Foreign direct investment continues to post negative growth. Central bank’s latest data shows that net flows in February 2021 continued to fall for the fourth consecutive month on a year-on-year basis. At $155 million, net FDI was down by 44 percent year-on-year, and also 20 percent month-on-month. Key features for Feb-21 were the usual: significant decline in FDI inflows; Chinese investment leading the pack followed by some European countries; and the same conventional sectors showing inflows. With February’s net flows, net FDI in 8MFY21 stood at $1.3 billion which is a 30 percent year-on-year decline.

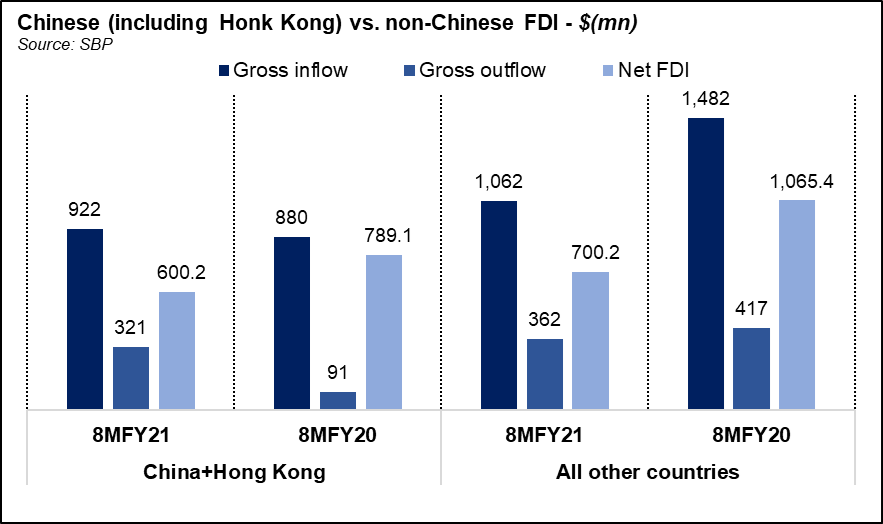

The decline in growth in net FDI in 8MFY21 was led by a 16 percent year-on-year fall in FDI inflows and a 35 percent year-on-year rise in outflows. This trend is also translated to Sino-led FDI. FDI from China and Hong Kong witnessed a drop of 24 percent year-on-year in 8MFY21 with inflows increasing sparsely and outflows rising by over 3.5 times. However, in this shrinking FDI platter, China continues to be the largest investor followed some European countries. And there are no new investment pouring in any new and rising sectors. Chinese FDI continues to be concentrated in the power sector that has share of 41 percent of net FDI in 8MFY21 versus 29 percent in 8MFY20. However, the growth here in power sector inflows were offset by the higher outflows with resultant net FDI remaining flat year-on-year. The increase in power sectors share in primarily due to shrinking size of other sectors in the pie.

Other conventional sectors like communication saw its share in total FDI decline from 28 percent in 7MFY20 to only 1 percent in 8MFY21; others like oil and gas, construction, financial business, transport, and electrical machinery saw minimal change.

Despite the dreary picture of FDI flows, some are of the view that Pakistan did not do poorly amid COVID-19 pandemic. That would only be known as the global investors gradually recover from the pandemic. However, recall that even before the pandemic hot, FDI has been declining since 2017. .FDI policy needs a revived vigor; there is a need for a revamped or renewed role of the investment promotion agencies (federal and provincial). The security and law and order situation improvement have still not been able to lift FDI; there is desperate a need for simplifying the operations and laws for the foreign investors.

Comments

Comments are closed.