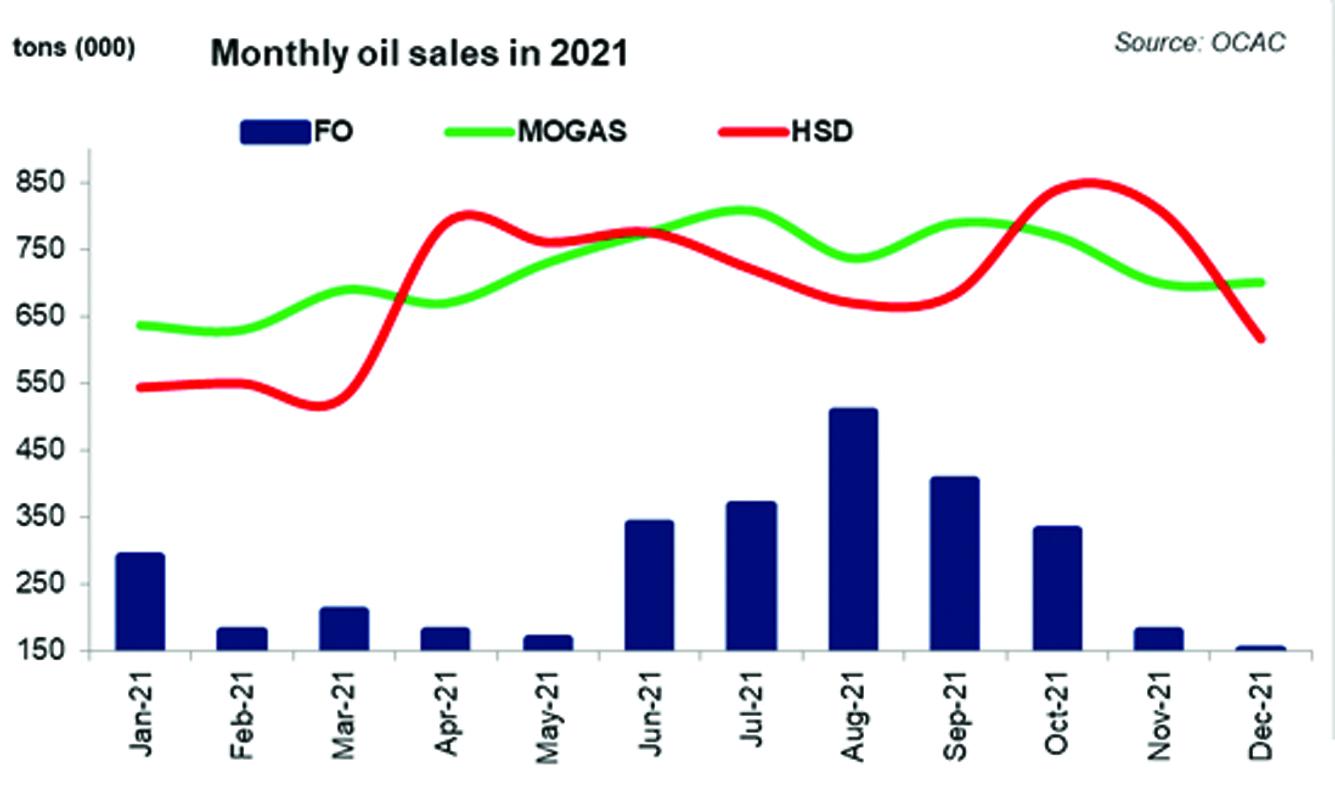

2021 ended on a rather slower note for the oil marketing companies as petroleum product sales slowed for the second straight month in December-21, month-on-month. With 1.5 million tons of petroleum products sold by the oil marketing companies in December, the year ended with a year-on-year decline of 6 percent, and a month-on-month decline of 14 percent.

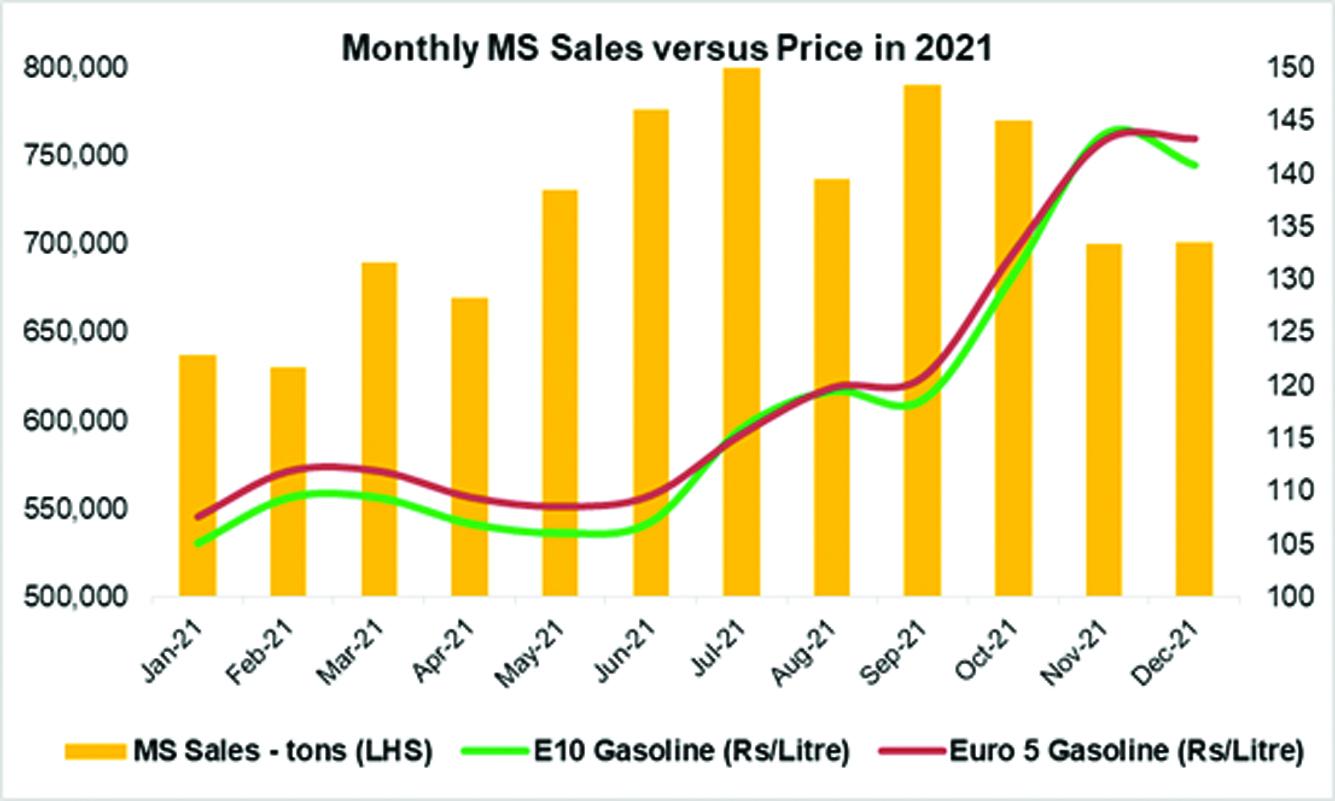

Slowdown in petroleum consumption – of which the OMC sales are a proxy of – in the last couple of months has come primarily from a slowdown in furnace oil sales due to weaker demand for the fuel in power generation during the winter season. Furnace oil sales by the OMCs slipped by 47 percent year-on-year in December-21, and by 47 percent month-on-month. Among the retail products, high speed diesel also depicts a decline in December-21 due to seasonal agricultural slowdown. HSD volumes during the month declined by one percent year-on-year, and by 24 percent month-on-month. On the other hand, motor gasoline sales remained flat year-on-year in December-21 with a rise of 4 percent month-on-month.

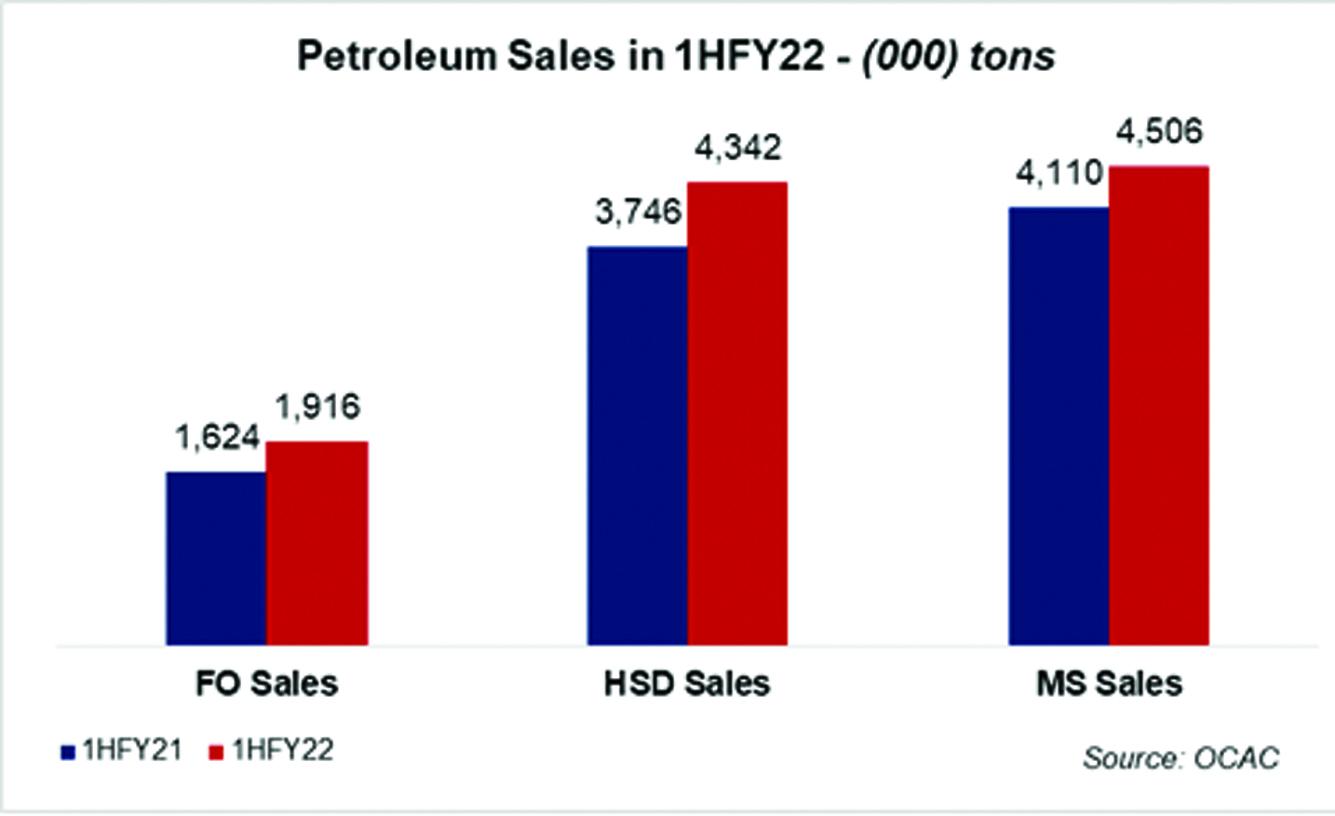

Despite the slowdown witnessed recently, 1HFY22 volumetric sales by the oil marketing sector remained elevated by 14 percent year-on-year. The growth in volumes in the first half of FY22 was led by a return of furnace oil into the mix, and relatively improved economic activity, auto sales, agriculture activity and hence a rebound from a low base. Volumetric growth was in double digits at 18, 16 and 10 percent for furnace oil, diesel and motor gasoline.

A look at volumes sold in 2021 shows that furnace oil volumes grew staggeringly by 38 percent, and double digit growth in both retail volumes. Overall, volumes were up by around 20 percent year-on-year in 2021. Petroleum consumption has continued to go unabated amid rising inflation. The petroleum products and lubricants sold by the oil marketing companies continue the growth trajectory despite rising prices. In general, retail fuels account for over 80 percent of the total petroleum product sales by the OMC sector, but furnace oil has returned to the mix despite the country’s plans and efforts to phase it out as demand from power sector rise amid gas shortages.

Comments

Comments are closed.