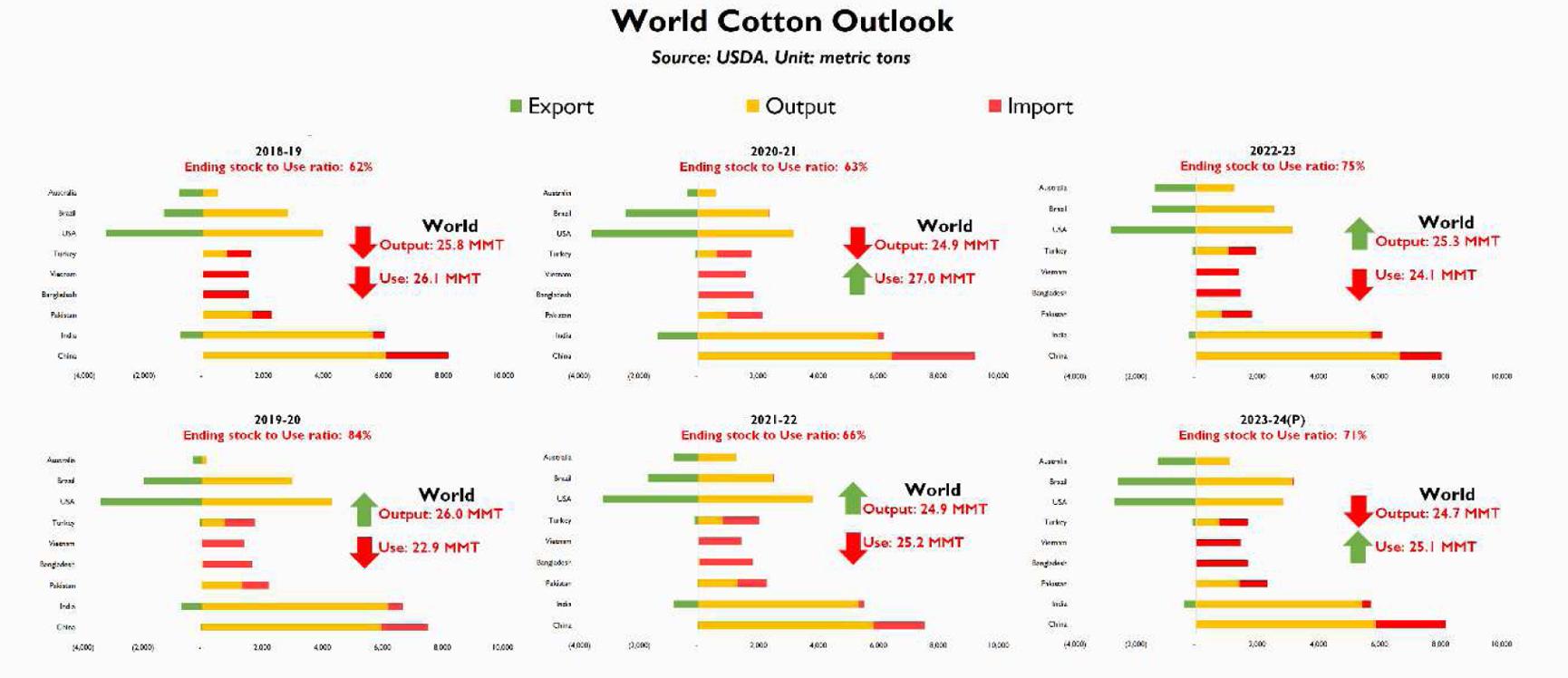

The last time cotton output fell to this level, demand in the global economy drove prices into a super cycle, with the market witnessing 11-year record prices. That was 2020-21, when the nascent output recovery post-Covid reluctantly faced up to resumption of industrial activity amid supply chain disruptions. Global output forecast for 2023-24 has once again been revised to post Covid-lows. In fact, to its lowest in the past eight years. Yet price trends in the global market seem to suggest that the commodity is flirting dangerously close to recessionary levels.

After the release of USDA’s monthly WASDE report, world cotton prices finally fell below the psychological barrier of 80 cents per lb beginning November 2023, breaking the agonizing tango of the last 12-months, when prices remained rangebound between 80 – 90 cents per pound.

Market watchers will recall that world cotton prices had been locked into this above long-term average territory following a spectacular fall between May to Oct 2022 when market prices fell some 45 percent from an 11-year peak of 150 cents per lb. It took exactly two years for the world cotton prices to effectively triple from their peak-Covid bottom of May 2020. By that standard, so far the world market has only been downward trending for 18 months, and may witness few more bear month before it bottoms out.

But what really is driving the downward trend? On the production side, Pakistan has been the biggest positive surprise this year, where output is forecast to leap forward by two-thirds or 66 percent over last year. However, technically, the Pakistan surprise hasn’t really been a surprise since at least July 2023, which is when USDA put forward the country forecast at 8.5 million bales (of 170kg). Therefore, while Pakistan may be a good reason for oversupply in the market, it doesn’t explain the rapid decline in prices in the near term.

For almost all other major producers, USDA forecasts a downward revision in output, with China forecast to witness a production slowdown of 12 percent over last year; India by 5 percent; and USA by 10 percent. In fact, despite the rise in output of two key producers – Brazil and China – total world output is expected to slowdown by 3 percent over last year.

In fact, it is the demand side that seems to be unable to catch a break. Since the marketing year began, USDA has revised down global consumption of cotton during the current season every month, indicating that demand remains in reverse gear despite 18 months of price decline. In fact, USDA estimates indicate that global demand is well-below pre-Covid era, setting aside the extreme volatility witnessed during the lockdown (2020) and post-lockdown (2021) years, when demand from certain textile pockets (home linen etc) distorted the picture for a short while.

Will world cotton prices finally slip below 75 cents for a sustained period? That’s hard to say, especially considering that the global inflation of the past three years has irreversibly impacted cost of production in most major production regions. However, the demand side does not look too upbeat.

Comments