Beginning mid-December, broiler prices across country have marked a major inflection point, declining by more than one-third in major centres such as Karachi and Lahore, and over a quarter nationally. Is the reversal permanent?

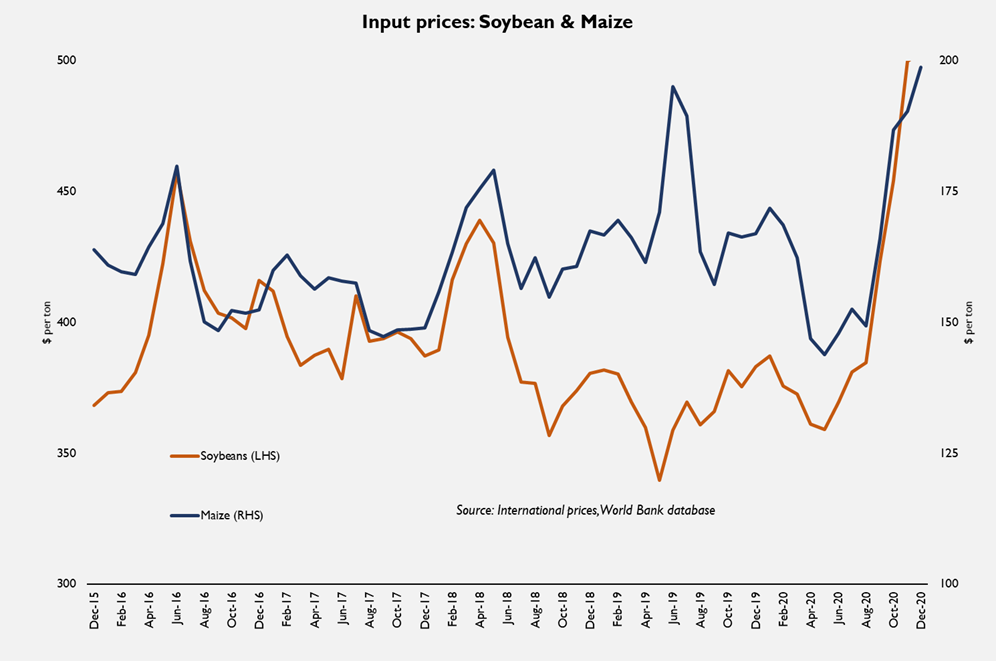

Regular readers will recall that prices of poultry value chain products have been on a rollercoaster ride throughout of 2020, initially led by demand side volatility during the first phase of lockdown and exacerbated by a sharp increase in commodity prices of key inputs such as soybean and maize in the latter half of calendar year. Now that prices have begun to reverse direction, is the U-turn buoyed by fundamentals?

But let’s first examine whether the reversal in poultry products is broad based? Geographically, the answer appears to be yes, as broiler prices have come down across all provinces and regions tracked by weekly SPI of PBS. More importantly, the decline in prices is now backed by the most key indicator of the value chain, the prices of Day-Old Chicks (DOCs).

After climbing to a never-before-seen Rs 65 per unit, DOC prices have fallen to levels last seen in September 2020, when the lockdown was eased after first Covid wave took a downward turn. Back then, DOC prices begin to increase sharply as commercial demand began to mark resurgence, especially after the country left behind the red meat season of Eid ul Adha (July – August).

But DOC prices are yet to enter the long-term average range of late teens and mid-twenties, meaning that the decline is not sharp enough to claim with certainty that supply, and demand have already reached equilibrium.

Moreover, the upsurge in input prices – of which, soybean and maize constitute 90 percent cost of poultry feed – continues unabated. On the other hand, forecast of domestic maize output in the upcoming season is also marred with uncertainty, as wheat has once again become the first choice for winter crop among farmers attracted by improved support prices, shortfall in past season, and subsidy on inputs.

But most importantly, price of farm eggs continues to mark a double century in several towns and cities tracked by PBS, keeping layer out of reach of many across the country. In fact, as broiler prices have reversed, dozen farm eggs are trading at a premium over kilogram of broiler, with the differential fast increasing.

Read together, the indicators show that it may be too early to call it a day on poultry price spiral. Follow this space later this week for an insight into possible interventions that can be made to make chicken affordable again.

Comments

Comments are closed.