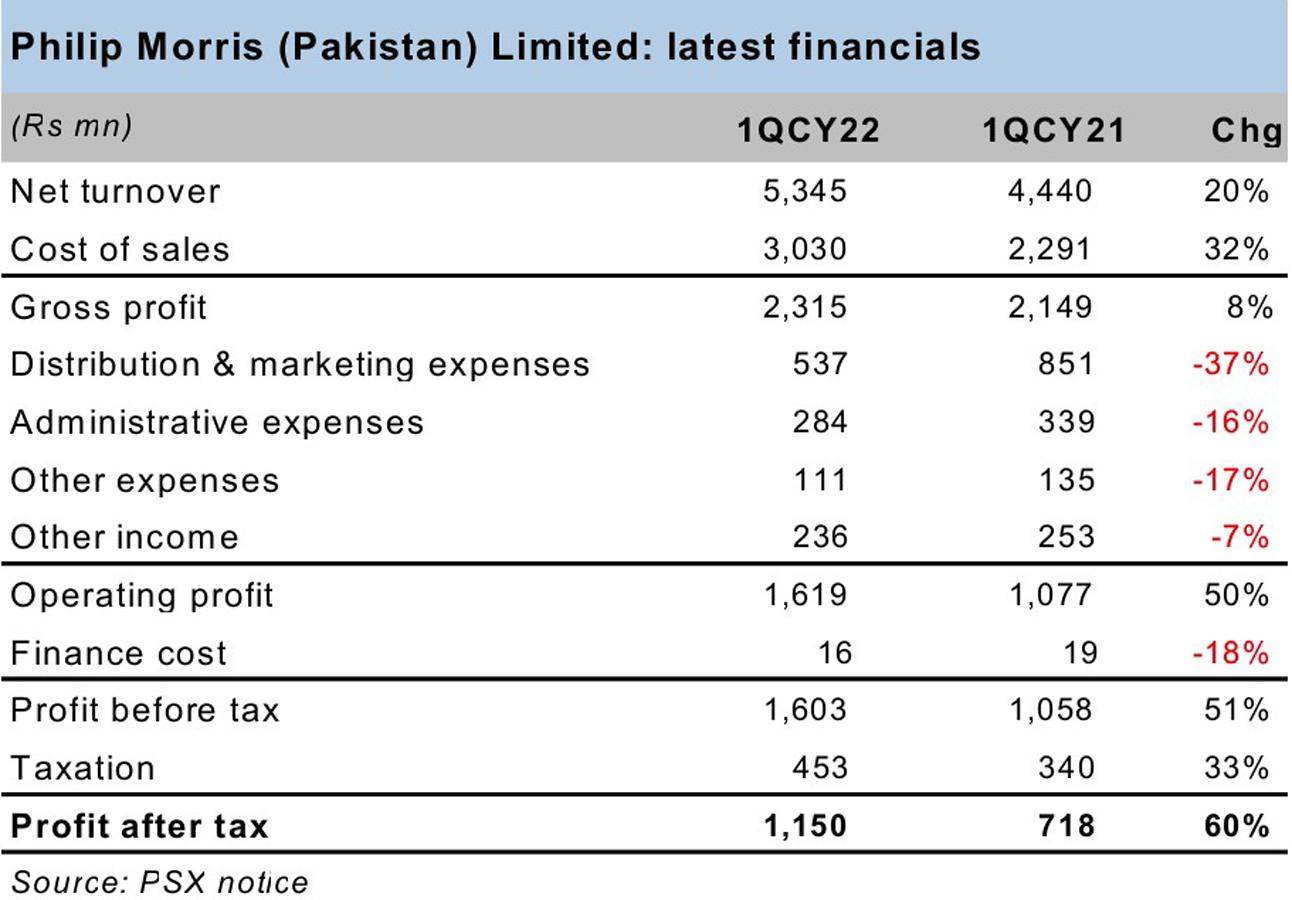

After achieving strong, double-digit bottomline growth in CY21, Philip Morris (Pakistan) Limited (PSX: PMPK) is off to a solid start in CY22. As per the company’s latest financials posted to the bourse for the quarter ended March 31, 2022, the second-ranked cigarette manufacturer expanded its topline by a fifth, which, in addition with operational efficiencies, yielded net profit gain of 60 percent year-on-year.

These are good times, as it is rare for PMPK to score double-digit growth in sales. Since the retail price increments have been difficult to implement in this price-conscious, inflation-fatigued market, it appears that the major reason for the 20 percent yearly increase in net turnover is the uptick in cigarette volumes sold in the market. Government’s LSM data also point towards higher cigarette output in recent months. (Market leader, Pakistan Tobacco, had a lower, 9% net turnover growth in 1QCY22. Read more here).

Despite topline gains, the increase in gross profit (8% YoY) was on the lower side. This was due to the ‘cost of sales’ growing out-of-proportion (32% YoY) to consume 57 percent of net turnover during 1QCY22, which was higher than 52 percent of the same ratio seen during the same period last year. Just as rest of the industries, the tobacco manufacturing industry has also been reeling under the weight of significantly higher input prices and rising cost of utilities, logistics services.

Thankfully for PMPK, the management’s grip on non-production costs seemed to further tighten during 1QCY22, thereby providing significant cost savings to return 50 percent yearly growth in operating profit. The distribution and marketing expenses, administrative expenses and other expenses all declined in double digits. Together, these three expense heads exhausted 17 percent of net turnover in 1QCY22, which was much lower than 30 percent of the same ratio witnessed in the same period last year.

In the end, thanks to topline growth and cost savings in non-manufacturing domains, PMPK closed the first quarter of the ongoing year with net profits of Rs1.15 billion, growing significantly by 60 percent year-on-year. If it is rare for this firm to achieve double-digit topline growth, it is also unique that PMPK booked over a billion rupees as net profits in a single quarter. At this pace, the firm is on track to beat Rs2.3 billion net profits that it had booked last year.

But can this momentum be sustained? The market leader, whose topline has grown strongly in double-digits in recent years, has witnessed revenue growth slowdown in 1QCY22. A lot is riding on how the upcoming federal budget impacts the tobacco industry. If the cash-starved government ignored the formal industry’s arguments and raised the FED rate on cigarette sales, it would likely depress volumetric growth in upcoming quarters. Whether or not there will be a rate hike will become known in a month’s time.

Comments

Comments are closed.