Mari Petroleum Company Limited

Being the second largest producer of natural gas, Mari Petroleum Company Limited (PSX: MARI) has been operating the country’s largest gas reservoir at Mari Gas Field, Daharki, Sindh.

Formerly known as Mari Gas Company Limited, it is an integrated oil and gas exploration and production company and around 70 percent exploration success rate, which is much higher than industry averages of around 33 percent national and 14 percent international, as per the company’s annual accounts.

In addition to Mari Gas Field, it holds development and production leases as well as operatorship of exploration blocks, and is also a non-operating joint venture partner with leading national and international E&P companies D&P leases and exploration blocks.

Starting of as a key supplier of gas to the fertilizer manufacturers, it also is a supplier of gas to the power generation companies and gas distribution companies; while its crude oil and condensate are supplied to the refineries.

Shareholding Pattern at Mari Petroleum

The government of Pakistan has around 18.39 percent shareholding in Mari Petroleum, with divestment plans on the cards since a long time that have recently been shelved now. Apart from that, Mari has two key shareholders: Fauji Foundation with 40 percent shareholding; and OGDCL with a share of 20 percent.

Mari historical performance

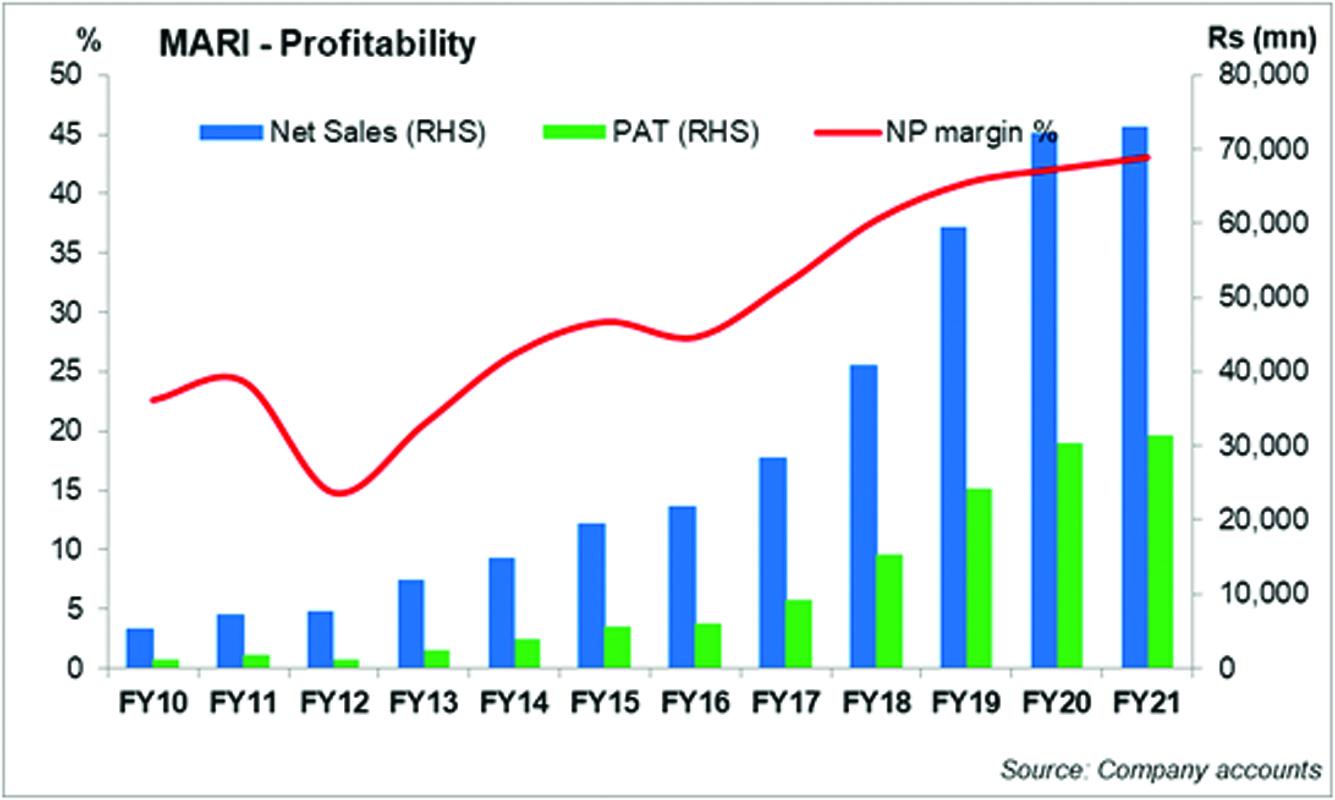

Over the last few years, Mari Petroleum Company Limited has seen rising crude oil production and relatively stable gas production flows. Its revenues and earnings have been on an upward trajectory over the past 6-7 years.

In FY16, the revenues increased by 12 percent year-on-year due to sale of 60 mmcfd additional gas under incentive price provided to Guddu Power Station along with overall increased hydrocarbon production. At the same time, the exploration and prospecting expenditure increases two times on a year-on-year basis.

FY17 was another good year as revenues continued to increase by 30 percent along with 51 percent, year-on-year increase in incomes. The company’s performance over the years had seen its operating expenditure come down consistently - from 46 percent of sales in FY12 to 26 percent in FY17. The company’s strategy has been to increase production of oil and gas to take maximum benefit of the incentive offered in the 2012 Petroleum Policy on enhanced production of gas from the existing reservoirs, by at least 10 percent. In FY17, Mari Petroleum witnessed 18 billion cubic feet of incremental.

In FY18 the company witnessed highest ever production rates and profits. During the year, MARI made one new hydrocarbon discovery in its operated blocks and also completed one appraisal and one development well during the year. In terms of production, Total production as up by 5 percent year-on-year in FY18. The company was able to further enhance incremental production as planned. The company’s gross sales exceeded Rs100 billion for the first time in the history of the company. Its net profit jumped by 68 percent year-on-year. In addition, the finance income also supported the earnings for FY18.

FY19saw higher crude oil prices on average. But what has been the key factor to increase the oil and gas exploration and production companies’ profitability was the currency depreciation. Mari Petroleum Company Limited announced a hefty increase in its earnings for FY19 – 58.2 percent year-on-year due to increase in net sales and finance income, and somewhat controlled operating expenditure. Growth of 17.5 percent year-on-year in gross sales came from better gas volumes sold as well as increase in wellhead/consumer gas price. And the increase in exchange gains further lifted the bottomline. Growth in profits however, was cut short by increase in royalty expenses and exploration and prospecting expenditure, which were higher due to higher drilling activity.

FY20 was marked by the impact of Covid-19 and depressed oil prices for the oil and gas exploration and production companies. Mari Petroleum’s gross sales increased by around 8 percent. Adjusted for taxes, cess and duties, the net revenue of the company was up by almost 21 percent year-on-year. Growth in the company’s revenues was solely due to the increase of around 20 percent in gas wellhead prices and currency depreciation. Oil and gas production were down by 8 and 2 percent year-on-year respectively during the year. Its bottomline grew by over 24 percent year-on-year. Where revenue growth helped boost earnings for Mari Petroleum, higher exploration and production expenses during the year contained the growth. The company witnessed 2.5 times increase in exploration and prospecting expenses.

MPCL in FY21

FY21 in comparison to FY20 came with some revival in the E&P landscape. Mari Petroleum Company Limited announced a 4 percent increase in its earnings for FY21. Where the 1HFY21 posted growth in earnings, the company’s earnings slipped slightly in 3QFY21 due to drop in oil prices negatively impacting the gas wellhead prices. This was followed by another positive last quarter despite the drop in oil prices continuing.

However, in spite of the weakness in prices, topline growth was supported by better hydrocarbon production flows in FY21. Mari’s overall oil production in FY21 stood up by 17 percent year-on-year, while natural gas production was up by 8 percent year-on-year during the year. The growth in E&P’s earnings was fueled by weaker exploration and production expenses that declined due to absence of dry well. However, drop in other income and rise in finance cost did the opposite.

MARI in FY22 and beyond

The E&P giant kept it stable as FY22 began. The decline in gas wellhead prices was offset by rise in gas production. With a share of 21 percent in the country’s gas production, Mari’s gas volumes grew by one percent year-on-year. The oil production for Mari Petroleum was up by over 60 percent year-on-year. Mari Petroleum’s revenue for 1QFY22 was up by 2 percent year-on-year, while its bottomline was flat at Rs9 billion. Exploration and prospecting expenditure was another factor in restricting earnings growth for the company. The E&P expenses grew by 43 percent year-on-year during the quarter, which also increased exploration expenses’ share in total revenue from 6 percent in 1QFY21 to 8.4 percent in 1QFY22. Mari also recorded other income of Rs18 million in 1QFY22 against other expense of Rs507 million in 1QFY21.

The company has diversified into mining business by investing in National Resources (Pvt.) Ltd (NRL), where MPCL shareholding in the project is 20 percent. The company also won the offshore exploration license in Block 5 of Abu Dhabi as part of the consortium with ADNOC where the first spud in the block is expected to commence in FY23.

Comments

Comments are closed.