Aruj Industries Limited (PSX: ARUJ) was set up in 1992, under the Companies Ordinance, 1984. The company manufactures Fusible Interlining and dying/bleaching/stitching of fabric at its factory in Lahore. The export destinations for both, denim and non-denim products from its apparel division are UK, Europe and the US.

Shareholding pattern

As at June 30, 2020, more than 86 percent of the total shares are with the directors, CEO, their spouses and minor children. Within this, 22 percent shares are held by each of the following: Mr. Ali Maqsood Butt and Ms. Aruj Butt, both directors of the company. Over 11 percent shares are with the local general public, while associated companies, undertakings and related parties own close to 2 percent shares. The remaining roughly 1 percent share is with the rest of the shareholder categories.

Historical operational performance

Aruj Industries Limited has mostly seen a rising topline, while profit margins declined until FY18 and FY19, and improved in FY20.

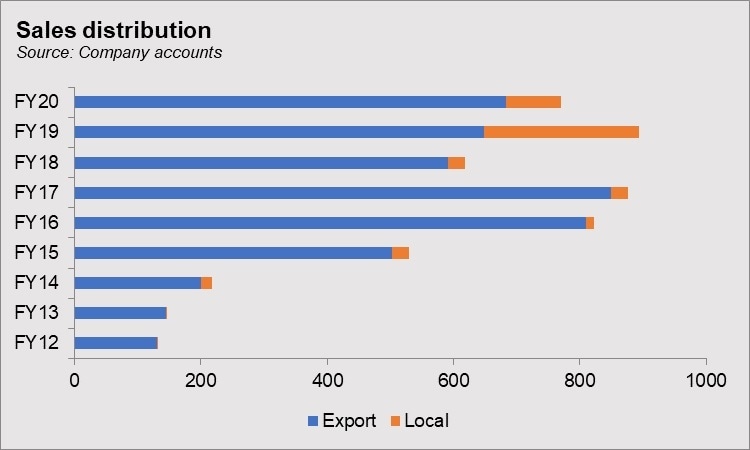

Revenue growth was relatively subdued in FY17 at 10 percent. While export sales made a large part of the total revenue, both, local sales and export sales registered an incline. The apparel division in particular, helped to increase the topline, however, the rate of growth slowed down due to the referendum for UK to leave the EU. In addition, the general economic climate of Pakistan also played its role as despite efforts, the country was unable to increase exports. Cost of production, on the other hand, remained unchanged at 88 percent of revenue, keeping gross margin flat at close to 11 percent. But net margin fell to 2 percent due to an increase in distribution expenses that primarily constituted of export expenses that grew from Rs 32 million in FY16 to Rs 52.6 million in FY17.

After growing for five consecutive years, revenue contracted by nearly 16 percent in FY18. While local sales remained more or less unchanged, export sales, which makes the biggest contribution to revenue, fell drastically by 30 percent. Given that a major chunk of the revenue came from exports, it also meant that the company had to face competition from regional peers. The latter had a low cost of labor that gave them an edge while Pakistan’s cost of production was higher. In order to sustain customer base, the company compromised on profitability that is reflected in the lower year on year gross margin at 9 percent; cost of production exceeded 90 percent of revenue. With administrative and finance expense also making a larger share in revenue, net margin fell to an all-time low of below 1 percent for the year.

FY19 saw revenue rising by over 23 percent; while both, export and local sales saw an incline. The share of local sales in the total revenue grew. In FY18 it contributed Rs 26 million while in FY19 it grew several folds to Rs 246 million. With the election of the new government and hence the new tax policies, there arose a gap in the local market that could not be filled by the unregistered sector. Aruj Industries being a public limited company saw this opportunity and expanded its customer base. But the devalued currency increased the cost of production as is seen by cost making 92 percent of revenue. However, the slight decline in administrative and distribution expense allowed net margin to improve marginally to close to 1 percent for the year.

The company saw revenue declining by 18 percent in FY20. Local sales shrunk to its original level, making a small share in revenue, while the export sales dominated the revenue pie, growing by 5.4 percent. With regards to the company’s business divisions, the processing division remained in demand despite Covid-19, while garment division saw the major brunt of decreased revenue. Despite the lower revenue, profitability improved on the back of lower costs as cost of production fell to 87 percent of revenue, raising gross margin to 12.8 percent. this also trickled down to operating margin, but the finance expense and taxation kept net margin flat at close to 1 percent.

Quarterly results and future outlook

Revenue in the first quarter of FY21 was higher by 52 percent year on year. This was in part driven by the processing division that saw a healthy demand. The garments division too saw a 13 percent rise in exports. but with costs making a large share in revenue, profitability remained flat year on year with both quarters seeing a 1 percent net margin.

The second quarter of FY21 also saw revenue higher year on year, by over 3 percent. This was largely driven by local sales “due to firm demand as lockdown restrictions eased”. Cost of production saw a very marginal decline as a share in revenue; with other costs also reducing slightly, collectively it made net margin improve to 3 percent for 2QFY21 compared to 2 percent in 2QFY20.

The third quarter also saw higher revenue year on year by 5.7 percent as lockdowns eased and mass immunization programs commenced. However, the rise in prices of cotton trimmed profitability; gross margin reduced to 7 percent. But net margin in 3QFY21 was supported by the drop in finance expense due to lower KIBOR, that was substantially high in 3QFY20. Cumulatively too, the higher cost of production kept gross margin lower year on year in 9MFY21 while net margin was better on the back of lower finance expense.

With rising product demand and some stabilization in cotton prices, the company expects better financial performance in the last quarter, while the local market is subject to uncertainty with regards to Covid-19.

Comments

Comments are closed.