Earlier this week, BR Research estimated that the domestic sugar industry shall comfortably achieve production of 5.5 – 6 million tons in the ongoing crushing season, even if crop utilization remained on the lower side between 75 – 80 percent. (For more, read, “Time to go short on sugar?”, published on November 24, 2020).

This begs an obvious question. If given utilization levels will lead to certain decline in selling prices and trim producers’ margins, should they not restrict output levels even further? While controlling supply on a national level is not an easy proposition even for an oligopolistic industry, desired output level for sugar industry is not merely determined by sweetener prices alone.

The crushing process also produces molasses as by product, where molasses is derived in a ratio of 1:2 to amount of sugar produced. Historically, molasses was considered a waste product, but has since found its way into various uses such as animal feed. But its most significant use is as raw material for production of ethanol, a $400 million wholly export-oriented industry.

Since mid-2000s, nearly 20 players in the sugar industry have set up major ethanol producing complexes, taking advantage of the chemical’s international demand. Due to non-existent domestic consumption, over the past decade Pakistan has consistently featured among the top 5 ethanol exporting countries.

But Pakistan is a price-taker in global ethanol trade. Corn and cane-based ethanol producing giants such as Brazil and United States exercise unusual amount of influence as they switch production between sugar/sucrose syrup and ethanol depending on global supply-demand outlook.

Pakistan’s sugar industry’s affair with ethanol export peaked between 2010 – 2015, when international ethanol prices shot over $1,000 per ton. Since then, ethanol prices are on a secular decline, as is the quantum of country’s ethanol trade volume.

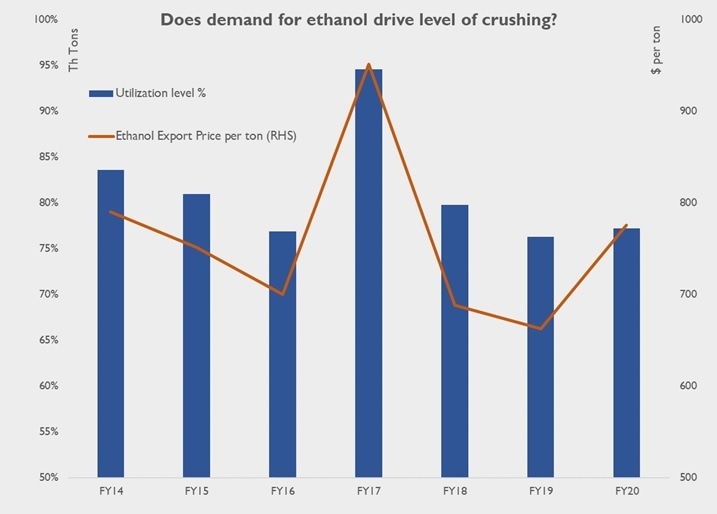

The above context - when juxtaposed against the illustrations - makes a recent trend in the sugar industry hard to miss. The volume of sugarcane crop crushed - which takes place between Dec to March – appears to move largely in tandem with average unit price per ton fetched by ethanol exporters.

The hypothesis may also make sense to those familiar with domestic industry’s dynamics. While excess installed capacity has made sugar trading a low margin business over past two decades, vertically integrated mills earn as much as 50 percent margin on export sales of ethanol. Thus, whenever ethanol price outlook takes a turn for the positive, it appears that industry ramps up production to take full advantage of the opportunity (see FY17), followed by low utilization in succeeding years when global ethanol prices dropped (FY18 – FY19).

Of course, not all mills are vertically integrated or own direct or indirect share in ethanol units, and profits from sale of sugar can be equally lucrative, such as over the past two years. However, even standalone sugar mills benefit from ethanol bonhomie, as price of molasses jack up each time ethanol units increase production.

Since July, global ethanol prices are on a sharp reversal after bottoming out in April-May when lockdowns were imposed across the world. If ethanol export unit prices revert to $800 - $900 territory, the sugar industry will be anxious to not miss the bandwagon. Already, ethanol producers have found an unfamiliar friend in the shape of domestic demand for hand sanitizers, even if international prices do not pick up. Either way, the industry looks all set to ramp up crushing in the upcoming season. Even if domestic retail sugar prices decline, rest assured that not all mills will be on the receiving end of it equally.

Comments

Comments are closed.