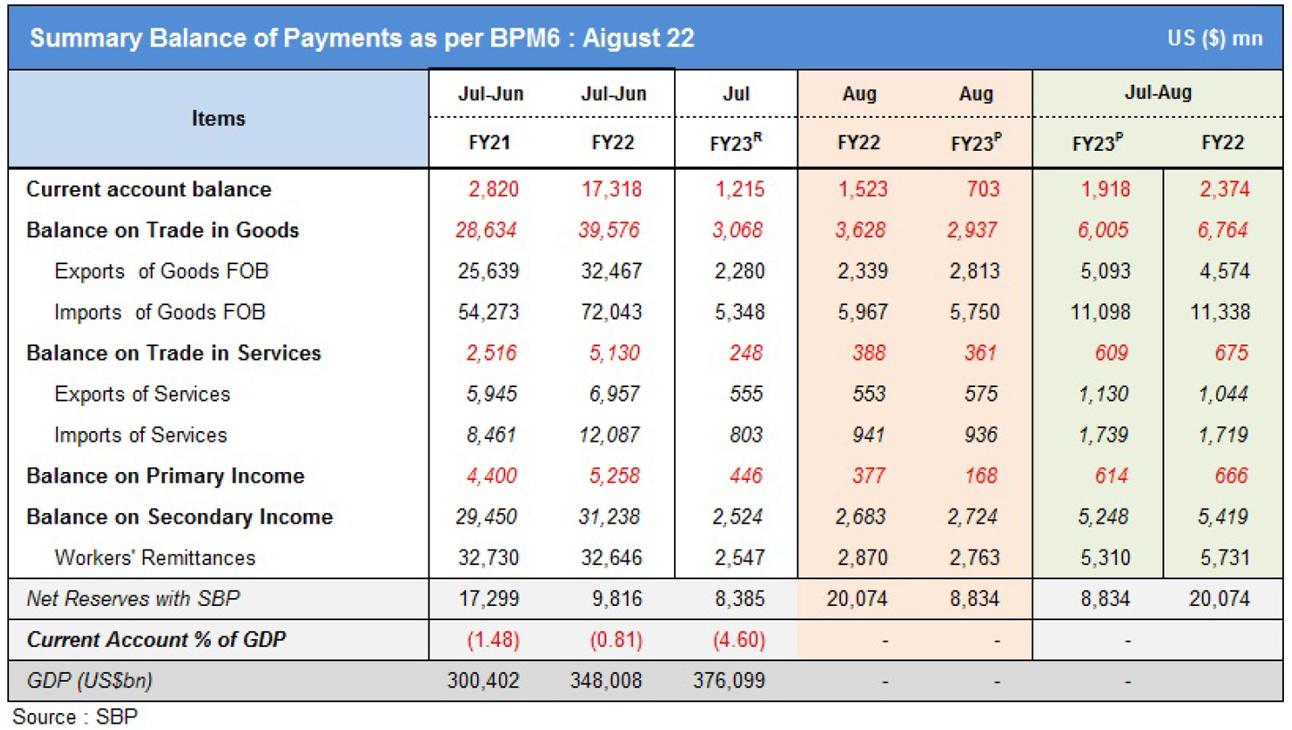

The current account deficit is coming under control. This was expected. The transmission of tightening policies takesits sweet time. Just like it takes time to kickstart growth – which was done prematurely by Shaukat Tarin. And when the slippages started appearing along with the IMF pressure, he was back to tightening. The pre and post VONC episodes of freezing energy pricing didn’t let the transmission take place. And later Miftah had to impose administrative measures to lower imports which worked.The deficit stood at $705 million in August 22 – down by 42 percent from the previous month. The 2MFY23 deficit is down by 19 percent to $1.9 billion.

Now, demand destruction will come into play. Currency and energy pricing adjustments along with global commodity prices have significantly put a dent on consumption. People are economizing energy usage which is already reflecting in numbers. The import of ‘so called’ non-essentials are in check. LSM nose-dived. The current account is likely to remained suppressed and controlled. The falling commodity prices will also help. There could be some slippages due to the floods. But these won’t be as big as being generally commented by many.

The imports are up 8 percent from the previous month to $5.8 billion – but the number is less than $6 billion. And in 2MFY23 imports are down 2 percent. The savior for August is exports – up 23 percent MoM to $2.8 billion. The lower number of previous month was due to delay in payments. And the number may not be high in September. The goods trade deficit is down by 4 percent on MoM and for 2MFY23 is down by 11 percent.

The food imports are up 28 percent MoM to $852 million, and its higher by 28 percent from the previous 12 months average. The higher food imports growth is mainly due to palm oil which is likely to normalize in months to come. The machinery imports are up 15 percent MoM but down 25 percent over the last 12 months average. Here the biggest gains are from reduced mobile phones imports. In this case and for other machineries, its mainly administrative measures of controlling LCs that are at work.

The story of transport sector is similar – where the decline in August is 49 percent from the last 12 months average. Here the control is on car imports – CKD is controlled through LCs measures while CBUs are curbed due to higher duties. CKD kits for cars import are down 53 percent from the previous 12 months average and SBP is allowing mere 50 percent quota of imports from the previous year’s monthly average.

The real gain which is going to accrue in coming months is from petroleum imports. Although, there is some decline from the peak in June, still the monthly number is north of $2 billion. It stood at $2.2 billion in August 22 – up by 32 percent from the previous 12 months average. The recent decline in oil prices – if it persists, along with lower consumption due to higher electricity and gas prices, the expected number will be below $2 billion in coming months. That is one relief everyone is looking at.

In case of exports, the number at $2.6 billion is slightly lower (6%) than the previous 12-month average. Barring textile the toll is down by 12 percent from the last 12month average to $907 million, and the textile exports are down by 2 percent to $1.58 billion. And the story of textile is not shaping well. The yarn manufacturing gross margins are in red in the short run. Many spinners are reducing production. Then there is fall in demand of made-up products, and some players are finding it hard to imports parts for manufacturing value added. Overall textile exports are likely to remain lower than last year. And all other exports are already under pressure.

The services trade balance is in control due to SBP’s strict control on payments. There is a huge backlog. Sooner or later, these will put pressure. The home remittances are up by 8 percent MoM and down by 3 percent in the 2MFY23. The growth is likely to remain muted and that will put further pressure on controlling imports.Economic slowdown would help it. Thus, CAD will remain in control.

Comments

Comments are closed.