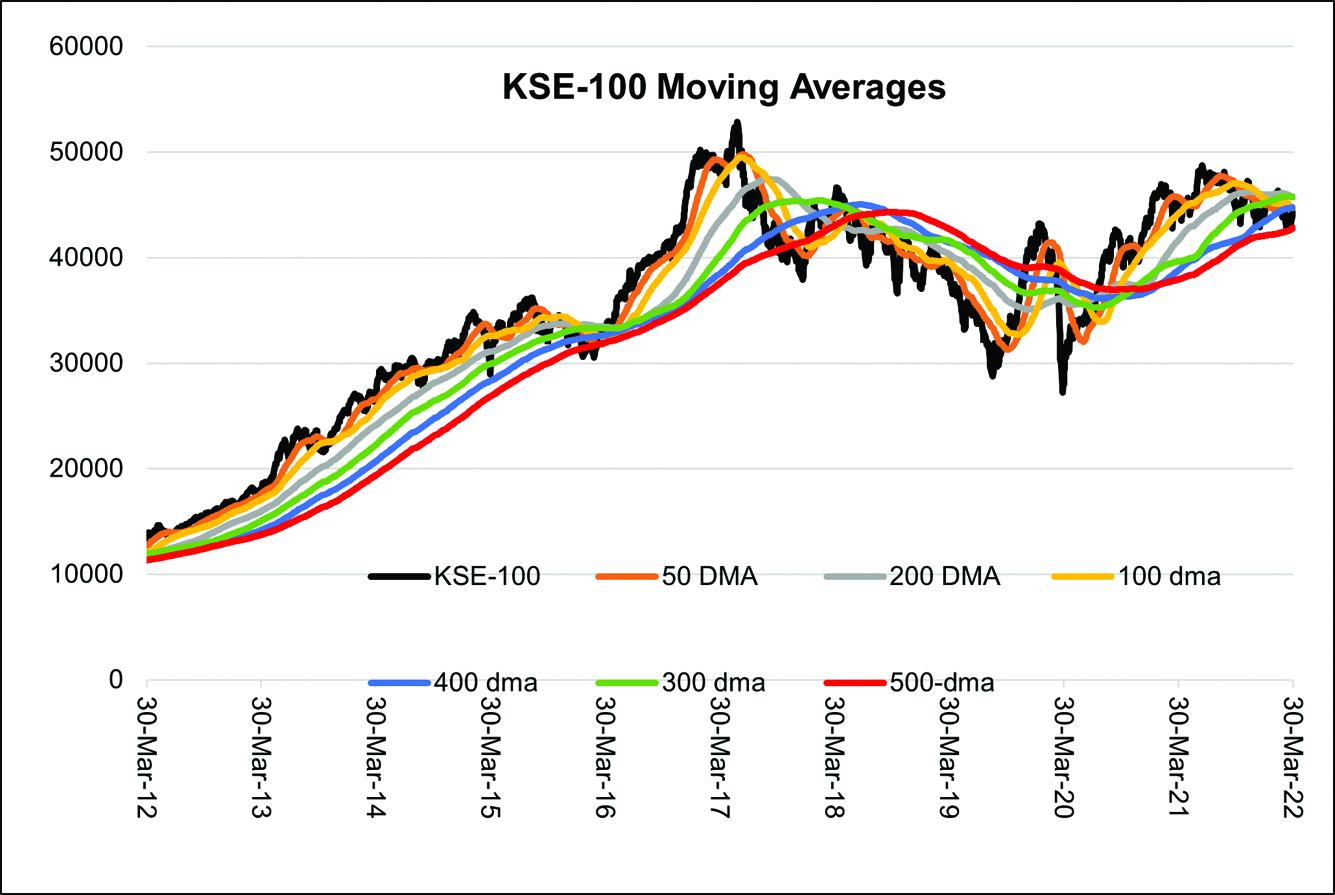

The stock market hates uncertainty. And uncertainty has headlined Pakistan for quite some time. The recent wave has revolved around political turmoil. The benchmark 100-index at the Pakistan Stock Exchange has continued to stutter and move in a narrow band, struggling to cross 45,000 mark. The last day of the month took the 100-index up by 591 points of 1.33 percent – the highest daily increase in 2022 so far.

The calendar year started on a positive note with January returning 1.75 percent positive yield. This was much in line with the January bias that has been observed over the years and confirmed by a drop of similar magnitude in February. The March trajectory stayed flat throughout the month, save for the last trading day, which took the monthly return to the positive territory.

All this while, the listed companies have continued to rake in record high profits. The supposed discount to fair value is getting more mouthwatering by the day. Only that the KSE-100 index more often than not look at political, geopolitical and even traditional factors than the fundamental ones, before taking a firm direction.

The Russia-Ukraine tensions that led to a massive slide in equities across the globe, is surely going to lead to re-rating of the earnings multiple. The much-fancied foreign investors have been shy for quite some time too, leaving the local investors to take the punt. The local investors seem to have turned their backs on the market once again, playing safe in other investment avenues.

The 100-index volumes have dried up and promise to remain sluggish as the holy month of Ramadan approaches. There is enough evidence that suggests lackluster trading activity during Ramadan. Add to it the political drama that is being staged in Islamabad, and does not appear close to curtains. Even if the government is to be overthrown, there is a fear of further political instability hitting the country.

Nothing less than an announcement of early elections will bring any semblance of calm on the political front. Then, there is the element of interest rates, where secondary market yields are nearing multiyear highs. The relationship of the KSE-100 index with that of 10-year PIB yields has stayed true on most times, and there is little reason for it to change. From what it appears, another month of range-bound index movement, with sluggish trading volumes, is in the store.

Comments

Comments are closed.