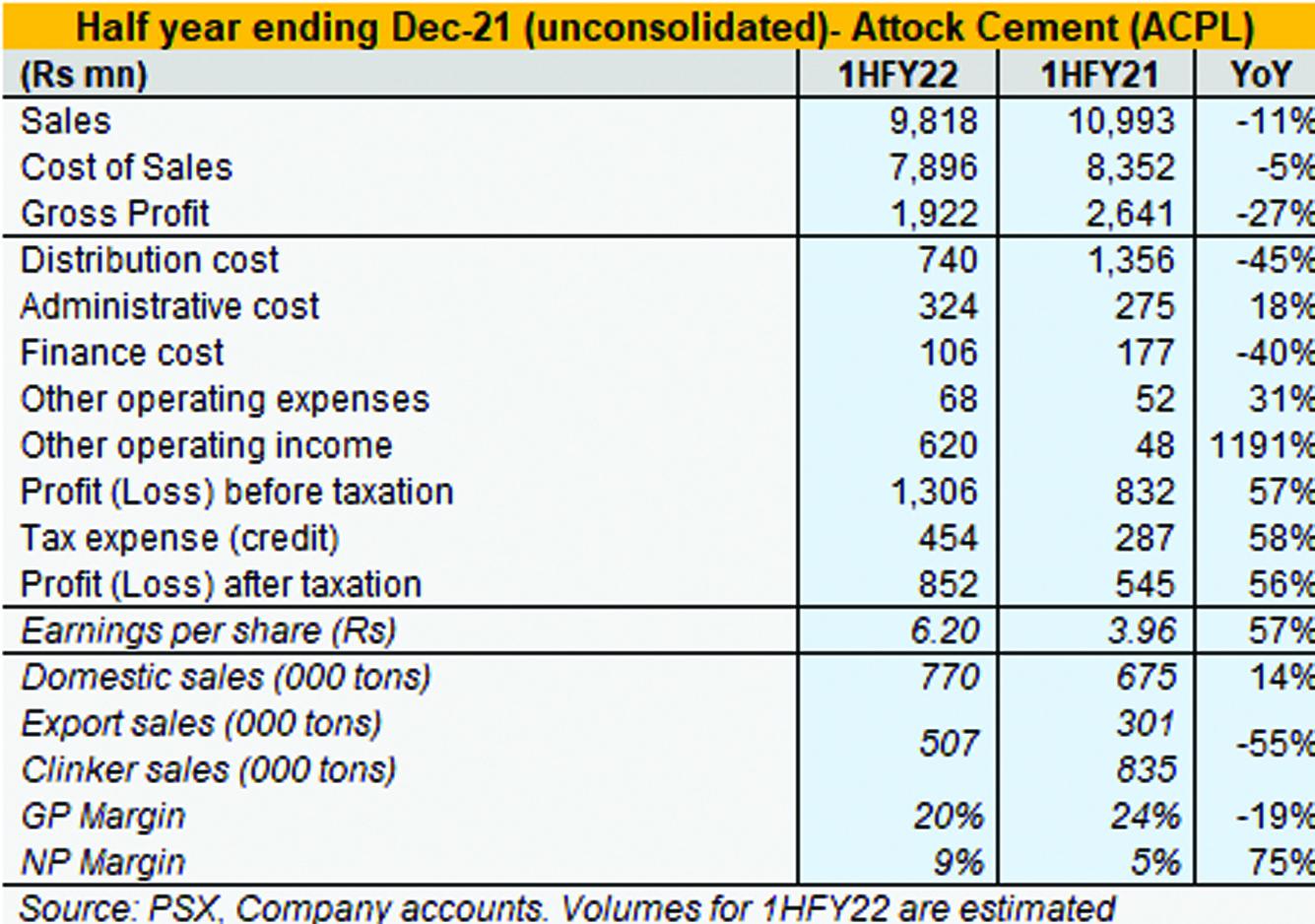

For the small cement manufacturer Attock Cement (PSX: ACPL) exports matter. Located closer to the port, the company has been exporting to market overseas fairly significantly. Even last year, the company’s export share in its total sales mix was 60 percent (in 1HFY21) and in the past, this share has been even higher. But skyrocketing freight costs due to the not-quite-post-pandemic supply chain disaster and importers’ reluctance to increase prices has caused both cement and clinker exports for Attock to plummet. The company’s revenues resultantly despite growth in domestic dispatches (about 14% in 1HFY22 and 20% in the first quarter year on year) have fallen.

Notably, the profitability growth of 57 percent (before-tax) comes due to other income. In 1HFY22, other income contributed 47 percent to the pre-tax earnings of the company. Last year during the period, this was only 6 percent. While primary business is under pressure, the company is relying on other income to shore about profits.

Domestic demand has been robust against all odds, and favourable prices in the domestic market managed to keep revenues from domestic sales up. Overall, the company’s average revenue per ton sold (using estimated sales numbers for 1HFY22) is up 27 percent which supports the assertion that whatever Attock sold, it fetched higher prices of it.

Costs however had Attock beat. Given coal’s unrelenting rally in the global market, domestic cement manufacturers have been using local coal and inventories from earlier to manufacture cement. Other fuel costs amid rising oil prices have also been under inflationary pressures.

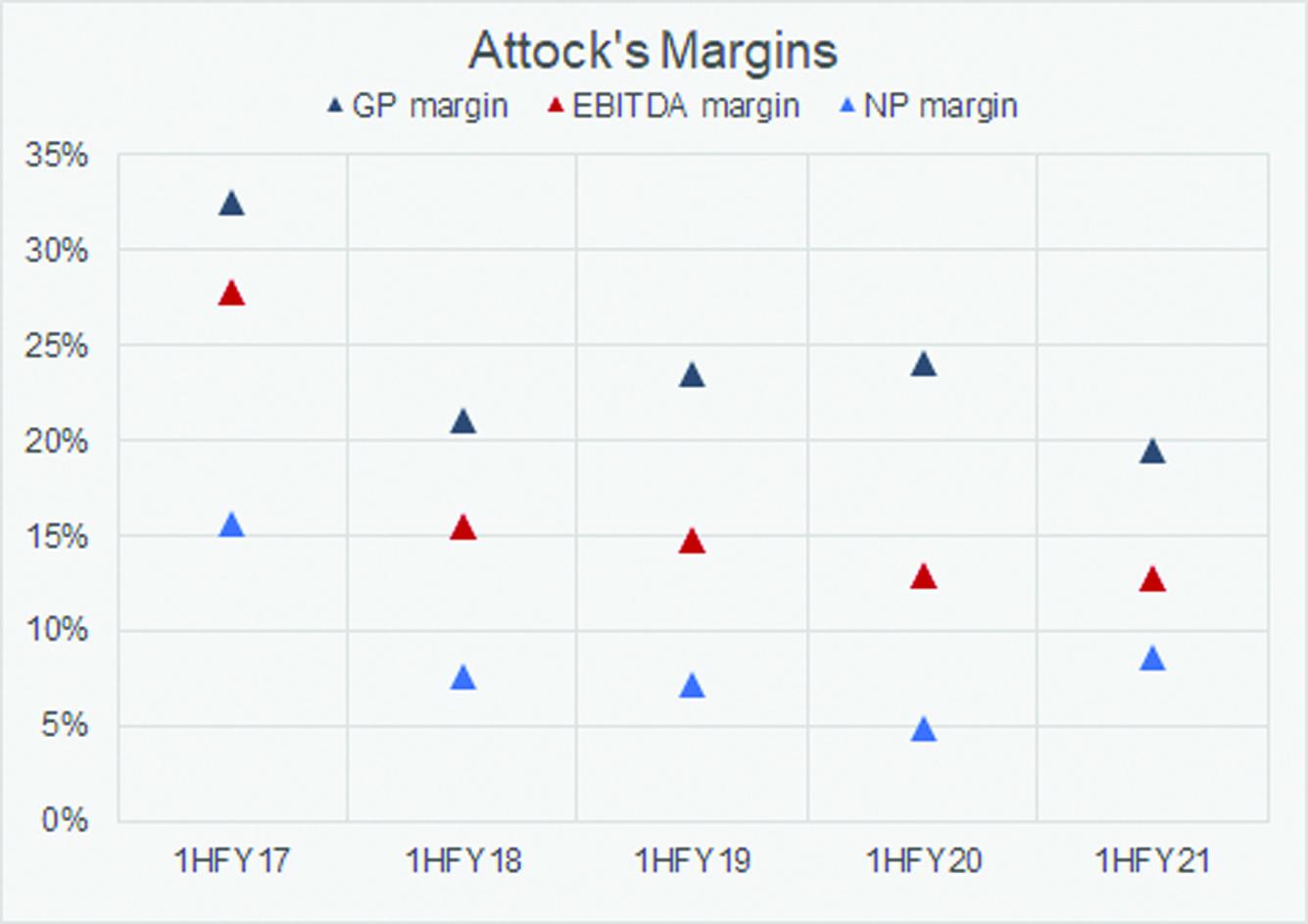

Costs per ton sold for Attock (again using estimated sales numbers for 1HFY22) grew 34 percent year on year. As a result, gross margins have squeezed from 24 percent down to 20 percent. The company’s net margins meanwhile have only grown due to other income plugging in the gaps left by declining revenue. The company has cut down on overheads from 15 percent down to 12 percent of revenue. Distribution costs saw significant decline due to lower exports.

Exports are expected to remain in similar growth vicinity for most cement manufacturers. For players like Attock, this does not bode well as they are more tuned to selling abroad than domestically. In the south, domestic demand while upward moving is never as vibrant as demand in the north.

Evidently, most housing and construction projects under Naya Pakistan Housing Plan (NPHP) and hydropower projects are concentrated in the north with little demand trickling down. Tough times ahead.

Comments

Comments are closed.