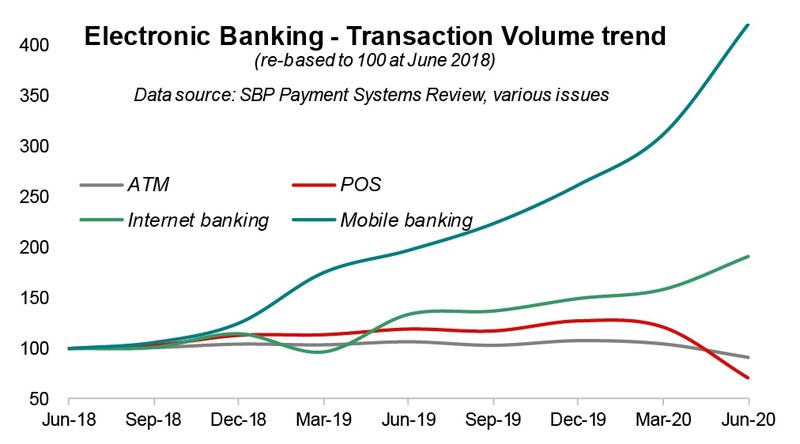

With the latest release of SBP’s Apr-Jun quarterly data on alternate delivery channels (ADCs) for banking sector payments, it is time to review how the electronic banking channels had fared during the pandemic. After all, there was an expectation among observers that lockdowns were a godsend for electronic payment channels. Below, four main ADCs in the e-banking universe are analyzed to decipher impact.

First, the ATM, which dispenses cash but it’s an ADC nonetheless, has always had an over-sized presence in Pakistan’s e-banking transactions. But the environment of lockdowns hurt ATM transactions, which was obvious as lower incomes and falling spending resulted in fewer cash-out trips. At 115 million, volumes were down 13 percent in Apr-Jun quarter over Jan-Mar period and down 14 percent year-on-year. At Rs1.52 trillion, value was down 9 percent quarter-on-quarter and 10 percent lower year-on-year.

It isn’t clear whether the lower cash withdrawals were more due to economic slowdown or lockdown-related mobility restrictions. But during the lockdown quarter, ATM transactions, both in terms of volume and value, had gone below the level seen in June 2018. It remains to be seen if the subsequent quarters will help recoup the couple of years’ growth that is lost by the ATMs, whose number had grown to 15,612 machines as of June end.

The second significant ADC is the mobile phone banking channel. It must be noted that this particular ADC has already been growing well in recent years, doubling its transactions each year since FY17. The registered mobile phone banking users had reached 8.5 million as of June 2020, a growth of 50 percent percent in just a year. Some 27 banks were offering this ADC as of June end.

The mobile banking momentum continued amidst the lockdowns. For instance, transaction volume of 29 million in Apr-Jun was higher by a third on quarterly basis and it more than doubled on a yearly basis. The transaction value of Rs622 billion in the same quarter followed similar levels of quarterly and yearly spikes. There is continued growth across the board, but mostly in intra-bank and inter-bank fund transfers.

The third pillar of e-banking is internet banking, which is another fast-growing ADC, offered by 28 banks to nearly 4 million users as of June 2020. The lockdowns had accelerated the growth in this channel relative to recent quarters. At 17 million transactions in Apr-Jun, the volume was higher 21 percent over previous quarter and up 43 percent year-on-year. At Rs894 billion, the transaction value in the corona quarter was 20 percent and 64 percent higher on quarterly and yearly bases, respectively. Just as with mobile banking, fund transfers take the lead in expanding transaction pie for internet banking.

And finally, the ever-shrinking POS machines, which had reduced by 14 percent year-on-year to 49,000 as of June 2020, and embraced by mere 9 banks. The pandemic quarter’s troubles have set back quarterly POS transactions even more than two years. The lockdowns didn't help, as only food-related establishments and essential services providers that had POS machines were accepting such payments. POS volumes stood at 11 million in Apr-Jun quarter, down 42 percent on quarterly and 41 percent on yearly basis. At Rs62 billion, value was lower 40 percent on quarterly and 43 percent on yearly basis.

This analysis would be remiss if it didn't point out that a significant economic slowdown in the Apr-Jun quarter would have hurt transactions across different payment channels in any case. In that context, what stands out is the pronounced growth in mobile banking and internet banking. Official quarters are attributing this growth to a waiving of transaction fees, but it may be too simple an explanation. Still, e-banking numbers hardly depict a breakout performance. Besides, what to talk of pre-crisis levels, ATM and POS quarterly transactions were sent back quite a few quarters. This needs to be closely observed.

Comments

Comments are closed.