Fauji Cement: Familiar territory

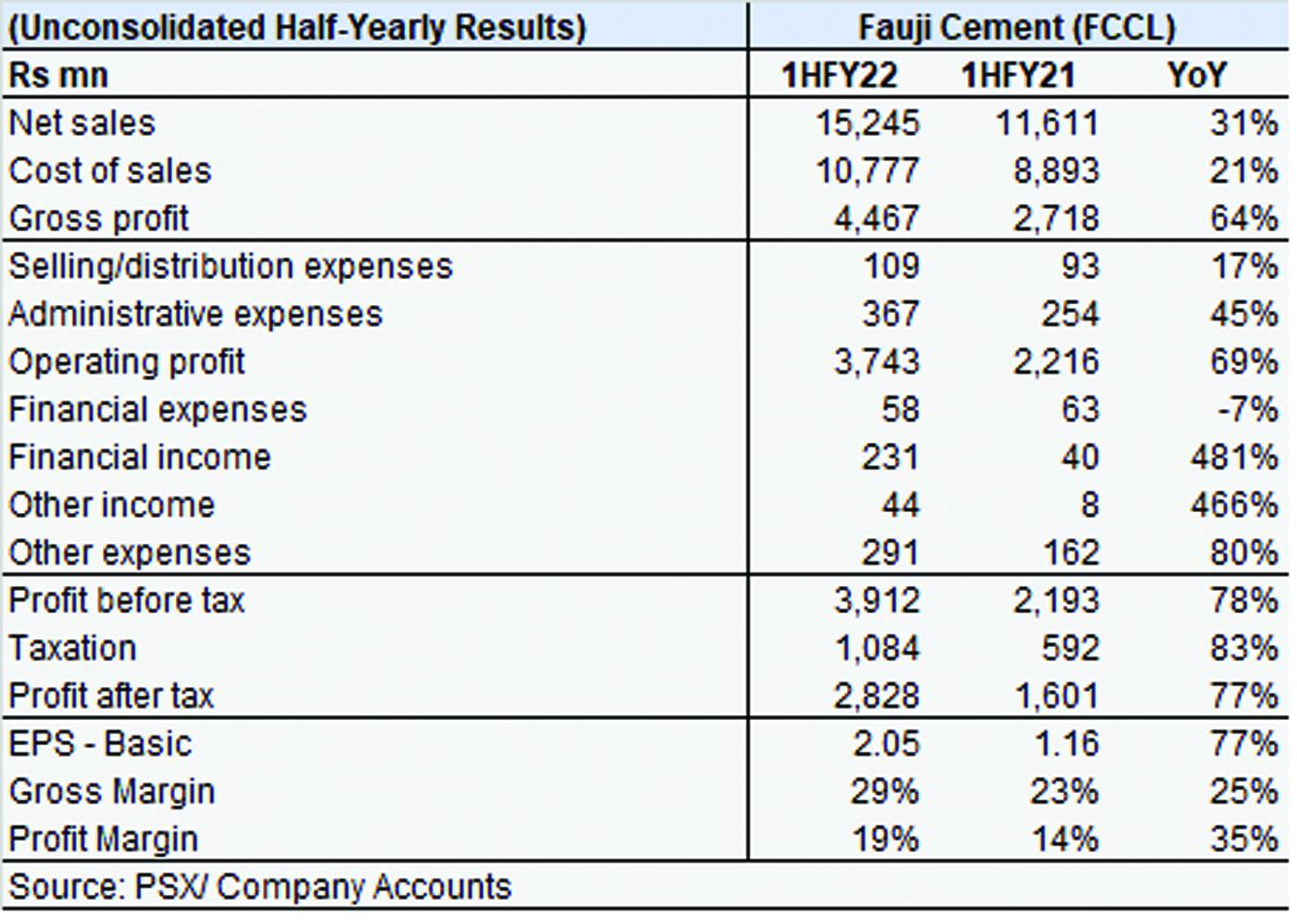

Undeterred by rising fuel and coal prices and a slump in demand, Fauji Cement (PSX: FCCL) much like its peers reported a highly profitable half-year with earnings up 1.8x amid a moderate increase in the top-line. This moderate increase by the way emerged despite a 3 percent drop in total offtake; in which exports that contributed 4 percent to the sales mix dropped 46 percent. Last year, exports for the company were 7 percent of volumetric sales. Timely and gradual increase in cement prices seems to have yielded the right outcome. It came down to retention prices to take earnings forward and they delivered. Fauji Cement utilized the upward run to the max. Revenue per ton sold for Fauji during 1HFY22 grew 36 percent year on year. The company’s margins improved to 29 percent (from 23% in 1HFY21) given that costs—despite the global price rally of coal, rupee depreciation and fuel price increase—grew 25 percent; less than retention.

Fauji is utilizing Afghan coal in its fuel-mix which is about 10-15 percent cheaper than coal imported from South Africa, but Afghan coal is in short-supply and cement manufacturers cannot completely rely on it for their coal needs. Coal switching however has worked thus far and minimized the impact of price volatility.

Fauji’s overheads (including other expenses) stood at 5 percent of revenue against 4 percent last year which should have impacted earnings negatively. However, other income from short-term investments and finance income generated a combined 7 percent to before-tax earnings sufficiently buttressing the bottom-line. Last year, these constituted 2 percent of before-tax profits. As a result of these factors, Fauji managed to improve its profit margin to almost 20 percent in 1HFY22. In fact, margins are in familiar territory again.

Now comes the hard part though. With exports declining and highly dependent on the political climate in crisis-hit Afghanistan that is adversely affecting that economy—Afghan businesses are struggling to make payments in dollars for imports for instance—the burden falls almost on domestic demand which has so far remained sluggish.

Without such a recovery—and on sustained level— cement prices will drop and cement manufacturers would be racing with discounts to sell off excess cement. Between the hydro power projects under construction and Naya Pakistan Housing projects towing the boat out to sea, so to speak, cement offtake should improve. But would it, more on that later. Fauji’s fate meanwhile is tied to it.

Comments

Comments are closed.