Profit and dividend repatriation in the particular context of foreign direct investment during the first quarter of FY22 fell by 19 percent year-on-year as per the latest available data on the central bank’s website. Repatriated profits and dividends in 1QFY22 were largely led by four key segments: Food and packaging, telecom, financial businesses, and power that together accounted for over 73 percent of the total outflow during the quarter. While in terms of country of origin for the foreign companies, UK and USA together accounted for 42 percent of the repatriation on FDI while another 20 percent was sent back to China and Netherlands.

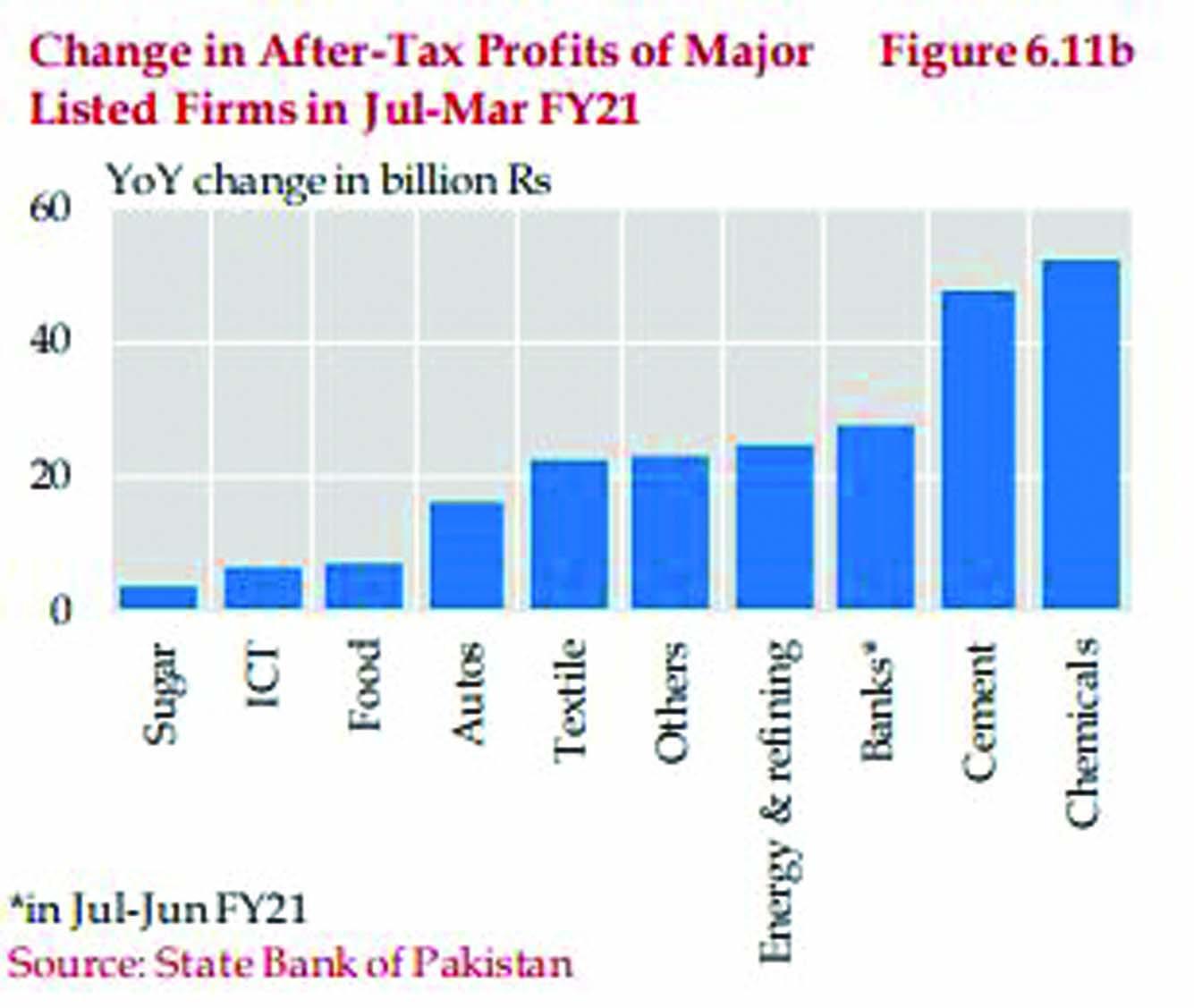

Repatriation by foreign companies in 1QFY22 however follows a decline in annual repatriation of profits and dividends on foreign direct investment. In FY21, repatriated profits and dividends increased by 24 percent year-on-year. The latest SBP’s State of Economy report (2020-21) highlights that the sectors that posted a substantial increase in profits after the Covid-19 outbreak, such as multinationals in food, chemicals including pharmaceutical and cleaning supplies companies, as well as banks, were the ones that higher profit and dividend repatriations. On the other hand, sectors with weaker profitability such as the oil and gas and refining sectors witnessed lower profit repatriations in FY21.

Rising profit and dividend repatriation by the foreign companies and MNCs portrays improving foreign investor confidence in general, and local laws impose no limits on the repatriation of profits to attract foreign investors and allow 100 percent foreign ownership of companies. But the opponents also highlight that the situation of FDI in the country does little to match the concept. FDI in Pakistan has been declining, and FDI net of repatriation in FY21 stood at a paltry $373 million, which was otherwise $1.86 billion. Many also believe that increase in the repatriation of profits and dividends back to their parent companies by the multinational players amid continuously falling FDI inflows, as well as rising outflows, is akin to eroding investor interest in reinvesting earnings in the host country - a better signal of investor confidence to attract new investors.

Comments

Comments are closed.