It wasn’t long ago when the startup ecosystem in Pakistan was largely about setting up incubators and accelerators and startups that had little technology backing. Back then, the challenge was to scale and move past the incubation stage. Then came the digitization and fintech drive that shifted focus toward tech-centric startup infrastructure and ecosystem. And while the sector was inching forward with technology infrastructure and innovation, Covid-19 pandemic happened, which seems to have acted as a catalyst for startup funding in the country.

There has been a meteoric rise in startup funding in Pakistan, which is a sign that the startup ecosystem is progressing. Several local and international researches show that this space has been growing at a staggering pace since the beginning of 2020. In the recently released “Global Startups Ecosystem Index 2021”, Pakistan has jumped 7 spots to enter the top 75 across the globe and number 2 in South Asia region.

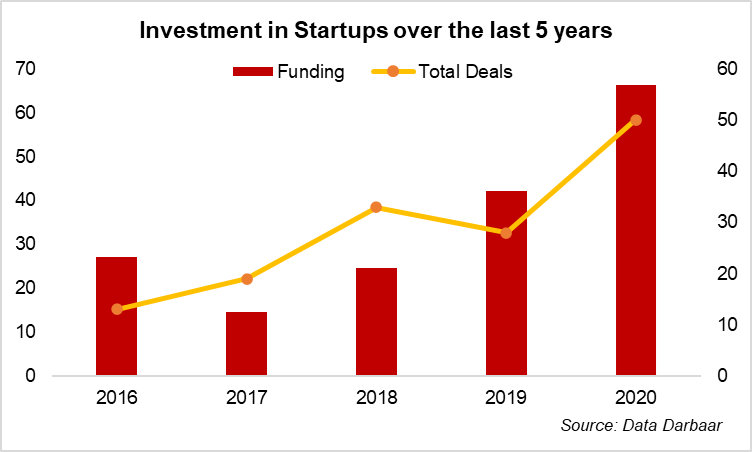

Another report by Magnitt titled ‘2021 Emerging Venture Markets Report’ points out that Pakistan saw a 45 percent increase in deal flow, a 63 percent increase in venture capital funding, and a 97 percent surge overall in startup funding, contributing to the country’s growth as a startup ecosystem hub. Up till 2020, the country saw a record high level of VC funding, of which was $66 million disclosed funding. The finding of the report also shows that adding undisclosed funding took the tally to $77 million in 2020. This trend of record high transactions was not matched by others in the MENAPT region, which is Middle East, North Africa, Pakistan, and Turkey.

VC funding moved up a notch further in 2020. Data from Invest2Innovate Ventures show that venture capitalists injected more than $85 million in disclosed funding in Pakistani startups in the first five months of 2021 – the highest ever. This matched the data collected by BR Research that shows over $87 million raised by startups in 6 months of 2021, which is phenomenal as that is already over and above 2020 total for disclosed as well as undisclosed estimates.

Good signals were also given by Magnitt in its recent report where it highlights that Pakistan is very likely to experience the greatest growth in startup funding in 2021 among the largest community for startups across the MENA region. Bloomberg is also reporting a flood of overseas capital pouring into the country during the coronavirus pandemic.

The funding wave has been in favor of ecommerce, fintech, ed-tech, healthcare, payment solutions, and logistics among others, which together have raised over $150 million funding in the last year and a half. While sector dynamics such as internet penetration, tele density and growing middle class and younger population are all dividends for the sector, a key push was provided by Covid-19 travel restrictions that pushed Pakistan up the ladder for investment consideration.

Pakistan is surely on global venture capitalists’ radar. However, there is a need to maintain and propel this momentum further. Indian Startup Funding is at all time high too, recording two times increase in the first six months of 2021 – a total of $10.8 billion. While investment and funding attracted by Pakistani startups in 2021 so far is only one percent of what India has raised during the same time; the first half of 2020 was arguably the worst for VC investments and startup funding in India and thus the 100 percent increase seen in first half of 2021 came from a low base effect. On the other hand, Pakistan’s performance on a year-on-year basis could be termed better than India as the country’s performance during 2020 was great which has followed phenomenal growth in 2021 as well. Also, the difference between the two countries is in the stage of startup attracting investment. While in Pakistan, most of the funding was concentrated early stage pre seed, seed capital and series A, it was largely around growth and late-stage startups in India and later stages of funding.

Comments

Comments are closed.