The latest T-Bill auction indicates the market is not expecting rate cut in next three months. Out of Rs591 billion accepted (against target of Rs500 bn), Rs472 billion (80% of total acceptance) were in 3M papers at 13.43 percent. The cut off yield went down by 4 bps. However, it is up by 12 bps in the secondary market. In 6M and 12M papers government accepted Rs19 billion and Rs99 billion at 13.29 percent and 13.13 percent respectively – no change in yield from previous auction. The secondary market yields are down by 3 bps and 12 bps respectively.

The latest T-Bill auction indicates the market is not expecting rate cut in next three months. Out of Rs591 billion accepted (against target of Rs500 bn), Rs472 billion (80% of total acceptance) were in 3M papers at 13.43 percent. The cut off yield went down by 4 bps. However, it is up by 12 bps in the secondary market. In 6M and 12M papers government accepted Rs19 billion and Rs99 billion at 13.29 percent and 13.13 percent respectively – no change in yield from previous auction. The secondary market yields are down by 3 bps and 12 bps respectively.

The net foreign portfolio investment (hot money) was $209 million (inflow: $221mn; outflow $12mn). This was 5.5 percent of the amount the government raised. The remaining 94.5 percent was picked by commercial banks, insurance companies and other local investors. In the previous auction, foreign portfolio investment was $536 million (highest single day inflow to-date), it was 32.3 percent of that day auction issuance of Rs257 billion. Since it was the first auction after the relaxation of taxation to portfolio investors, the inflows were unexpectedly high. The auction pattern in last auction is similar to the previous two auctions. For instance, in Dec 31 auction, government accepted Rs467 billion with 81 percent in 3M paper, and on Jan 15, 3M paper contribution was 66 percent. However, in preceding two auctions, the participation was not skewed towards 3M paper. There were active participation and acceptance in 12M paper. Now market is not keen to bid much beyond 3M.

The auction pattern in last auction is similar to the previous two auctions. For instance, in Dec 31 auction, government accepted Rs467 billion with 81 percent in 3M paper, and on Jan 15, 3M paper contribution was 66 percent. However, in preceding two auctions, the participation was not skewed towards 3M paper. There were active participation and acceptance in 12M paper. Now market is not keen to bid much beyond 3M.

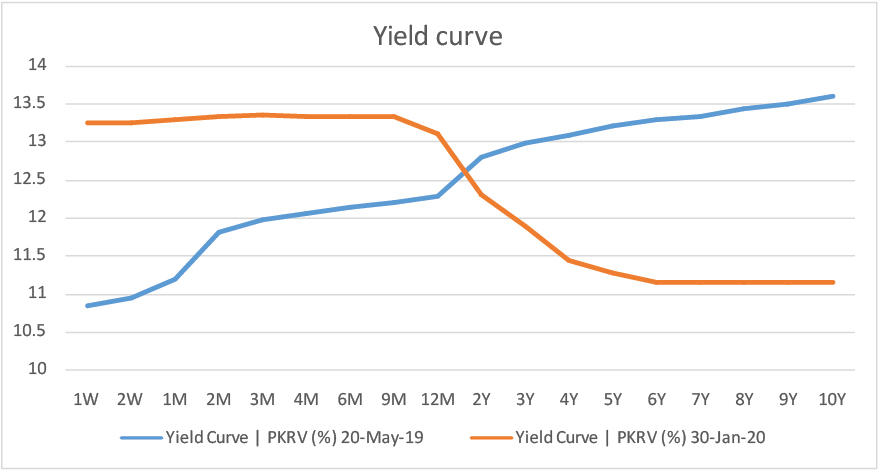

The National CPI at 14.6 percent for January 2020 will surely further delay the expectations of rate decline. Earlier, the market was anticipating that rate cut might take place in March, now earliest rate cut chance is expected in May or Sep. This means no change in rate cut in next three months. The rates are marginally better in 3M – participants are looking to grab as much as they possibly can.

Comments

Comments are closed.