Saritow Spinning Mills Limited (PSX: SSML) was incorporated as a public limited company in 1987, under the Companies’ Ordinance, 1984. It is part of the Saigol group of companies. The company is in the business of manufacturing and selling yarn, with its manufacturing facility located in the province of Punjab. Its sales are limited to the domestic market.

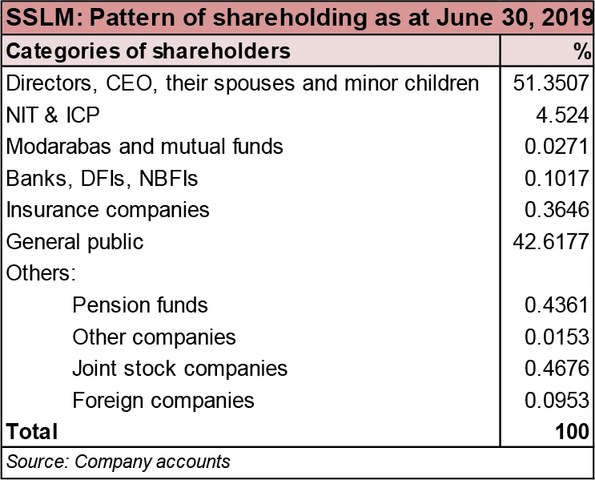

Shareholding pattern

Saritow Spinning Mills is primarily held by the directors, CEO, their spouses and minor children, with 51 percent shares held under this category. Of this, a little over 27 percent is held by Mr. M. Naseem Saigol, who is the Chairman. Close to 43 percent of the shares are distributed with the general public. The remaining about 6 percent of the shareholding is between the rest of the categories, most of them holding less than 1 percent of the shares.

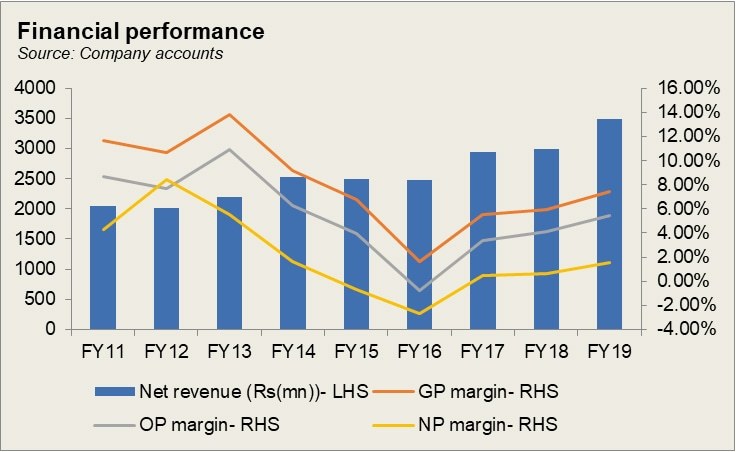

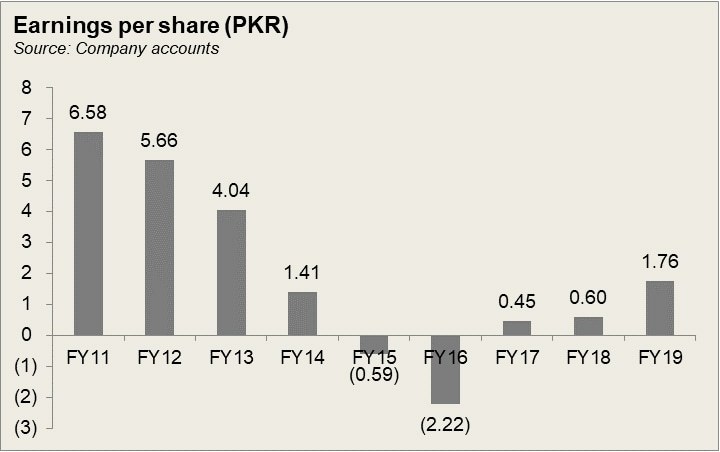

Historical operational performance

Over a period of time, the company has grown in terms of its topline, with gross margins reaching as high as 18 percent. However, the growth in profit margins is not similar to the growth seen in the revenue, due to a high percentage of revenue consumed by cost of production which has gradually but consistently increased for the most part of the decade.

Looking at the financial performance of the company in the last fives years specifically, revenue saw a negative growth of 1 percent in FY15. This was due to the decline in yarn prices. In addition, exports also remained low which kept demand for the product subdued. Costs rose to take up more than 93 percent of the revenue. Most of this came from increase in raw material prices in addition to an increase in minimum wages. Finance cost also rose to make up nearly 4 percent of the revenue due to a rise in interest on long term finances. Thus, the company incurred a loss of Rs 18 million during the year.

Revenue fell by another 1 percent in FY16. Slow down and a resultant decline in global demand affected almost all the textile players in the industry, regardless of their presence in the international market. The country saw one of the lowest textile related exports during FY16. While yarn prices remained low which affected revenue on one side, raw material prices rose which increased the cost of production causing the latter to consume 98 percent of the revenue. In FY16, the local harvest of cotton crop stood at 10 million bales, lower from 14.5 million bales last year. The shortfall caused was filled through import which raised the cost of production. With cost of production making up 98 percent of the revenue, loss was unavoidable.

Sales revenue improved significantly in FY17, growing at nearly 19 percent. As per the company’s report, yarn prices remained high for a large part of the year, before declining in the last quarter. Cost of production was also comparatively lower, however, it still remained above 90 percent of the revenue. This was due to the shortfall in the local harvest which meant raw material had to be imported. However, with the improvement in the revenue and other factors unchanged, the company was able to post a profit for the year.

Growth in revenue was marginal during FY18 at 2 percent. Yarn prices remained subdued for a large part of the year whereas it improved only in the last quarter of FY18 which allowed revenue to increase. Cost of production was relatively unchanged as a percentage of revenue, thus profit margins also increased only marginally. Companies that were present in the global market benefitted from currency depreciation; since Saritow Spinning catered only to the domestic market, it did not see a drastic change in revenue. Another development during FY18 for the company was the consideration of merger/amalgamation of Kohinoor Power Company Limited and Saritow Spinning Mills

Saritow Spinning Mills again saw double digit growth of nearly 17 percent in FY19; with this, its revenue reached Rs 3.5 billion. The increase was attributed to “running appropriate yarn counts at the right time”. Cost of production reduced marginally as a percentage of revenue, yet it still crossed the 90 percent mark. Unlike other companies, the company was unsupported by other income, with the latter remaining negligible. Thus, the company concluded its year with the highest net profit in five years- at Rs 53 million.

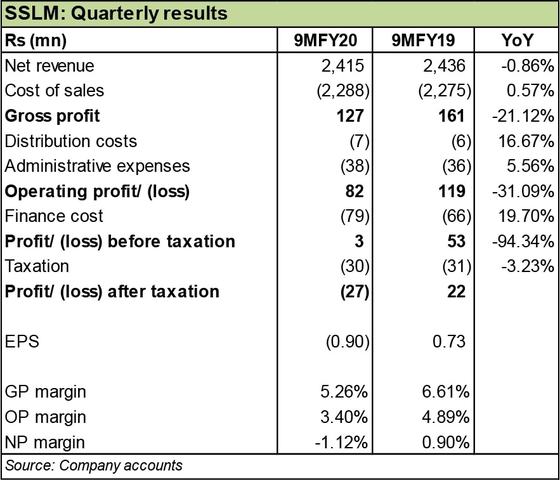

Quarterly results and future outlook

There was a marginal reduction in revenue during 9MFY20 year on year of less than 1 percent. This was due to shut down of mills in March owing to the outbreak of Coronavirus in the country. Cost of production also increased slightly to consume nearly 95 percent of the revenue, compared to 93 percent during the corresponding period last year; latter is also quite high. With finance cost rising to high interest rates, the company incurred a loss of Rs 27 million. Looking at the last quarter, the company’s sales had picked up in the last year to total to Rs. 3.5 billion. The same scenario cannot be expected this year due to ongoing pandemic and slower business activity.

Since China is one of the major trade partners for Pakistan, the outbreak of Covid-19 in China affected Pakistan significantly. Prior to that global textile trade was also affected due to the trade war between China and the US. While the future is still hard to ascertain, companies will have to come up with novel strategies to stay afloat.

Comments

Comments are closed.