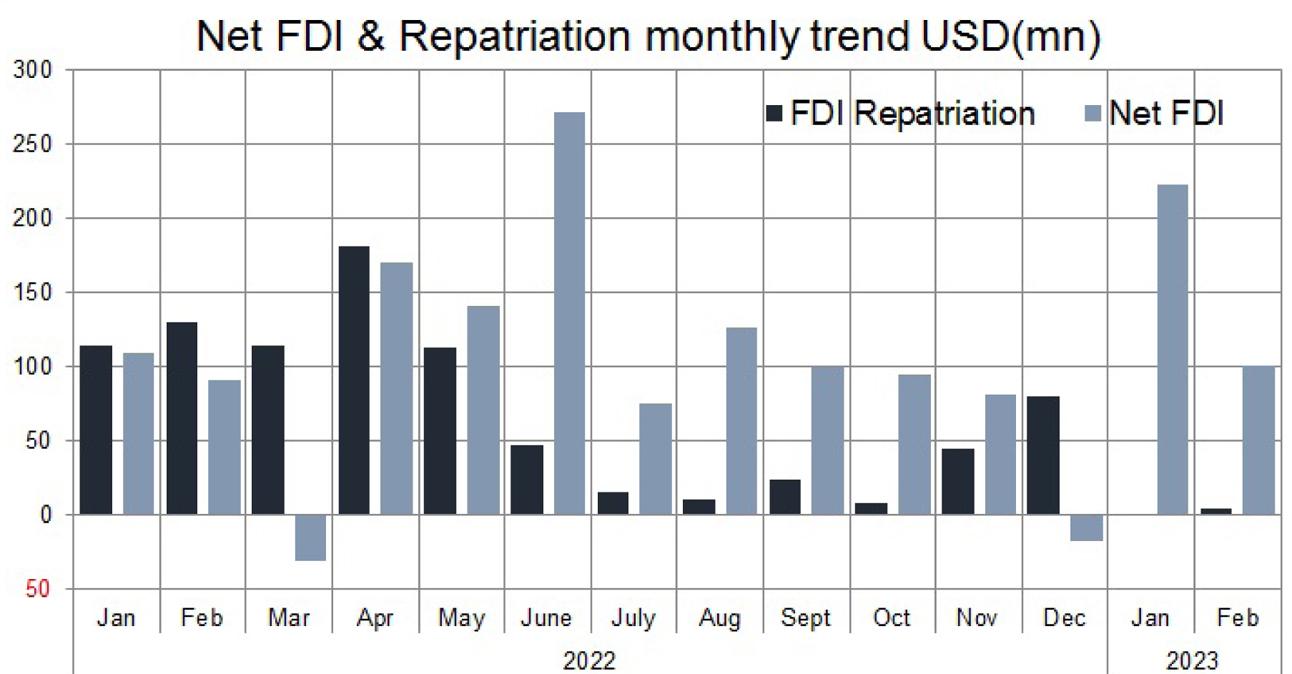

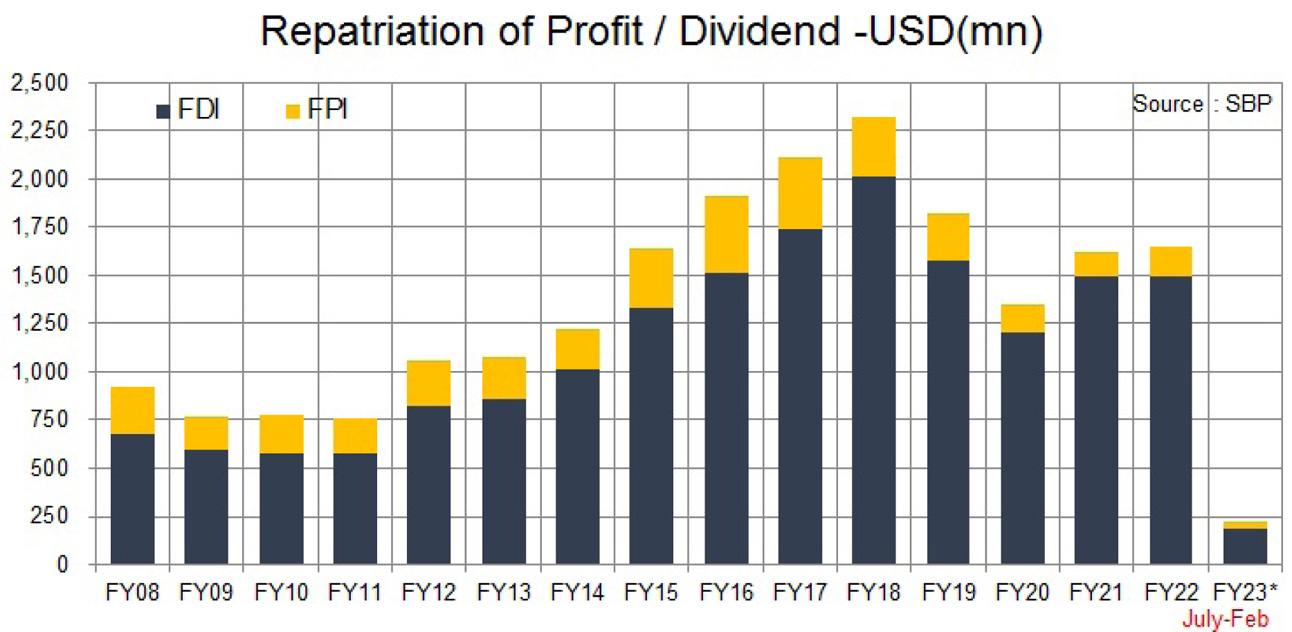

Dividend and profit repatriation on foreign direct invest has been falling over the last eight months of the fiscal year (FY23). The massive decline in the repatriation of profits and dividends by the multinational companies has been witnessed due to the fragile foreign exchange reserve position in the country and the resultant curbs by the central bank on dollar outflow including the restrictions on imports to curtail the trade deficit.

Not only that, the decline in repatriation by the MNCs has been due to weak economic activity in the country, which has resulted in weaker profitability and decline in dividend announcements by the subsidiaries.

Decline in earnings and business activity has also forced existing investor to rethink and move out as they struggle to repatriate profits and dividends amid dollar shortage. Furthermore, with the IMF program in limbo, there investor confidence is at its nadir.

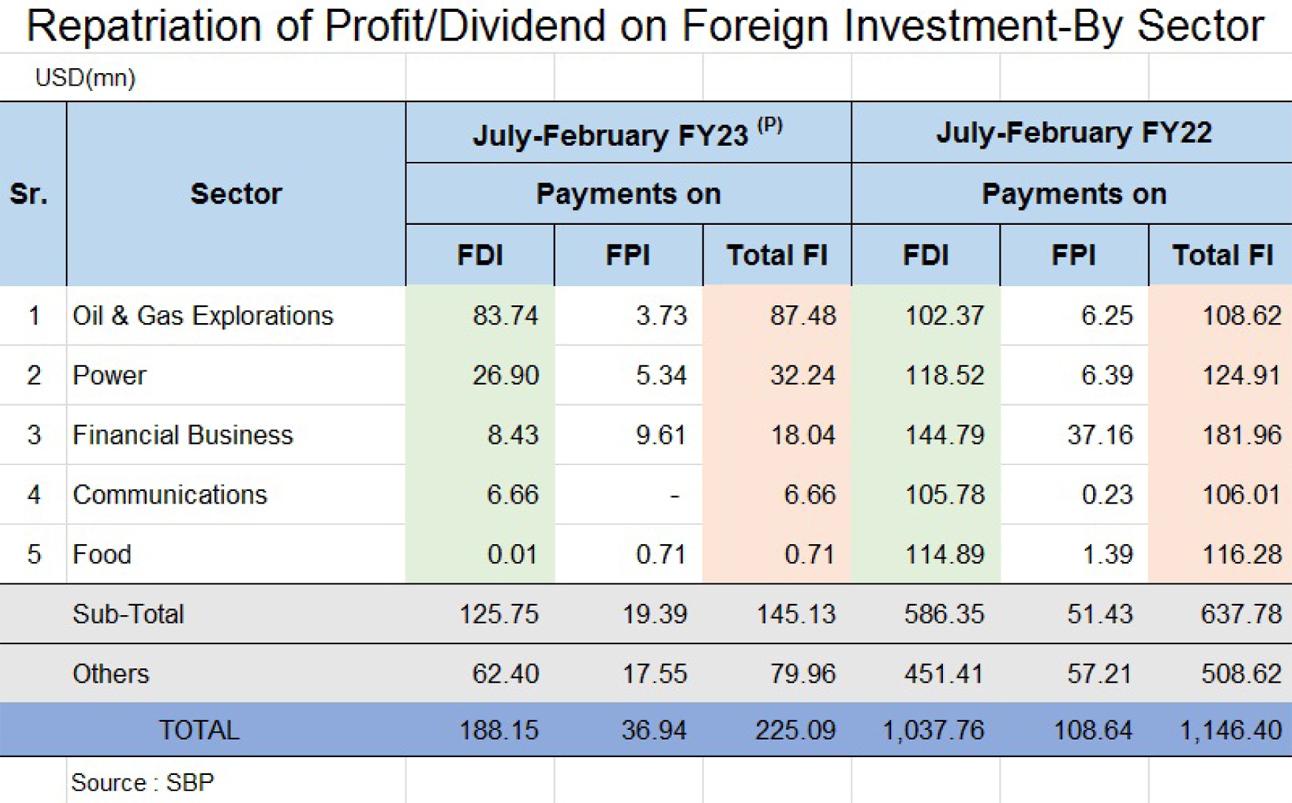

The profit and dividend repatriation against foreign direct investment for 8MFY23 stood at only $188 million versus $1.038 billion in similar period last year – a decline of 82 percent year-on-year. Due to dollar shortage, around $1 billion of dividend and profit repatriation is reportedly stuck. And the decline in repatriation has been felt across all sectors – be it power, telecom, transport, energy or food and beverages. Of whatever was sent to the parent companies, the outflow of profit and dividends came from the oil and gas E&P, mining, power and the financial sector. While multinational organizations have been operating in the country and have faced volatility and instability in the past, this kind of squeeze has not occurred before and does more damage to the already poor FDI landscape in the country.

Comments

Comments are closed.