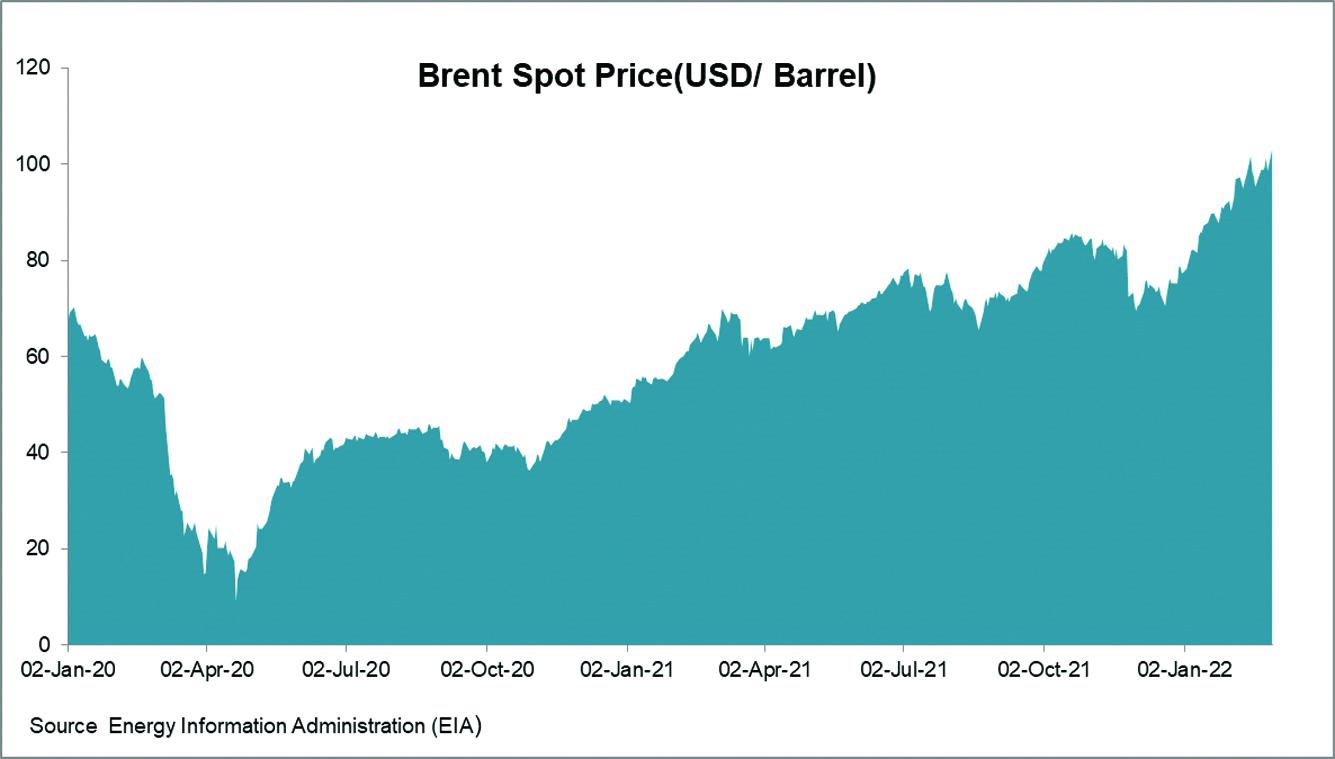

And just when the global economy was returning to normal as coronavirus pandemic weakens, the Ukraine-Russia war has pushed crude oil prices to highest levels since 2008, which will mostly likely batter economic growth and global demand. While the commodity super-cycle has kept pushing oil prices up, the markets around the world are down as crude oil prices stand at second highest on record. The recent surge in global crude oil prices is primarily due to high likelihood of a ban on Russian oil imports by the US and the west amid rising inflation. Soaring crude oil prices mean extended commodity super-cycle and rising prices of many products as a significant part of global consumption comes from fuel.

Oil prices have spurred by more than 60 percent since the start of 2022, and by over 30 percent since the beginning of the Russia-Ukraine standoff. And with a rapid return of Iranian crude to the global market looking less likely, the immediate outlook will remain upward. Such conditions have seriously dented the prospects of global economic recovery – much awaited in the post pandemic era.

The bad news for consumption does not end here. Oil prices are expected to rise further amid the ongoing disruption and long supply shock from Russia where the extended war in Ukraine is opined by the experts to push oil prices to record levels. Goldman Sachs research has raised its 2022 Brent spot price forecast to $135 per barrel from the earlier forecast of $98. Russia has also warned the west of price reaching $300 for crude oil and cutting gas supply to EU.

The situation spells tough times for oil importing countries. For a country such as Pakistan where inflation is already high and fuel is the main driver for overall prices, demand will have to be brought down and the decision of freezing petroleum prices till the next budget will have to be revisited soon.

Comments

Comments are closed.