Trade numbers – start worrying?

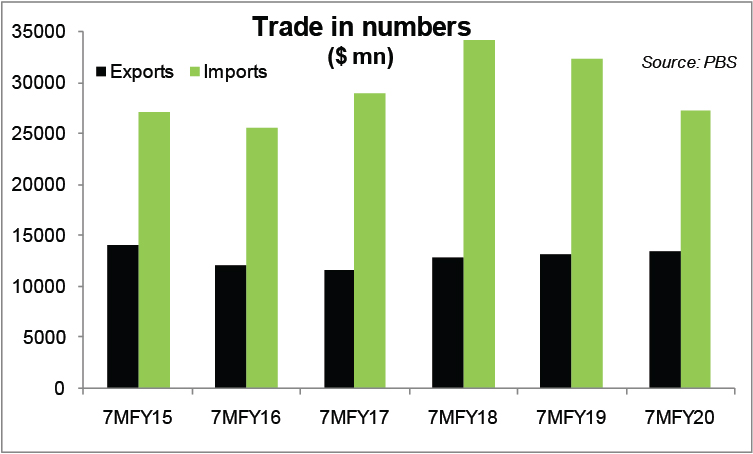

Pakistan’s January 2020 trade deficit at $2 billion is an improvement of 15 percent year-on-year. It had improved at an average of 30 percent in 1HFY20. The low base effect is fast catching up with trade deficit improvements. It won’t be long before the government will have to find another indicator to do the posturing of improved economic indicators.

This is not to say that the trade picture has all gone haywire in a month or two. But surely, there was always going to be a limit to where the imports could be kept down. And that seems to have been achieved in August 2019 at monthly imports of $3.7 billion. One will have to keep a close eye on composition of imports, to assess if the slow and gradual pickup is evenly spread, or more tilted towards consumption related imports.

The monthly import slide having stayed in high double digits for seven straight months has come down to single digits in the last two. This could well be indicating a slow but sure reversal of the trend. Growth in imports, on standalone basis, is not necessarily a worrying sign. But if the other half of the trade equation simply refuses to lift itself – the concerns have some merit.

The exports during 7MFY20 have grown by a mere 2 percent year-on-year. The imports have gone down by 16 percent in the same period – and that keeps the overall picture look good. Good it is, but it is fast becoming deceiving and won’t be long before the table turns, if exports do not grow.

Yes, there has been a visible improvement in the quality of exports, as evidenced by significant growth in quantum of textile exports. What is also encouraging is the increase in value added segment exports, where quantitates have gone up by as much as 30 percent year-on-year. Rice exports have also staged a strong comeback. But at the end of the day, quantities, for no fault of Pakistan’s own, will only be one part of the equation. What matters is the dollar value – and that has not taken off.

Pin it down to slowdown in global demand and downturn in commodity prices. But that is the reality of the competitive global trade landscape. Pakistan cannot forever have favourable conditions. A lot keeps being said on Pakistan’s supposed lack of export diversification, but on the trade map, Pakistan does not fare that low on diversification. It is the competitiveness where Pakistan’s exports have fared worse.

Pakistan would hope the oil prices remain low. That, seems the only way in the short-term to keep the trade deficit from going back to the highs of old days. Meanwhile, those at the helm would do well to not possibly irk the export industry by levying surcharges on energy consumption. It does not hurt to do some math, or research, on matters of such importance. It seems a no-brainer that a few billion rupees in levies from the export sector, are not worth risking more export dollars. The fiscal deficit has already started to look like a headache for FY20. One hopes, trade does not make it a migraine.

Comments

Comments are closed.