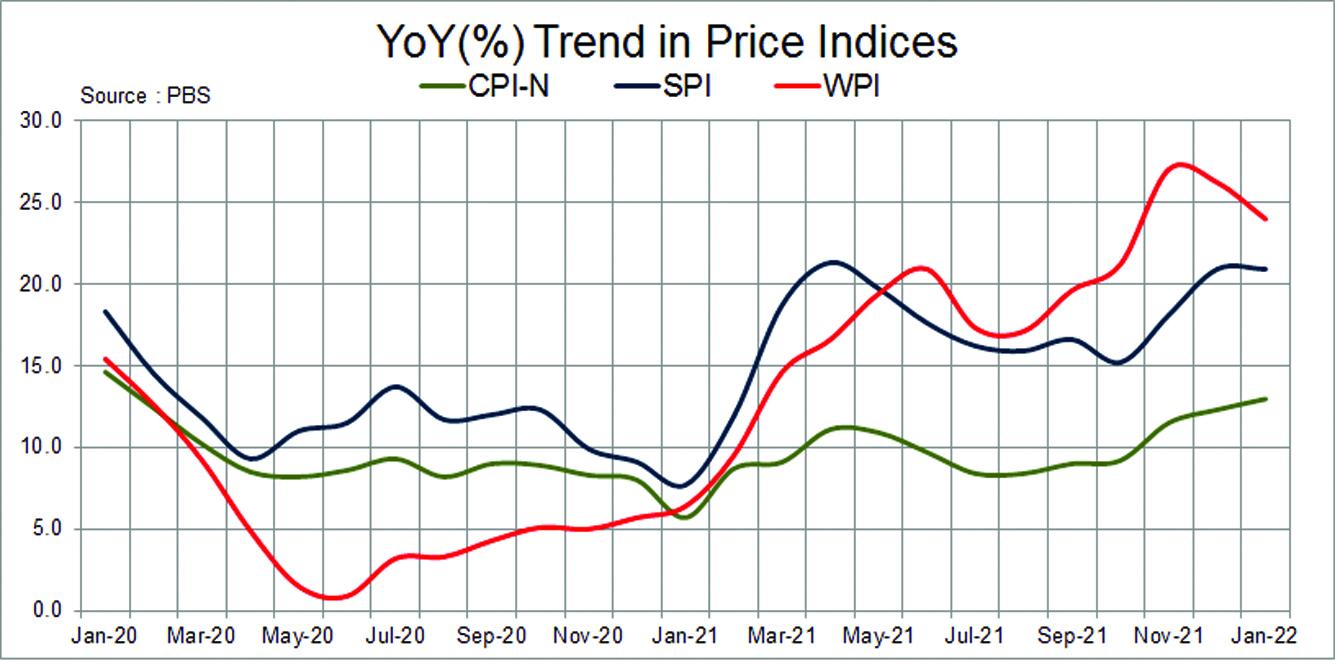

The CPI inflation clocked at 13 percent in Jan 22 – highest monthly recording since Jan 20. The headline inflation has probably peaked in Jan and from now onwards it is on a downhill due to the base effect. Then there would be negative fuel adjustments in electricity charges to tone the inflation down. The key risk is raising oil prices and its direct and indirect impact which is passed on to the consumers. Seeing all the factors, double-digit inflation may continue in the remaining fiscal year with full year average inflation to hover around 11 percent. SBP is seemingly comfortable with running significant negative real rates.

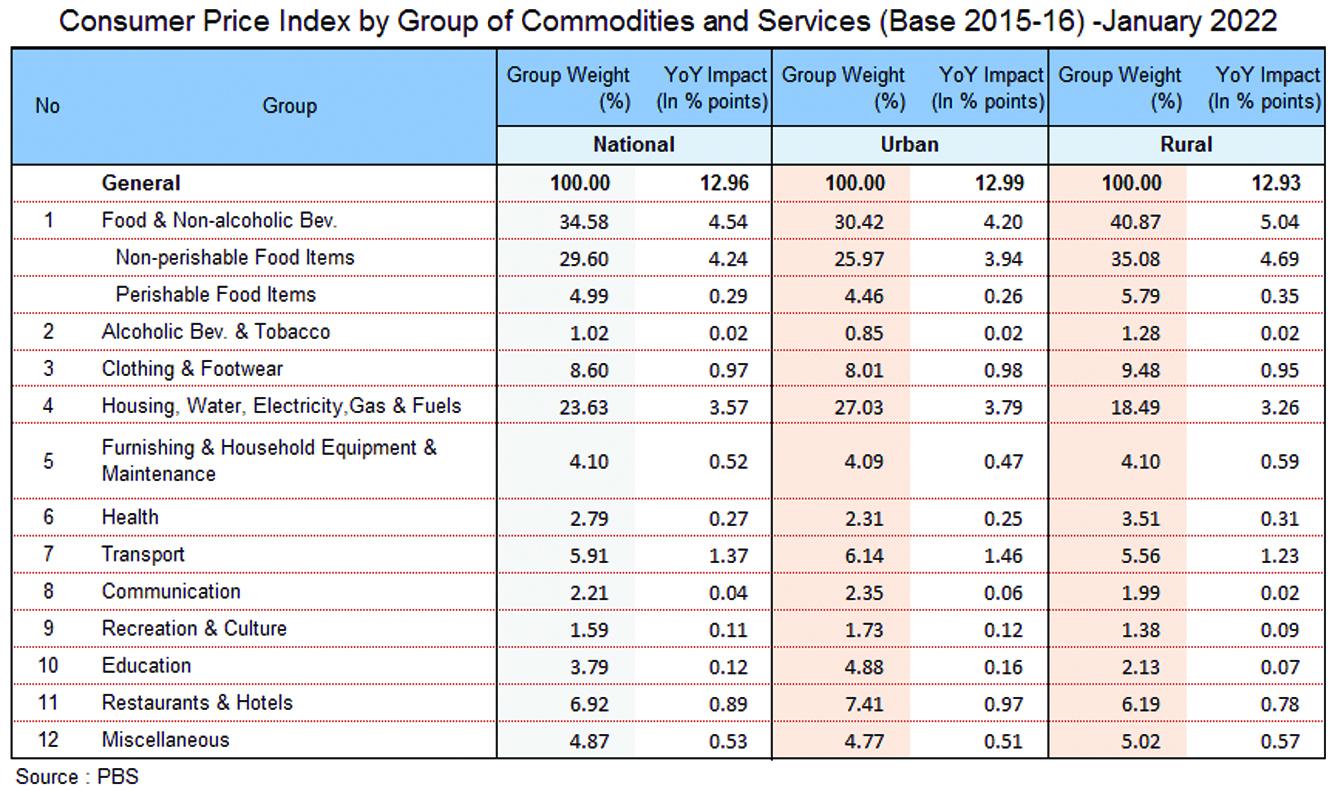

In Jan-22, the MoM inflation is up by 0.4 percent as compared to no change in the previous month. The high base effect continues to play, and the yearly recording enhanced from 12.3 percent to 13.0 percent. January is a month of quarterly house rent index which is up by 1.5 percent in urban and 2.2 percent in rural - from the previous recording in October.

The food inflation sub index is down by 0.45 percent MoM in January and the highest decline is in perishable items- down by 5.5 percent. The weekly SPI index is suggesting that the fall is to continue in the last two weeks of January which is to be recorded in Feb CPI numbers. Nonetheless, the food inflation is up by 12.6 percent on yearly basis in January and that is a high increase over a high base. The biggest culprit is cooking oil – up by 54 percent YoY and that is due to over a decade high palm oil and other cooking oil prices. The second in line are pulses.

On the other hand, perishable items like tomatoes and onion are on a decline.

The heavy weight (second in size after food) housing and utilities index is soaring. It is up by 0.97 percent MoM -mainly due to house index revision and increased by 15.5 percent YoY. Here both urban and rural are experiencing high increase. Electricity charges are up by 56 percent YoY both for urban and rural – there might some downward adjustments in coming months.

The second in line is liquefied hydrocarbons – up by 53 percent for urban and 42 percent for rural. Here the weight of hydrocarbons in rural CPI is at 1.0 percent which is double of that for urban. The reason is higher reliance on LPG in rural areas for cooking and heating purposes while urban dwellers in many areas enjoy pipeline gas.

The weight of gas in urban is 1 percent in CPI and its prices have remained flat. The weight of gas is zero for rural. Then the weight of solid fuels is 4.5 percent in rural which is almost ten times of that of urban. The solid fuels prices are up by whopping 6.6 percent MoM for rural. That largely explains CPI monthly increase of 89 bps in rural (12.9% YoY) versus mere 0.06 percent increase in urban (13.0% YoY).

The headache for the government is transportation index – up by 1.0 percent MoM and 23 percent YoY in January. No thanks to 36.2 percent YoY increase in the motor fuel. Rising international prices and depreciating currency is impacting the end consumers.

The prices were supposed to increase further in February; but the PM has temporarily deferred it. There was a higher increase proposed in diesel and its weight in transportation is significant. However, not passing on the impact to the consumers is not a good idea. The government should refrain from such practices as that would hit harder in terms of inflation and currency depreciation in the medium term.

The inflation increase is largely broad-based – barring alcohol beverages and tobacco, and education, every other item is up by over 5 percent, and by taking perishable food items, recreation and culture, and health sub sectors out, the increase is in double digits everywhere.

There is no respite to inflation in the past three years. And seeing the way global commodity prices are expected to remain high, the pressure will sustain. Then the PM’s push (if it has any meaningful impact) on urging businesses to increase wages would also have inflationary consequences.

Nonetheless, due to 15 percent currency adjustment and 275 bps increase in interest rates along with other taxes, the demand will taper off. There would be less demand-pull inflation, but supply push is not coming in control. SBP has recently changed its pivot again and is of the view that current negative real interest rates are fine for its medium-term inflation target of 5-7 percent. Let’s see how the number evolves in FY23. Given no new inflation spiral, assuming modest 0.5 percent average monthly increase, FY23 inflation indeed could average at 6.9 percent. But seeing 21.8 percent WPI (7MFY22 average), upside inflationary risk cannot be ruled out.

Comments

Comments are closed.