Karachi Electric Limited (PSX: KEL) announced its much delayed financial performance for FY17 just recently. This came a little after Nepra upwardly revised power tariffs by Rs2.15 to Rs3.63 per unit. (The range shows the overall increase for different usage slabs). While the utility’s quarterly and annual financial performances for FY18 and FY19 are still pending, those announcements shall come soon now that there is clarity on notified tariffs.

KEL’s prospects had been in limbo as the utility’s final notification of multi-year tariff (MYT) for 2017-2023 had hit a snag back in 2016. Recall that Nepra came forth with some major alterations in the tariff structure, including a seven-year period as against the ten-year period in the MYT determination. Also, the regulator revised the base-tariff downwards to around Rs12.07 per KWh from the existing Rs15 KWh.

However, KEL sought a higher MYT at Rs15.57 per KWh. Following the review petition, Nepra revised the tariffs up twice to 12.77 and 12.81 per KWh, to which KEL filed a reconsideration request. It was only recently that Nepra has revised the power tariffs upwards (as highlighted above).

The last few years have also been testing times for a buyer in waiting. The delay in notified tariffs kept KEL from holding its AGM for FY17 and beyond, as the tariff adjustment is a key component in the company’s top line determination. The limbo had also created uncertainty about the long-awaited takeover by Shanghai Electric. However, now that the increased tariffs have been notified, the Chinese firm is expected to complete the acquisition of KEL from the Abraaj Group in 2HCY19.

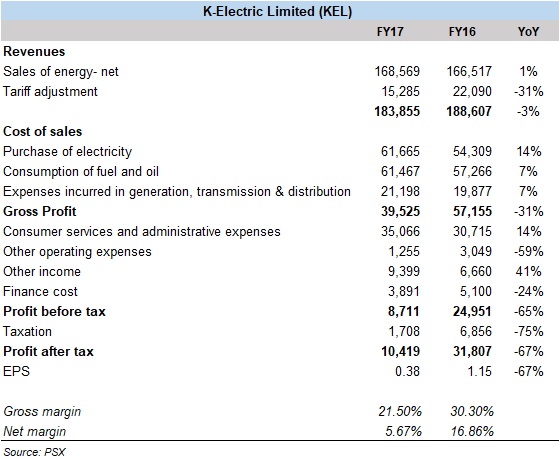

As for KEL’s financial performance for FY17, there has been no significant change in revenues for the year. Overall, higher cost of sales (which include cost of fuel, oil, purchases, generation and T&D) remained high and dragged gross margins. And even with lower finance cost and higher other income during the year, the company’s earnings for FY17 slipped by 67 percent year-on-year. It will be interesting to see how the utility has fared in more recent years.

Comments

Comments are closed.