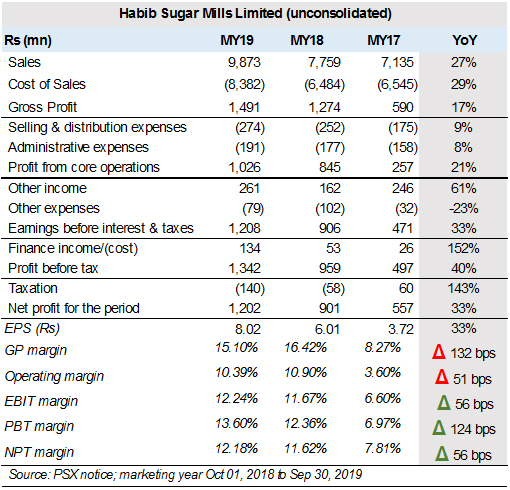

Is this what a recession looks like? Clearly not in the sugar milling industry. Habib Sugar (PSX: HABSM) became the first mill to announce annual accounts on the bourse for the fully year MY19 season, and the outlook for the remaining listed players in the sector looks anything but negative.

Is this what a recession looks like? Clearly not in the sugar milling industry. Habib Sugar (PSX: HABSM) became the first mill to announce annual accounts on the bourse for the fully year MY19 season, and the outlook for the remaining listed players in the sector looks anything but negative.

Granted, any corporation with the Habib prefix attached to it is synonymous with lean financial management, smart investment decisions, and negligible debt, if any. Having said that, the double-digit top line leaps are indicative that the sixers scored are not a Habib-specific phenomenon.

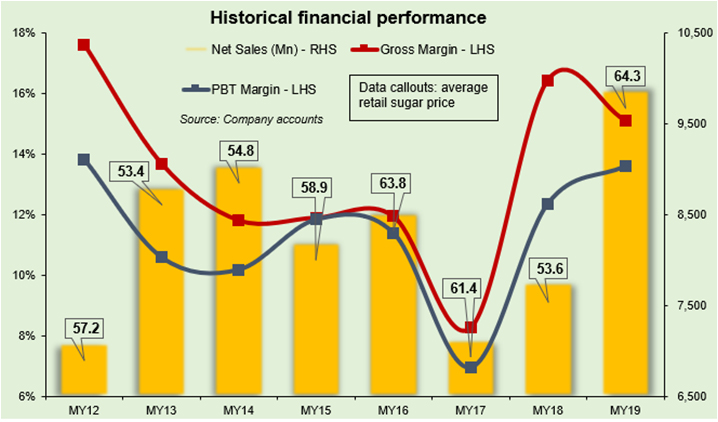

Let’s be clear, the star performance is not entirely unforeseen. Twenty percent increase in full year average retail price of sugar – primary topline contributor at 55 percent – was bound to create an upswing, even without any sweetener exports. And if interim accounts are any guide, additional impetus seems to have been received from the distillery business – with one-third share in revenue – which also appears to have recorded a double-digit jump based on buoyant international demand.

Imagine if things look so good for a sugar and ethanol producer from Sindh - where cane crop was short by twenty percent - smart money may almost salivate at the upcoming financials of millers from Punjab. Producers in the northern province not only enjoyed freight subsidy on sugar export for six-months during the year but some many also have bagasse-powered co-generation units installed with guaranteed electricity sale to the grid.

But it may be misleading to pretend that all is hunky dory in the industry. Naturally, constrained cane supply placed upward pressure on production cost, reflecting itself in modest erosion of contribution margin. That pressure is only projected to exacerbate in the ongoing MY20 year, as overall sugarcane crop production is expected to see another season of shortage. Already, PSMA-Sindh chapter is insisting that cane procurement is taking place at average commercial rate of Rs 215-220 per 40kg in the just began crushing season.

But it may be misleading to pretend that all is hunky dory in the industry. Naturally, constrained cane supply placed upward pressure on production cost, reflecting itself in modest erosion of contribution margin. That pressure is only projected to exacerbate in the ongoing MY20 year, as overall sugarcane crop production is expected to see another season of shortage. Already, PSMA-Sindh chapter is insisting that cane procurement is taking place at average commercial rate of Rs 215-220 per 40kg in the just began crushing season.

And it is exactly such tough times that separate leaders from laggards. Operating margins may very well witness attrition due to inflationary pressures, but Habib’s shrewd financial management made hay in gloom by making opportunistic gains on exchange rate (ethanol export) and taking advantage of high saving rates on short term bank deposits. Together, the two factors ensured that the spread between gross and before-tax margin was of only 151bps, a mere sum of Rs150million reflecting all incidental expenditure against a topline of Rs10billion! Ex-raw material, of course.

And it is exactly such tough times that separate leaders from laggards. Operating margins may very well witness attrition due to inflationary pressures, but Habib’s shrewd financial management made hay in gloom by making opportunistic gains on exchange rate (ethanol export) and taking advantage of high saving rates on short term bank deposits. Together, the two factors ensured that the spread between gross and before-tax margin was of only 151bps, a mere sum of Rs150million reflecting all incidental expenditure against a topline of Rs10billion! Ex-raw material, of course.

The coming year will be tougher, as overall sugar production may witness another slump over the one-fifth decline recorded in MY19. On the flipside, international commodity trends indicate that sugar price may finally see a turnaround. Insiders estimate that domestic producers can very much be export-competitive at $375 per ton even if procurement cost averages at Rs200 per 40kg.

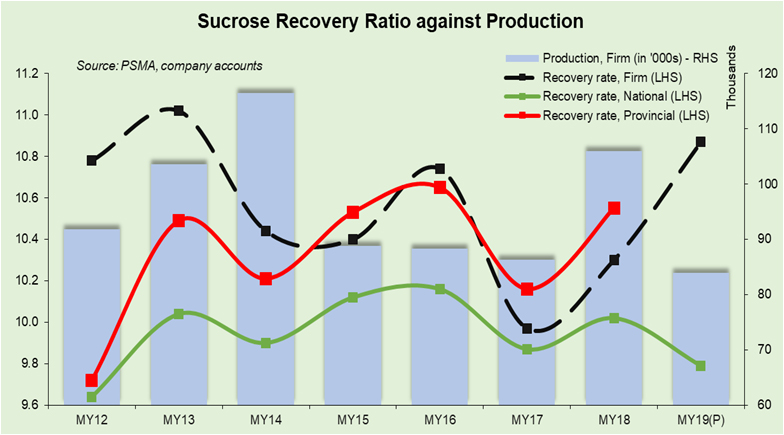

Whether that proves true for HABSM may all come down to sucrose recovery rate. At one percentage point strength over the national average historically, that may not entirely be out of question.

Comments

Comments are closed.