In 5M, cement offtake fell 3 percent which is rather anticlimactic given the enthusiasm around construction, and estimates that place demand in the range of 8-10 percent in the foreseeable years. In fact, the industry is adding a large chunk of new capacity to cater to this expanding demand, mainly due to domestic activity. Exports meanwhile rarely feature as a top market to target, and serve to merely balance out the sales mix wherever local demand falls short. After all, in domestic markets, cement manufacturers have pricing power while in export markets, they have to be “competitive” with highly competitive giants. Should the 33 percent drop in exports during 5M then bother cement makers?

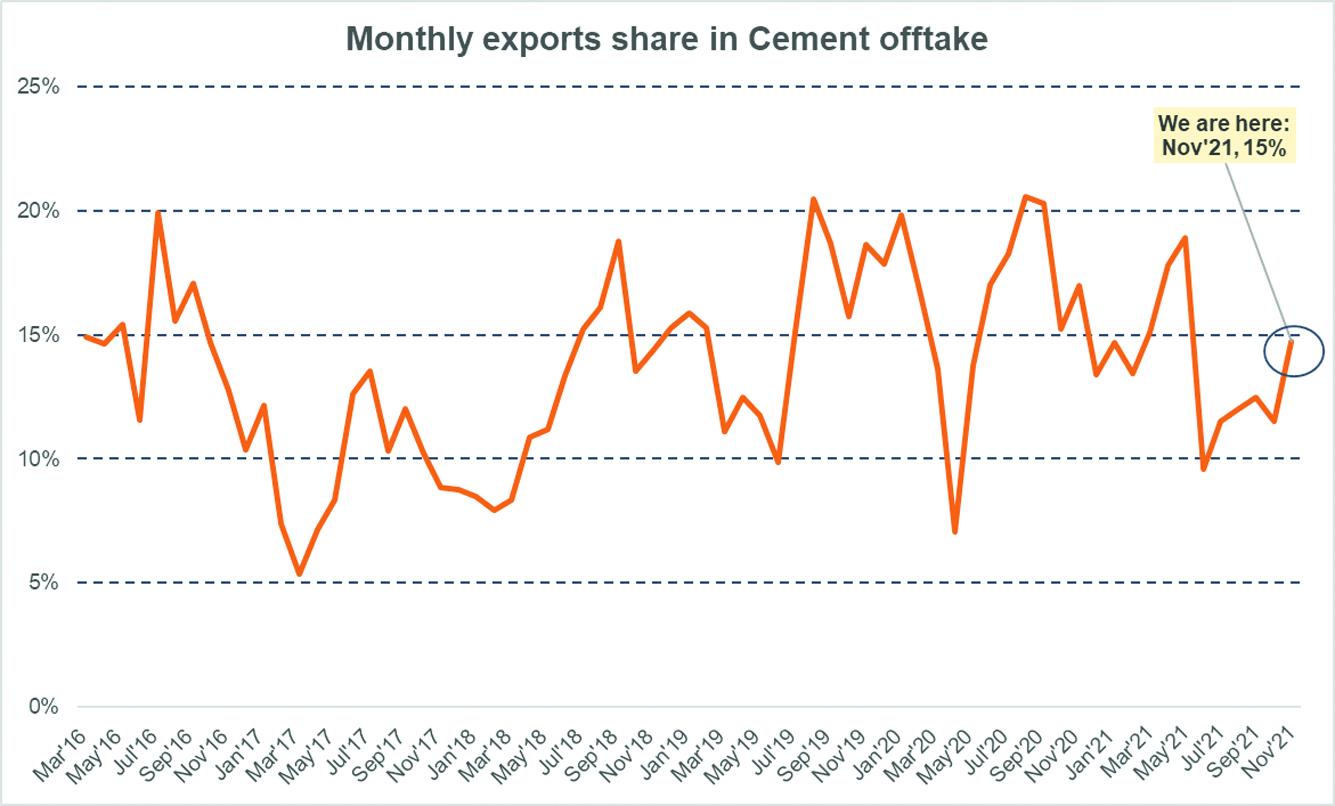

Short answer: probably soon. When do exports actually fall? Historically, exports share falls when demand for cement in the domestic market is really high. When cement manufacturers can sell in local markets at the prices they dictate because demand is dooming, it makes little economic sense to sell overseas. Since FY08, in the 5-month period under consideration here, exports share dropped to less than 15 percent only once during FY18 when domestic demand was skyrocketing. Even full-year numbers show the same trend. For the first time since, in 5MFY22, exports share has dropped to 12 percent. In monthly numbers, the industry is still between the range of 5 percent and 20 percent of offtake heading abroad.

The reasons are evident. With Afghanistan in the midst of political overhaul—even though exports have not stopped entirely—that market is going through a transition and orders from traders have visibly dropped. Overseas, the cost of freight is so high, exports are barely feasible. As a datapoint, the Baltic Exchange Dry Index saw a massive growth of 4-5x over the past year which is the highest increase the index has witnessed ever. This is demonstrable in the drop in clinker as well as cement exports. Clinker as a lower value-add product becomes even less viable to export which explains why clinker exports have all but disappeared.

Naturally, these factors will slowly subside. The global supply chain crisis that has been brewing in the wake of covid-19 outbreak is slowly easing which will in turn smoothen out the creases in the current trade climate. But as long as these factors persist, cement exports will remain weak which somehow intensifies the pressure on domestic demand to deliver.

Comments

Comments are closed.