K-Electric is usually in the news for wrong reasons. Either someone in Islamabad or Karachi bashes the company for power generation and other related issues. The fact of the matter is that it is one of the best examples where privatization has yielded results for the public. The supposed city of lights has gained massively due to the operational efficiencies of the company while its shareholders have not benefited much in terms of dividends or capital gains.

Ironically, KE’s privatization has been vehemently opposed by the energy sector bureaucrats in Islamabad and some politicians. They wrongly use the argument against privatization by using K-Electric as a poster child. They say that it’s a natural monopoly and a strategic asset which was best operated under public domain. And the argument is used to negate the need for privatization of other discos.

The story in fact is stark opposite. KE privatization is a great success story. The commitment and acumen of the sponsor is worth mentioning. One argument used by proponent of nationalization is of unsuccessful privatization of PTCL. However, it was not privatization in a strict sense. PTCL's controlling stake remained with a government entity (Etisalat), and it is a mess now. Its group profits after tax were Rs30 billion ($500 mn) in 2004 and now it’s a loss-making entity.

The story of KE is, however, different. KE was privatized in 2005 by KES Power a consortium of Middle Eastern investors who acquired 66 percent shares while Government of Pakistan retained 24 percent minority stake. The consortium has managed to drive significant improvement in the system contrary to perception. Now its deal with Shanghai Electric has been stuck in limbo for the past six years; still the company keeps on improving its operational efficiencies for the betterment of the inhabitants of Karachi.

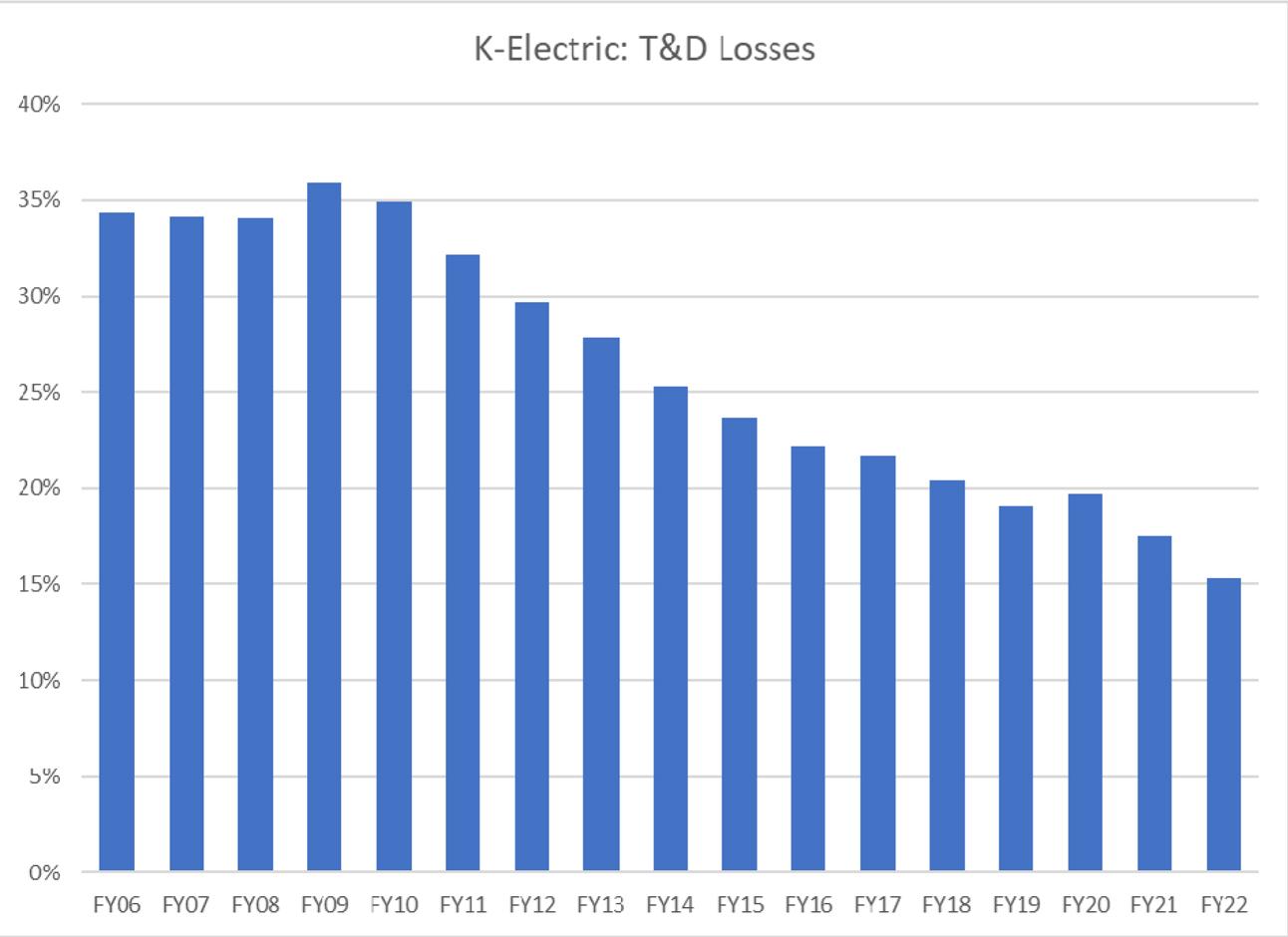

When KE was privatized, its T&D losses were at 34.2 percent, and within fifteen years, the losses reduced to 15.3 percent, more than half. This doesn’t happen out of thin air. The company has invested $4.1 billion in the value chain since privatization. One the flipside, other discos are losing almost equivalent amounts of money on an annual basis simply because they cannot curb T&D losses.

Before privatization, KESC, known then, was making huge losses which the government used to fund. Privatization reduced this burden, as KE has taken no operational subsidy since 2005. The efficiency improvements made by KE have translated into an annual benefit of Rs170 billion in the form of a reduction in tariff, whereas the conversion of lost units into billed units has enhanced the national tax base with an annual impact of Rs13 billion.

Karachi used to be a messy city and recovery was not easy in the city. When KE started its crackdown, all the political parties joined hands toprotest the entity. But the management stood by its resolve. That yields results. The number of KE consumers has increased from 1.8 million in 2006 to 3.4 million as of now. The quantity of units sold has gone from approximately 8.4 Gigawatt hours (8.4 billion units) to 16.7 billion units. This expansion is due to active marketing and distribution. The company has a full-fledged team working on it. This is in sharp contrast to other discos where there is no incentive for the management to increase the sales or number of consumers.

There are improvements in the generation fleet as well. And the company has a strategy unit that is working on the future planning. The company is working on adding renewable in the mix and on thermal efficiency to lower the cost of generation. The plan is to increase renewable generation from 100MW currently to 1,200 MW by 2030

The other element where KE stood out is customer service. They have a decent app, and the company communication department is active and dynamic. The company has touched the 1 million customer accounts activated on digital touch points - app, Whatsapp and SMS platforms and 100,000 customers have already consented to switch to paperless bills.

It’s about time that Islamabad learns from the success of KE and should start working on the privatization of other discos. It should start with problems making discos such Peshawar, Hyderabad, and Sukkur. Seeing KE turnaround story, others surely can become profitable and efficient entities.

Comments

Comments are closed.