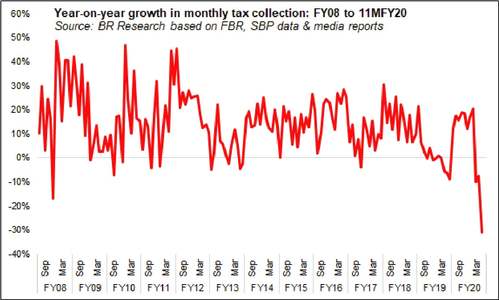

In latest news, the FBR released its press release stating that taxes and duties collected during the eleven months of current fiscal year posted a cumulative growth of 7.7 percent. What FBR’s press release did not state that cumulative growth in tax collection has actually tapered off to 7.7 percent in 11MFY20 from a growth of nearly 16.7 percent in the first half of the current fiscal.

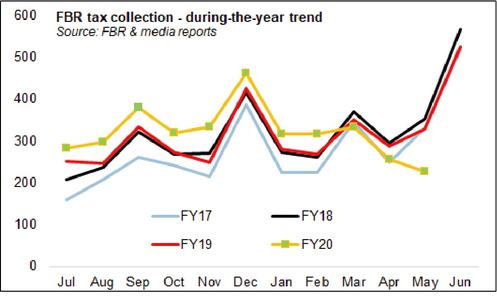

Until February 2020, the FBR was still managing to post high growth, admittedly although it was peanuts in comparison to the originally envisioned number. But things have gone south since Covid-19 struck Pakistan.

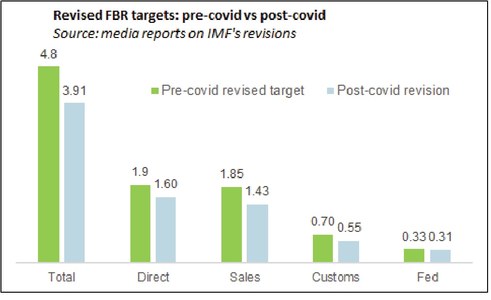

May 2020 saw the biggest year-on-year contraction in monthly tax collection in recent memory – a whopping 31 percent. Not even the era of Great Recession had hit FBR’s tax collection as hard. FBR’s target has been revised downward for the umpteenth time – the latest revision being Rs3.9 trillion in the wake of Covid-19 and the ensuing lockdown. At the risk of being a naysayer, however, even that target seems unlikely to be met.

In order to meet the target of Rs3.9 trillion, the FBR would have to collect about Rs370 billion in June. Being the last month of the fiscal year, June usually witnesses a huge month-on-month jump in tax collection, as companies file their returns for sales tax and WHT-mode income tax, and as FBR’s officials squeeze businesses to pay up in advance to meet their annual targets.

This month-on-month jump in June averaged 56 percent between FY11 and FY20. Even if that average month-on-month growth is met in June 2020, the year-on-year fall in June 2020 tax collection would be about 32 percent, allowing the FBR to collect a total of Rs3.8 trillion, which is just shy of meet its Rs3.9 trillion full year tax target.

That jump, however, is unlikely to come around this year. On the one hand, income levels have fallen, and so have transactions leading to a dent in sales tax collection. On other hand, administrative constraints due to lockdown have impaired tax collection at a time when businesses grapple with liquidity issues to pay the tax man what’s genuinely due, let alone pay in advance from next year’s dues to help him meet his annual targets.

Signs to this affect are already in. Historically, the month of May always posts month-on-month growth in tax collections – averaging 22 percent between FY11 and FY19. However, in FY20 the month of May saw 12 percent sequential decline, suggesting that the usual last quarter growth should not be expected this year. It would not be surprising if the final full year number is at least Rs200 billion short of the third revised target of Rs3.9 trillion.

Comments

Comments are closed.