On political clarity, KSE-100 registers 1,700-point increase, its highest in history

- This is the biggest day-on-day increase in terms of points at the Pakistan Stock Exchange, takes index past 46,000 level

Return of political clarity in the country boosted market confidence at the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 Index recorded a jump of 1,700 points on Monday – the highest day-on-day increase in terms of points – to storm past the 46,000 barrier.

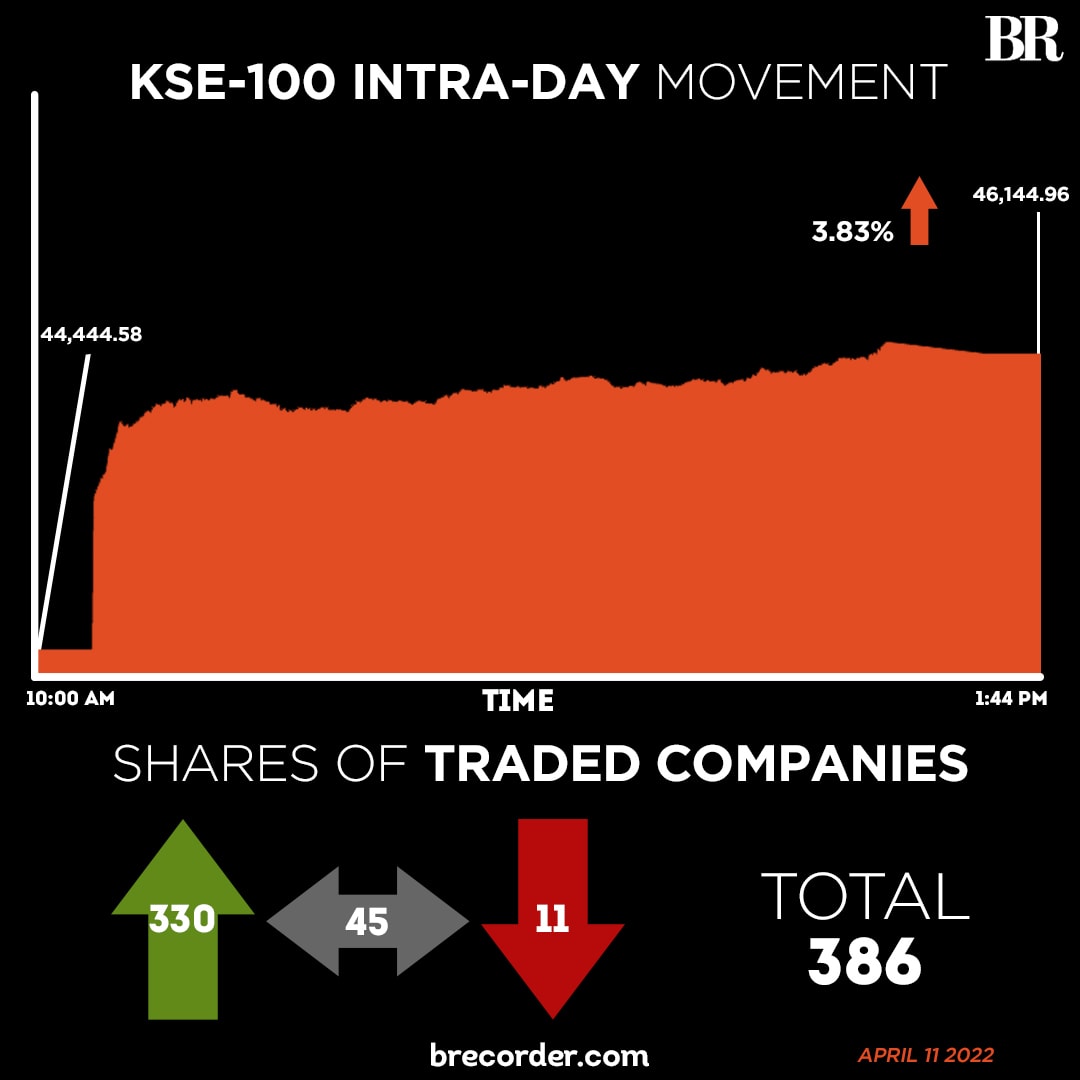

At close, the KSE-100 Index settled at 46,144.96, a gain of 1,700.38 points or 3.83%. In terms of percentage gain, this is the sixth-highest since 2010. In terms of points, this is the highest daily gain since June 2017, when the KSE-100 increased 1,566 points.

“Return of political certainty has led to this development,” CEO of Topline Securities Mohammed Sohail told Business Recorder.

The market expert said statements given by the new government regarding prioritising the economy and continuing talks with the International Monetary Fund (IMF) have also boosted market sentiment.

The PSX has remained under pressure due to concerns over political unrest after a no-confidence motion was filed against Prime Minister Imran Khan. Together with rising commodity prices, and a falling rupee, the index has hovered between 42,000 and 46,000 levels for the last six months. It was last trading at over 47,000 in November last year.

Last week, the benchmark KSE-100 plunged by 707.53 points on a week-on-week basis and closed at 44,444.58 points.

However, a number of key developments occurred during the weekend: the no-confidence motion was completed early Sunday morning, seemingly bringing an end to political upheaval after weeks of uncertainty.

Sectors driving the benchmark index upwards on Monday included banking (496.20 points), cement (309.83 points) and technology and communication sector (271.53 points).

Volume on the all-share index increased significantly to 557.67 million from 227.88 million on Friday.

The value of shares traded also improved to Rs13.36 billion from Rs6.79 billion recorded in the previous session.

WorldCall Telecom was the volume leader with 140.8 million shares, followed by Cnergyico PK with 40.15 million shares, and Fauji Cement with 18.18 million shares.

Shares of 386 companies were traded on Monday, of which 330 registered an increase, 45 recorded a fall, and 11 remained unchanged.

Comments

Comments are closed.