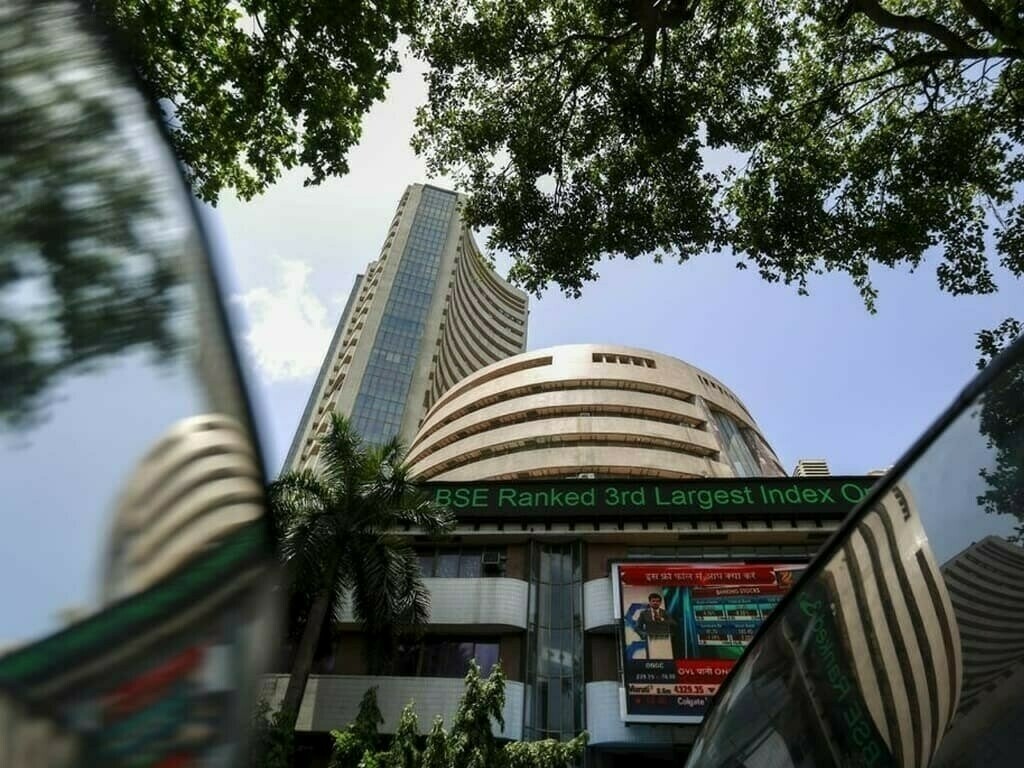

BENGALURU: Indian shares were set to dip for a third straight session on Thursday, as concerns over a possible US recession and the pace of the Federal Reserve’s rate hikes dampened sentiment.

India’s NSE stock futures listed on the Singapore exchange were down 0.07% at 18,658.50 as of 8:05 a.m. IST.

The blue-chip indexes declined on Wednesday, after Reserve Bank of India struck a hawkish note after announcing an increase in its key lending rate and reiterated its focus on taming stubbornly high inflation.

US worker productivity data for the third quarter beat forecasts on Wednesday, muddying a debate on the trajectory of Fed’s rate hikes.

The latest data followed better-than-expected US services industry activity numbers which came on Monday, signalling strength in the world’s largest economy.

Indian shares settle lower on hawkish Fed fears

Wall Street equities slid after the data overnight, and Asian shares were mixed in early Thursday trading, with the MSCI Asia ex Japan index rising 0.35%.

Offsetting the losses in domestic markets could be the slide in oil prices, which fell to the lowest in 2022, driven by rise in US fuel stocks.

A slide in crude prices is a positive for oil importing countries like India, where crude accounts for the bulk of the import bill.

Foreign institutional investors sold a net 12.42 billion rupees ($151.09 million) worth of equities on Wednesday, while domestic investors bought net 3.89 billion rupees ($47.32 million) worth of shares, as per provisional NSE data.

Comments

Comments are closed.