KAPCO – earnings slip with utilization

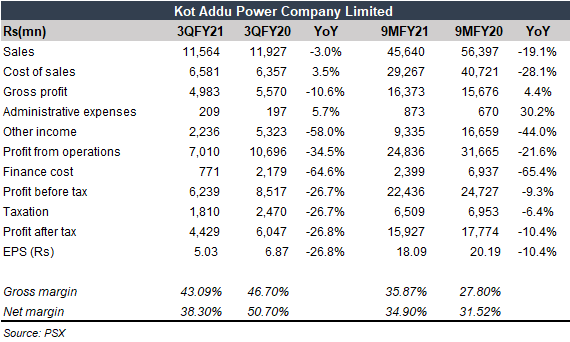

Kot Addu Power Company Limited (PSX: KAPCO) announced its financial performance for 9MFY21 last week where its earnings saw a decline of over 10 percent year-on-year. This decline was led by 2QFY21 and 3QFY21 financial performance where earnings took a dive of 20 and 27 percent year-on-year, respectively.

KAPCO’s revenues declined by 3 percent in 3QFY21, while in 9MFY21 the decrease was over 19 percent year-on-year. lower dispatches of electricity due to lower utilization levels were the main factor for lower revenue growth during 9MFY21. This was accentuated by lower furnace oil and LNG prices as well. And despite Rupee appreciation during latest quarter (3QFY21), KAPCO’s gross profit fell by 11 percent year-on-year in 9MFY21 likely due to high cost associated with maintenance expenses.

A key factor inhibiting growth in KAPCO’s profits for 9MFY21 was more than 58 percent decline in other income, which was due to lower interest rates and lower receivables. Although the decline in interest rates also pulled down finance cost and short-term borrowings but was not enough to lift profits up.

KAPCO’s PPA has been extended for 16 months. Also, it will be receiving payments as part of circular debt clearance under the agreement reached with the government. While the company did not announce a dividend in its most recent result announcement, the investor interest in IPPs is considered better today compared to last year with the initiation of Master Agreement and amendments to power purchase agreement.

Comments

Comments are closed.