There are many articles out there claiming that as Europe experience moderate temperatures this year, with sufficient gas inventories, it has averted an energy crisis that most feared.

However, this is linear thinking and recent developments show it is premature to claim that Europe’s energy crisis is over. Temperatures are falling, while demand for gas is gradually increasing. China’s reopening can further exacerbate this scenario.

Latest data show that temperatures have begun to fall again. According to a brilliant Twitter thread by Francesco Sassi, gas stocks have plunged to 78.35 percent from 81 percent a week ago — gas storage is below 80 percent now.

Gas stocks present a positive picture when viewed against last year during the time when tussle with Gazprom was at its peak and the inventory levels were below 40 percent.

But gradually and by spending billions of euros (according to one estimate around 26 billion euros), countries were able to fulfill the levels, providing a buffer against winters which were also unexpectedly milder than last year.

It is expected that temperatures will stay at this level for some weeks, lower than the seasonal average. Falling temperatures can cause a considerable uptick in gas consumption.

This was evident in the last week of December 2022 when Germany’s demand for gas jumped 20 percent during a week of colder than usual temperatures raising the demand of gas by 12 percent above the 4 year average during the same time as compared to the previous year.

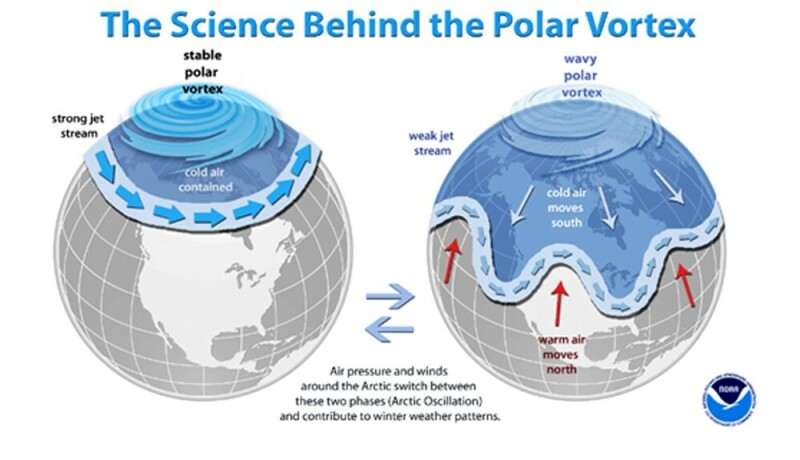

Additionally, the polar vortex that is expected to hit Europe soon might be milder but still enough to keep temperatures lower than the previous one.

According to some people I spoke with, they have started to feel colder in European countries.

As a result, gas consumption is likely to rise. Gas prices are dropping too which can, ironically, increase demand and thereby prices (again).

One important thing to note is that gas prices are still three times higher from their 2010-2019 average. But they are only down from their post Russia-Ukraine war highs.

One of the most important variables is the reopening of China. As China reopens it can spur the demand of LNG which can result in shortages of up to 7 percent of Europe’s annual consumption which can force them to impose rationing.

Moreover, the price of energy will skyrocket again which can test European resilience against the energy crisis.

Importantly, China is suffering from a shortage of natural gas as temperatures have plunged in recent days. Households are receiving gas for a maximum of 5 to 6 hours, angering millions of citizens. Russia has been China’s main supplier and the latter stocked up after the war in Ukraine as imports from Russia jumped 42 percent - this was done at a very high price.

However, in China, distributors cannot charge their consumers higher prices and the wholesale cost they receive is three times higher than what they can charge.

Therefore, to say that ‘Putin is losing the energy war’, as reported by the Financial Times, will be premature. There are many factors that remain in action in order to call off this energy crisis off.

The current year will remain a challenge for the continent besides the high inflationary environment, geo-political rumblings, the energy crisis in the wake of China’s re-opening and vicissitudes of weather which will continue to present Europe with hurdles to overcome.

The article does not necessarily reflect the opinion of Business Recorder or its owners

The writer is an international energy and economic analyst. He works at Primary Vision Network — a US-based market intelligence and consultancy firm

Comments

Comments are closed.