The export slide

Exports have been cut to half in a go. No half measures there for sure. It was all seen coming, and nothing is surprising in the monthly export number of less than a billion dollar. Make all the charts you want – they will look appealing. But just April’s export numbers for Pakistan on a chart tells you how big an event the ongoing pandemic is.

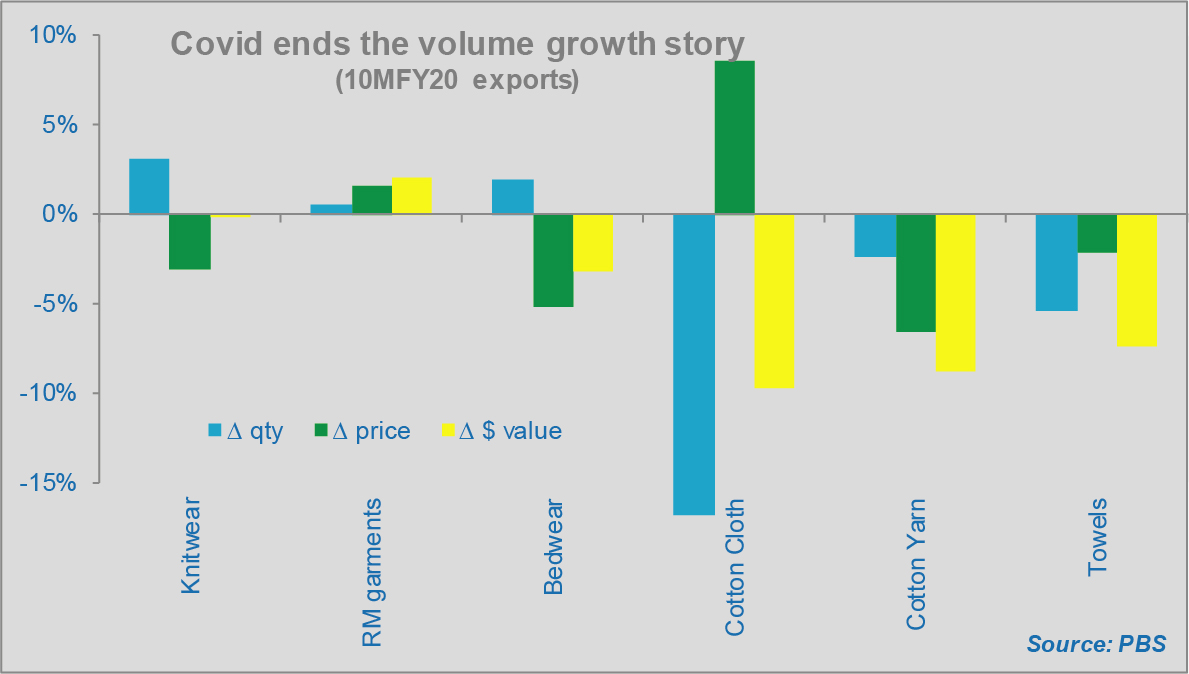

The exports for 10MFY20 went down by 4 percent year-on-year. They were up by 2 percent till last month. April alone has wrecked this much of havoc. The story was all so predictable as Covid was busy scoring peak after peak in one country in the West to another for much of April.

While some countries are considering and are at different early stages of reopening the economies – it may not necessarily mean a swift business revival for exporters. The double digit volume growth story which had built up gradually and was starting to look promising will have to start all over again, and it may not be very soon (Read: Exports growth on last legs, published Apr 20, 2020).

Pakistan’s major textile export destinations are some of the worst hit countries around the globe. Pakistan’s merchandise export is not the top of the drawer stuff the demand of which would be inelastic at the reopening of economies. Apparel consumption is slated to go down the priority list in the post-corona world. And no one even knows how far is “post-corona” from today.

Before textile exports came crashing down, some in the industry and around it, had pinned hopes on the chance to capture greater share of bedwear and towel demand, as hospital demand picked up exponentially. That has not transpired into reality yet, as hospitality related bedwear and towel demand still seems to be the driver. Towels volume were cut to a fourth, while bedwear went down by half. Any resurgence in either category, would be welcome, but may not be highly likely immediately.

Pakistan may well have opened up the economy sooner than some of its competitors in the region, especially India, which does offer a brief window of opportunity, to have a bigger share of the smaller pie. At present, even that would be welcome with open arms by the industry. Cost is not an issue at the moment, as most things were already in place for the industry in terms of taxes, energy prices, market access and refunds.

A lot of investment went in before the pandemic in the textile industry. The resurgence, whehenever it comes, will come from the textile sector. And no, the surgical exports are not going to make it up. They went down by almost a third month-on-month in case you are wondering.

Comments

Comments are closed.