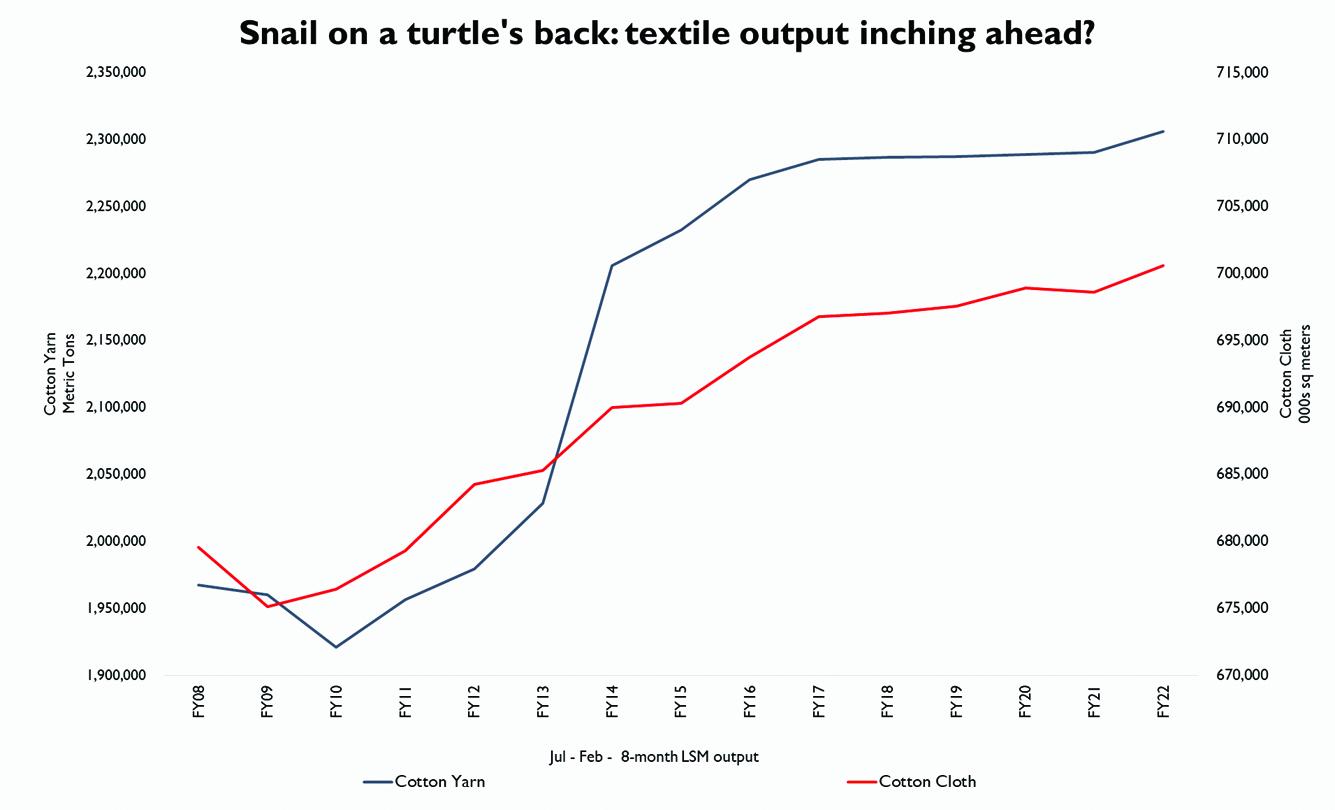

Pakistan’s textile sector output may finally be coming off the ventilator, after spending four years in the ICU. According to latest Large Scale Manufacturing (LSM) data released by PBS, industry’s cotton yarn output rose by 0.70 percent during 8-month of the ongoing fiscal, while cotton cloth output rose by 0.28 percent against same period last year.

These growth rates do not look much on first glance; however, all growth is relative. Between FY17 and FY21, cotton yarn and cotton cloth output rose at a CAGR of 0.04 percent and 0.05 percent per annum. Thus, the acceleration in growth rate during the ongoing year represents no small feat.

Although commentators may be quick to point to the rise in export earnings as the life force driving this resurgence, it is in fact the recovery in domestic cotton output that better explains spinning industry’s improved outturns. According to Pakistan Central Cotton Committee, domestic cotton output during 2021-22 marketing season is highest in three years.

Higher local cotton output – coupled with sustained import momentum – has improved availability of raw material in recent years for the local milling supply chain. Per USDA, domestic cotton consumption for 2021-22 is forecast at 14.4 million bales (of 170kg), up 8 percent against past 5-year average.

Although USDA’s forecast of both local production and imports during the current marketing year is suspect, the uptick in cotton demand is both visible and unmistakable. Cotton arrivals during July 2021 – March 2022 are up 32 percent over last year, according to fortnightly data released by Pakistan Cotton Ginners Association.

At 7.4 million bales, these arrivals estimates do not match with GoP’s - which insists local cotton output is in fact two million bales higher – but still confirms that the tightness in the local market has indeed eased. Similarly, while USDA predicts import quantum at 6.5 million bales, full year imports during FY22 may clock in at no more than 4.5 million bales. But it is worthwhile to remember that imports have nearly doubled compared to just a few years ago.

Pakistan’s textile sector needs to raise its output many times if it is to sustainably cater to both – a burgeoning local market thanks to higher consumer spending, as well as exports. In that respect, the recovery in yarn and cloth production indices (as tracked by LSM-PBS) is both nascent and insignificant. But it most certainly is inching in the right direction; the pace; however, needs to be modulated.

Comments

Comments are closed.