APL – another robust quarter!

After a good year (FY22), the oil marketing companies’ (OMCs) earnings were expected to come under pressure during the first quarter of FY23 due to significant inventory losses. These losses have been opined to come from significant inventory losses in 1QFY23 owing to the decline in international crude oil prices along with refinery cracks for petrol particularly. Also, the decline in volumetric sales of petroleum products of around 23 percent during the quarter was likely to affect the overall profitability As a result, the gross margins were expected to slide down significantly.

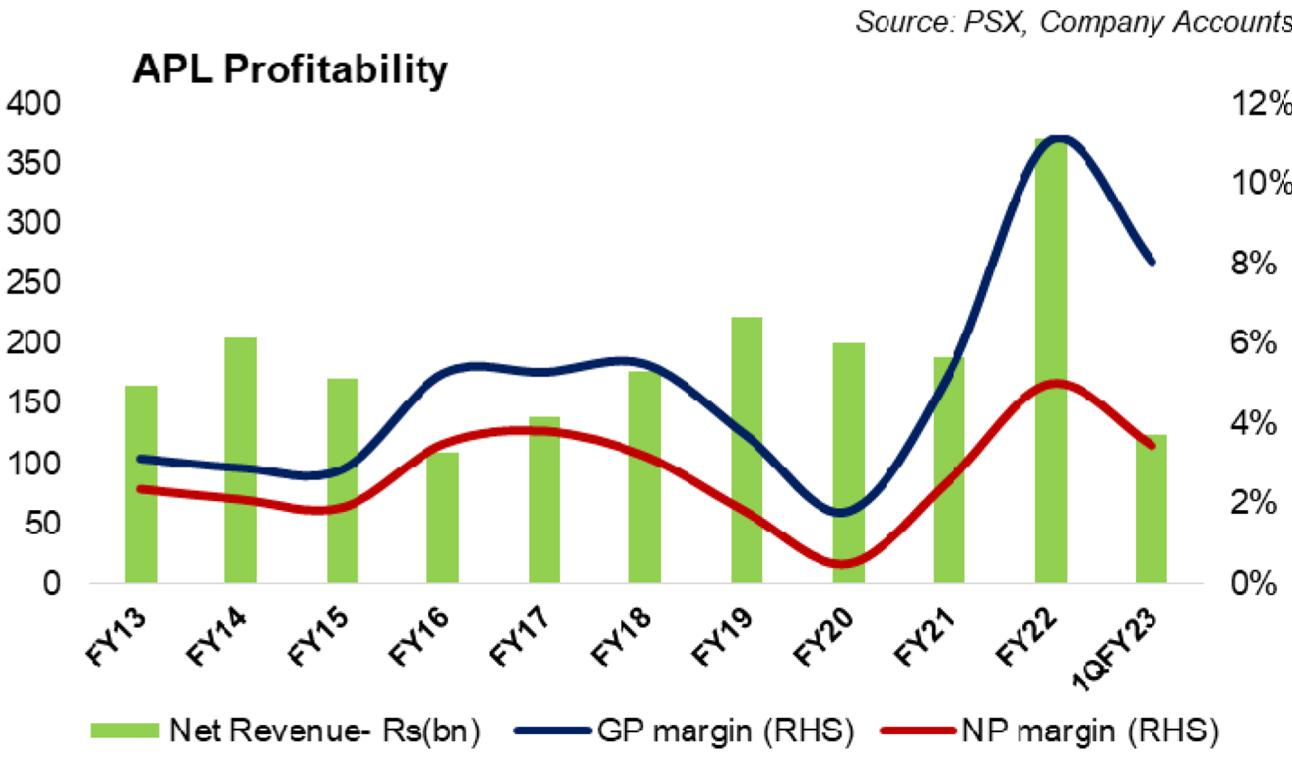

Attock Petroleum Limited (PSX: APL) however announced almost 80 percent rise in bottomline for 1QFY23 along with a gross profit of 8 percent versus 6.4 percent in 1QFY22. The result for the OMC’s performance was not even close to what the market was expecting. The growth in earnings started at the top with the rise in net sales recorded at 70 percent year-on-year due to higher petroleum product prices. On the volumes side, APL’s sales of petrol, diesel and furnace oil declined by 14, 18 and 40 percent year-on-year during the quarter. APL’s gross profit increased not only due to higher revenue growth but also inventory gains instead of inventory losses.

The OMC’s bottomline grew despite the two times increase in other expenses most likely due to exchange losses. The growth in APL’s earnings is a continuation of the high growth achieved in FY22 where bottomline grew by more than 3.5 times due to higher petroleum product prices, volumetric growth, and massive inventory gains.

Comments

Comments are closed.