Bata has shoes to fill

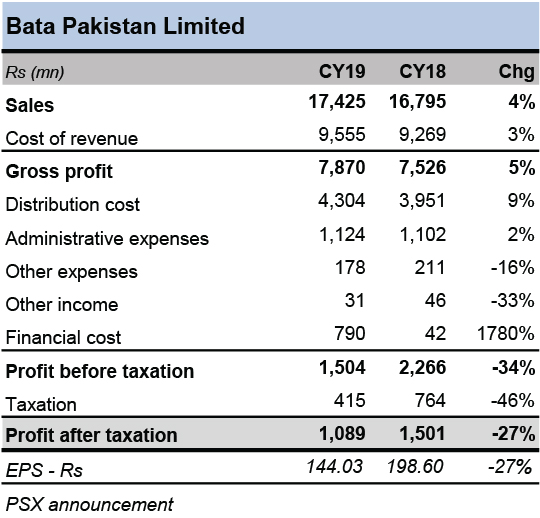

One of the country’s leading shoemakers has had a mixed year. But it isn’t due only to the downturn in the consumer-facing economy. Looking at the latest financial results released by Bata Pakistan Limited (PSX: Bata) for the year ended December 31, 2019, it is apparent that it was an accounting change in a non-core expense head that marred an otherwise disciplined performance.

Consumer mood affects this Lahore-based boot-maker, which deals in production and sale of footwear products, accessories and hosiery products. Bata has two production facilities, with an installed capacity of over 20 million shoe pairs a year. Its retail footprint spans 450+ outlets across different regions of Pakistan. Bata also exports its products, but those proceeds are generally below 1 percent of gross sales.

The 4 percent topline growth is lower for Bata when compared with its five-year average topline growth of 6 percent between 2014 and 2018. The economic slowdown and inflationary pressures have affected consumer spending power. The Bata brand is positioned towards middle and lower income groups, which are more prone to cutting down on spending. The higher GST effective July 2019 also didn’t help.

Still, the retail division has come out as the main source of growth, as Bata is focused on adding more “big format” stores and closing down stores that are proving to be mere cost centers. The footwear company is also spending significant sums on opening new stores and renovating existing stores. This is important as Bata’s shoelaces are increasingly tied with the retail economy.

During the year under review, the management did well to maintain its cost of revenues at 55 percent of sales, as this cost head grew less than proportionally with the topline growth. Despite inflation across the board, Bata recorded an increase of 2 percent in administrative expenses and 9 percent in distribution costs. Collectively, these two heads exhausted 31 percent of sales, almost the same as in CY18.

If it weren’t for the nineteen-fold jump in the company’s finance cost, Bata would have closed the year with almost the same amount of net profits as the previous year. The finance costs spiked in CY19 because the company switched to IFRS 16, which recognized a large “lease liability” that reflected future lease payments and right of use for leased assets for the company.

In the end, the company’s net profits slumped to just above a billion bucks. That profitability level in 2019 transports the company back to 2012. A new decade has commenced and Bata has quite some shoes to fill.

Comments

Comments are closed.