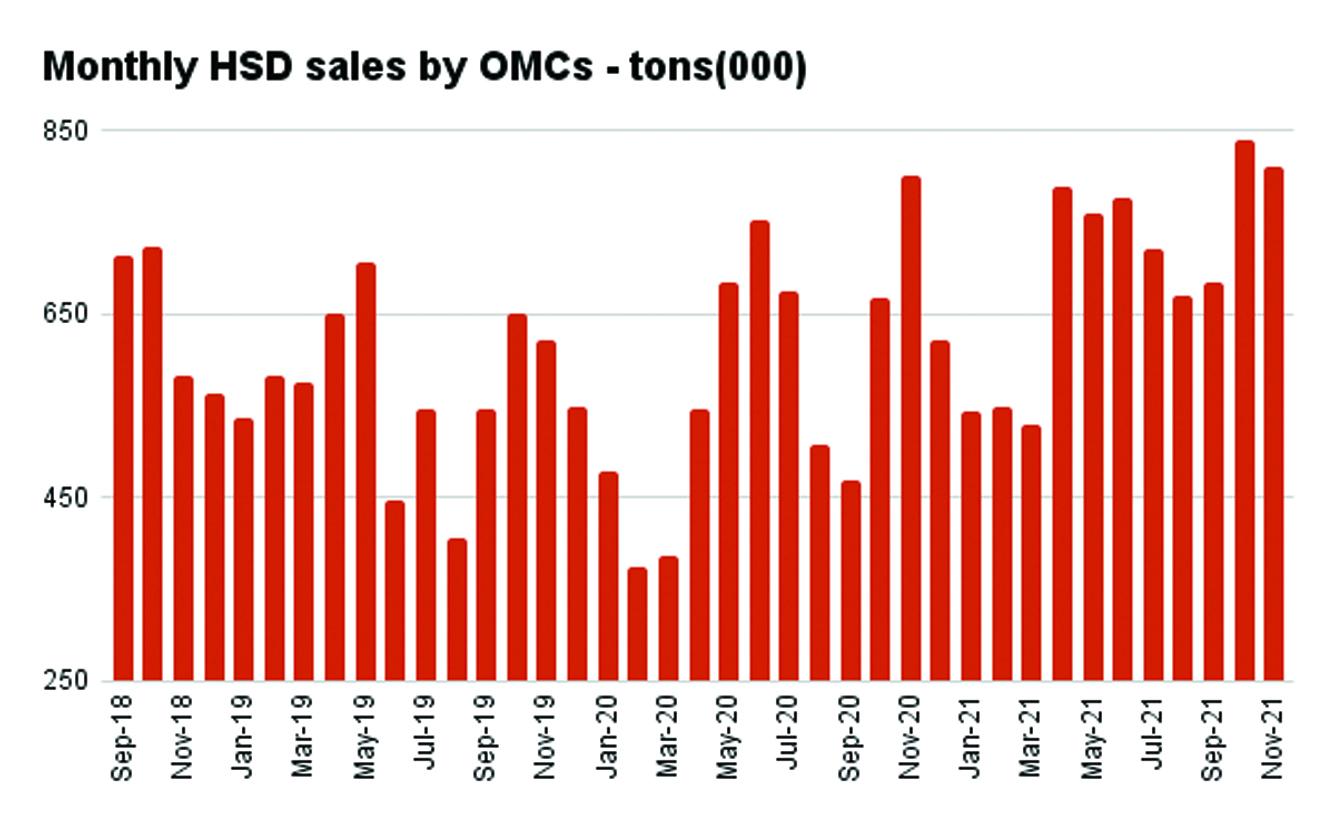

Petroleum consumption goes unabated amid rising inflation. The petroleum products and lubricants sold by the oil marketing companies (OMCs) continue its growth trajectory despite rising prices. In 5MFY22 (first five months of FY22), OMCs sales soared by 17.6 percent year-on-year. Of the three key petroleum products, furnace oil led the double digit growth in petroleum products with over 29 percent year-on-year growth. The other key fuels, high-speed diesel and motor gasoline, posted a rise of 19.3 percent and 10.7 percent year respectively.

Retail fuels account for over 80 percent of the total petroleum product sales by the OMCs sector, but furnace oil has returned to the mix despite the country’s plans and efforts to phase it.

The fuel is mostly used in the power sector, which has seen increasing share of furnace oil due to gas shortages. Where furnace oil has led the growth in 5MFY22 volumes, it was seen falling by 45-5 percent month-on-month in November 2021 as winter season lowered the demand for electricity.

In general, November 221 was a slower month for petroleum products volumetric growth with furnace oil, high-speed diesel and motor gasoline posting 8 percent, one percent and one percent year-on-year, respectively. Along with a sharp decline in month-on-month furnace oil sales, diesel and motor gasoline dropped by 3.6 percent, and nine percent, respectively.

Barring the November slowdown, the recovery in OMC sales continues, which is primarily due to a small base in 2020 and then an overall rebound in demand in 2021 due to the return of economic activities as economies came out of Covid restrictions and lockdowns.

Other factors like border control that has been saving the country from the influx of smuggled fuel, especially from Iran; and increased industrial and agricultural activity have been pushing up high speed diesel sales. Whereas, automobile sales have been driving motor gasoline sales.

Comments

Comments are closed.