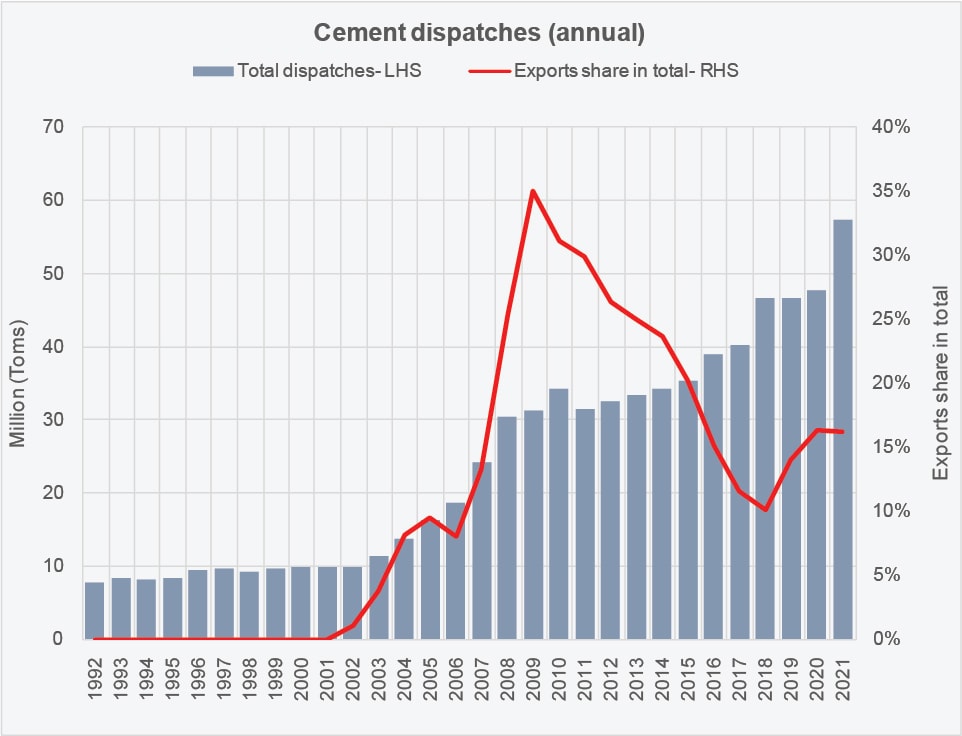

In just the last fiscal year, cement industry has sold 20 percent more cement compared to the corresponding last year which is a phenomenal growth number for the sector. Dispatches for the first time crossed and outran the 50-million-ton mark. In FY21, total dispatches stood at 57.4 million tons, of which 16 percent were exports abroad via sea and by road to Afghanistan. For the third time this fiscal year in Jun-21, monthly sales also crossed 5 million tons, setting a new benchmark for the industry.

There is no surprise to why the cement manufacturers are entering another expansion phase so soon after their last expansion cycle. In fact, over the next three years, the capacity will reach 100 million tons from the current 70 million tons on the back of an estimated 15 percent annual growth. The industry’s association attributes this growth statistic to the higher allocations in PSDP expenditures, CPEC-related projects as well as housing.

The growth expectations are not imaginary and they are not a function of low base-effect from last year. The industry performed well even during FY20. Moving in FY22, with the government’s construction amnesty and the promise of building 5 million houses (though only a small share of it can be accomplished immediately), in addition to the several small and large hydro power projects under consideration and the construction of Special Economic Zones (SEZs), the demand will likely continue to soar.

However, given there is so little data from FBR available, it is unclear how much of the current demand can be associated to the construction amnesty or the Naya Pakistan Housing Program (NPHP), if at all. Steel manufacturers believe the demand from new projects has not even started to yield results since construction has well and truly begun.

The likely possibility here is the resuscitation of stalled projects that have been breathed new life into due to tax reductions and benefits under the amnesty scheme. Those construction activities have certainly picked up pace (read: “Is ‘Construction’ the hill to die on?” June-14, 2021).

Comments

Comments are closed.