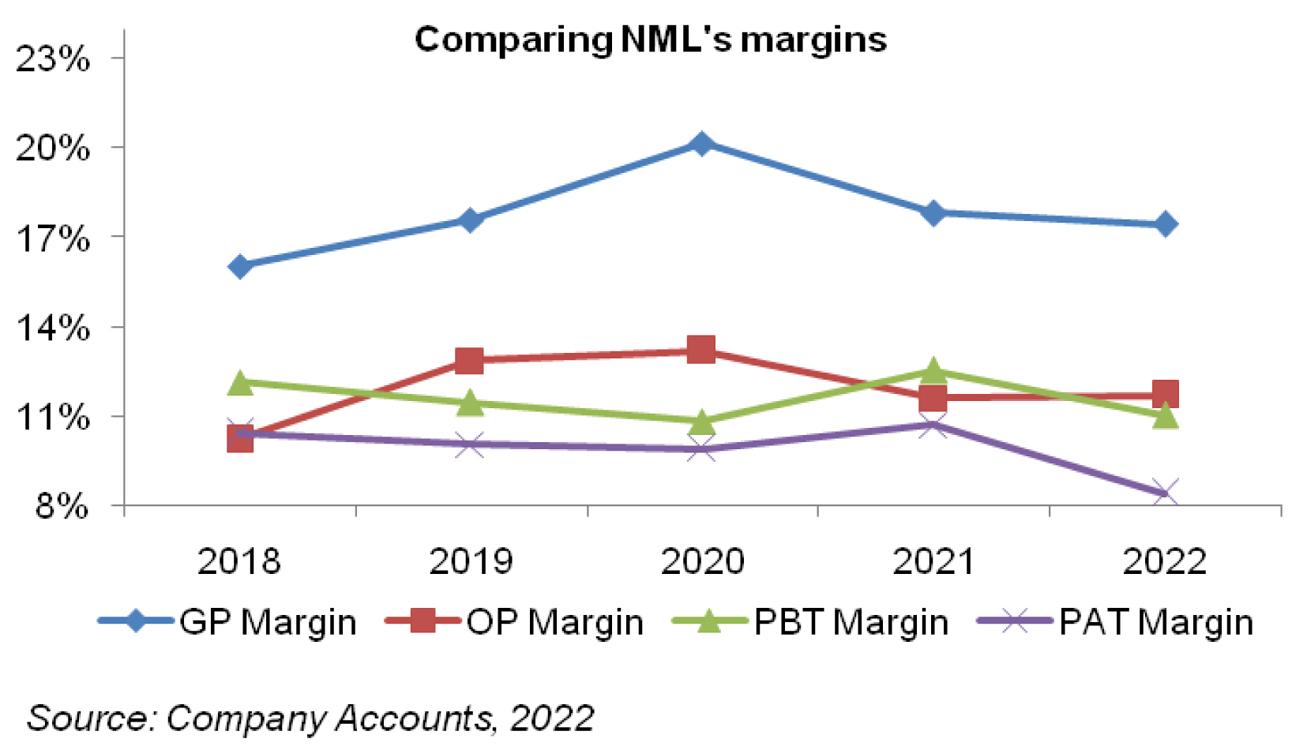

Among all the years under consideration, FY22 steals the show when it comes to top-line growth. The company posted the historically highest revenue with a year-on-year growth of over 58 percent in FY22. The bottom line also posted an impressive year-on-year growth of 24 percent in FY22 with EPS clocking in at Rs.35 versus Rs.28.15 in the previous year. However, when it comes to Net Profit Margin, FY22 shows the lowest NP Margin in the last five years. NML faced a fate similar to what other companies in Pakistan did in FY22. High discount rates, Pak Rupee devaluation, supply chain disruptions, huge increases in cotton prices due to damage to cotton crops on account of catastrophic floods and energy crisis as well as upward revisions in energy prices increased the cost of doing business. Besides, the economic downturn and low purchasing power of consumers affected the demand side. In the presence of all these hindrances, other income proved to be a savior and grew by 31 percent year-on-year primarily on the heels of net exchange gain as NML’s export sales grew manifold in FY22. Dividend income from associated companies also played a pivotal role in keeping “other income” healthy during the year. While this resulted in an upbeat operating margin, high finance costs and taxation for the year burst the bubble and culminated in to a net margin of 8.41 percent in FY22 versus 10.7 percent in FY21.

While NML didn’t succumb to the harsh macroeconomic headwinds in FY22, FY20 tells a different tale where NML’s top line posted a year-on-year downtick of 7.6 percent. This is when the economy was paralyzed by the global pandemic Covid-19. NML’s top line took a hit as export sales to its main markets – China, the US, and Europe – dropped considerably during FY20 owing to lockdowns imposed in the last quarter. Due to subdued demand, the company was also able to curtail its cost and attain a GP margin of 20.16 percent in FY20 which is the highest in the five years under consideration. Dividend income from associated companies remained strong during the year; however, net exchange gain massively dropped because of low export sales. While the discount rate was low during FY20 to revive the business activity post-Covid-19, the finance cost of NML increased due to short-term borrowings to meet the working capital requirements. All in all, the bottom line recorded a year-on-year plunge of 9 percent in FY20 with EPS clocking in at Rs.18.07 vis-à-vis Rs.22.20 in FY19.

Recent Performance (1QFY23)

Global recession, record high raw material prices, inflation, high discount rate, and Pak Rupee depreciation wreaked havoc on the textile sector during 1QFY23. The damage to cotton crops due to floods in the country and import restrictions amidst dwindling foreign exchange reserves created supply shortages for the company and the textile sector in general. Yet, NML posted a year-on-year top-line growth of 45 percent during 1QFY23. This growth mainly came on the back of high prices of yarn, grey cloth, processed cloth, and other products of the company. GP margin, however, considerably shrank due to high raw material prices as well as fuel and power costs.

A major hit to the bottom line came on account of an exorbitant rise in finance costs because of multiple upward revisions in discount rates coupled with an increase in short-term borrowings. Distribution costs also hiked on account of high freight and shipment cost. Other income didn’t support the bottom line either. While dividend income significantly grew in 1QFY23, the drop in other income might have come on the heels of a low net exchange gain. The operating margin dropped from 15.31 percent in 1QFY22 to 11.19 percent in 1QFY23.

Share of Profit from associates jumped from Rs.11 million in 1QFY22 to Rs.304 million in 1QFY23. Yet, the bottom line plummeted by 2 percent year-on-year in 1QFY23. Net profit margin also took a hit and stood at 8.72 percent in 1QFY23 vis-à-vis 12.9 percent in the same period of the preceding year.

Future Outlook

With strong recessionary waves hitting the economies worldwide, cotton consumption is dropping and prices are expected to bottom out by the end of FY23. The textile industry of Pakistan could take benefit of it and expand its margins which shrank in 1QFY23; however, with import restrictions amidst the dollar crunch, the future doesn’t bode well for the textile sector.

In the ideal situation, even if cotton imports are allowed, the sharply depreciating Pak Rupee wouldn’t allow the local textile manufacturers to enjoy the low international cotton prices and keep the margins squeezed. Furthermore, muted demand will result in unsold inventory as was the case in 1QFY23. Hushed demand coupled with the energy crisis might force the textile industries to curtail their capacity utilization which have a ripple effect on the economy.

Comments

Comments are closed.