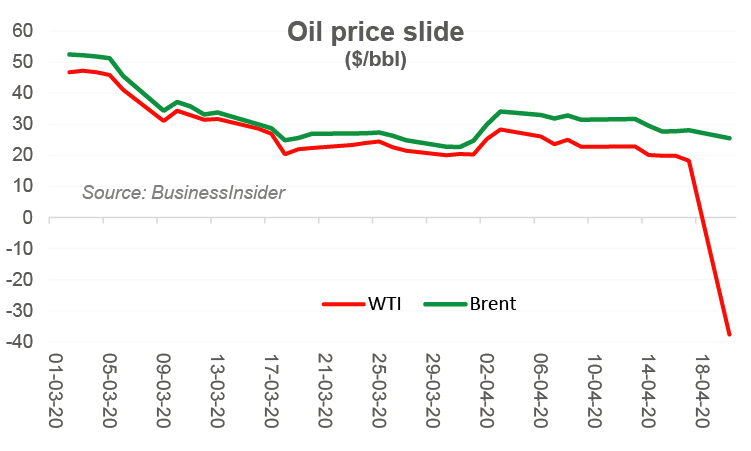

WTI done: is Brent next?

The WTI in the pre-open had recovered by a massive 88 percent yesterday early market hours. Yet it was trading at negative $4.5 per barrel. This is the level of madness that the oil markets saw on Monday. What happened on Monday in the oil markets was almost unreal. An analyst from Goldman Sachs later said, this may not be a symbolic one-off event. The oil producers were actually paying the buyers to get rid of some oil.

The June WTI contracts are well in positive – but were seen fast moving towards single digits – having already lost over 30 percent yesterday in the early trading hours. Don’t forget this comes at the back of “unprecedented” “historic” “once in a lifetime oil production cut deal signed a few days ago – shaving off a tenth of global oil production, with massive commitments from all the big players.

The equation is simple. The world is brimming with oil supply even at promised low production levels. Because of the price war between Russia and Saudi Arabia, although it did not last long, the storages got more than what they were looking for.

More than half the world is shut. It is anybody’s guess as to when will the world be back to normal – even close to it, if at all. The slide in demand has not peaked yet – and is expected to peak in May and June – hence the negative prices for May contracts when physical delivery became due.

The problem is threefold. The world is nowhere close to be asking for even 70 percent of its usual demand for a few more months. The supply is still 25-30 percent higher than the suppressed demand. The oil storage facilities are limited, especially in terms of WTI which is landlocked, unlike Brent, which can still find storage for those who could afford and arrange super tankers and bear the carrying costs.

Americans are now thinking of using the strategic reserves – which should offer some breather. But in absence of any demand trigger in sight, expect the prices to remain suppressed. The story on Brent front may not be as horrid but is far from rosy. The global benchmark Brent crude had lost 23 percent in the early trading hours yesterday, trading in teens.

Yes, there are many differences between Brent and WTI, which explains the usual spread, but things are only a little less scary for Brent outlook. There is no point guessing if Brent will go the WTI route. It probably won’t. It still can. But the point remains that Brent is under immense pressure.

The efficacy of the Opec Plus historic deal was always in question – and Brent freefall seems to have asserted that much more needs to be done. Brent won’t be able to resist much longer if the status quo on both demand and supply continues for a few more days. There is more drama to come in oil.

Comments

Comments are closed.