Overseas remittances are among the key drivers for economic recovery spelled out by the latest Economic Survey of Pakistan (2020-21). At the start of fiscal year FY21, the growth witnessed in remittances was baffling with many terming it a one-off phenomenon. However, over the course of rest of the year, it was seen that remittances remained a resilient force that protected the external front. Moreover, the latest economic survey highlights that - remittances along with cash transfer to low segment of the society through Ehsaas Cash Emergency Program - not only propelled GDP growth but were also instilled increase in domestic production, kickstarting economic recovery.

Evidence of growth in remittances is also shown by the increase in deposits during 10MFY21. The Economic Survey 2020-21 shows that bank deposits grew by 6.6 percent in 10MFY21; and within deposits, demand deposits grew staggeringly despite lower interest rate due to increased inclination towards digital payments and higher remittances inflows among other factors.

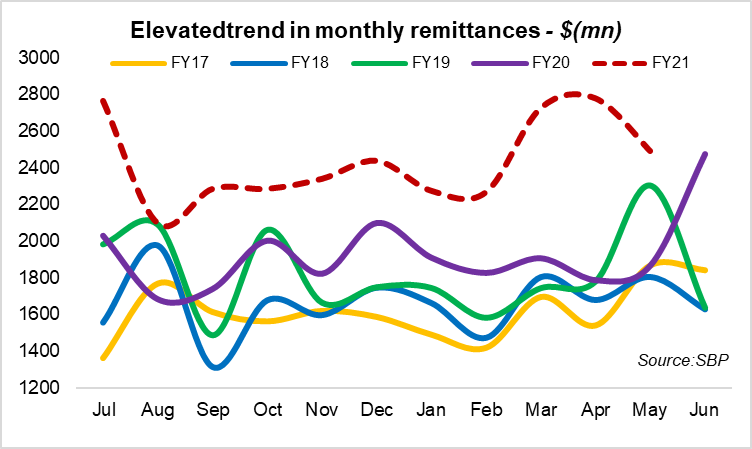

Released yesterday, the latest remittances numbers for May 2021 show that these foreign inflows have been above $2 billion for the fiscal so far, and the last 12 months starting June 2021. The official data show that while the growth in May 2021 versus April 2021 dipped by around 10 percent due to lower number of working days in May 2021 from the Covid imposed lockdown amid Eid and some front-loading of remittances in April as a result, the seasonal decline was lower when compared to previous years.

Remittances continued to grow year-on-year (34% YoY). Overall, remittances growth streak continues; in 11MFY21, the foreign flows were up by over 29 percent year-on-year and $3.6 billion above the total FY20 remittances.

Among the key factors behind current account improvement and rising foreign reserves according to Economic Survey of Pakistan 2020-21 have been rising remittances along with the government scheme of “Roshan Digital Account”.

Also, more formal channels were opted during the year due to restrictions imposed on informal means in the wake of COVID-19. The latest State of Economy Report by SBP also highlighted the same where the cross-border air travel restrictions after the Covid outbreak was counted to have helped channelize inflows towards the formal channels. Even in FY21 so far, global air travel is far below the comparable 2019 levels, which continued to push emigrants to utilize the formal banking channels to support their families back home.

And then efforts under PRI and the gradual re-opening of businesses in major host countries such as the Middle East, UK and the USA also supported remittances into Pakistan. Needless to say, FY21 will see record remittances - raising the bar much higher for the coming fiscal year!

Comments

Comments are closed.