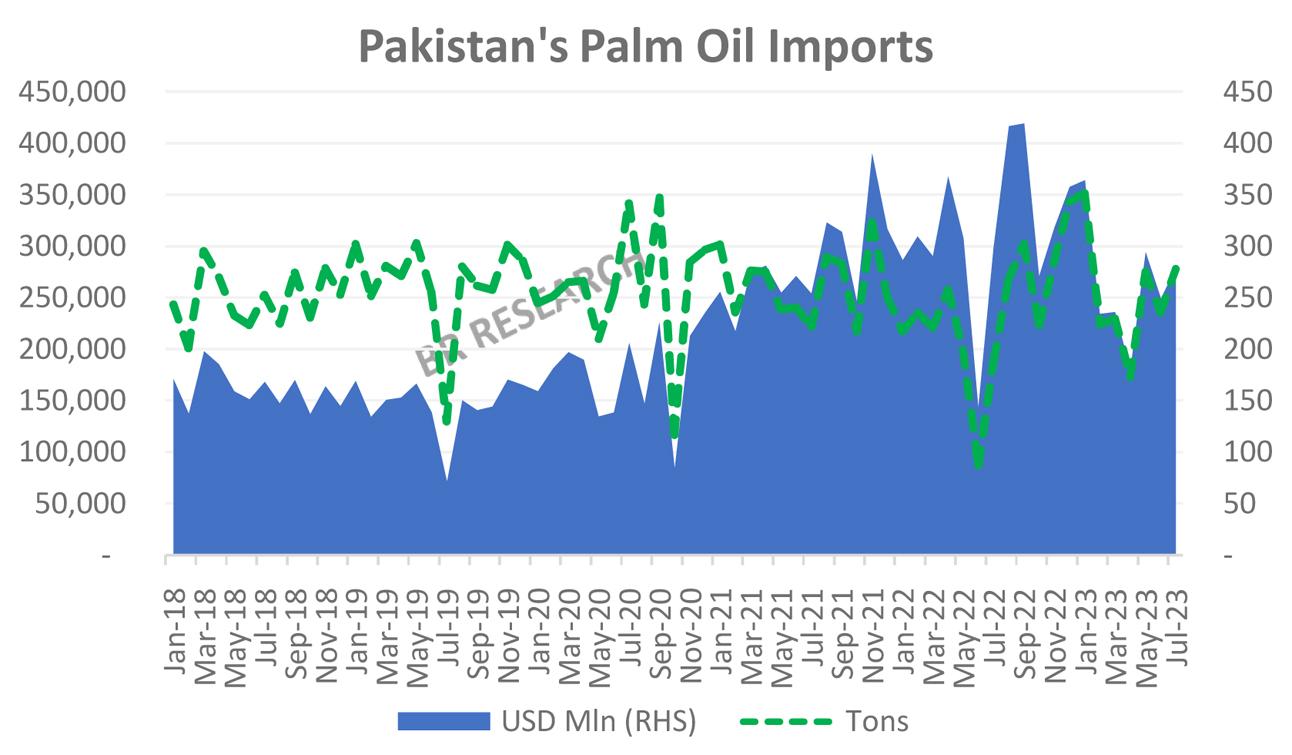

While the imports of pretty much everything else has gone down – Pakistan’s love for palm oil seems to be intact. Pakistan imported 3 million tons of palm oil in FY23 – much in line with previous highs seen in FY21 and FY20. Such is the resilience of the palm oil demand, that when Pakistan was almost on a standstill in the peak Covid era – palm oil imports went on as if it was business as usual. Today, when Pakistan faces its worst economic slowdown in decades, and all imports have considerably lowered (consider that Pakistan did not import diesel in July 2023 at all) – palm oil goes on its merry way.

This is also when retail prices are hovering near all-time highs (having slightly come down from the peak in April 2023). With runaway food inflation, and core inflation touching all-time highs, it is fair to assume that average Pakistani is struggling more today than a year ago – and surely the consumption patterns would have taken a hit – as real incomes go down considerably. But palm oil consumption is having none of it.

What could possibly explain such sturdiness? Maybe one does not have to look farther than the porous borders. It is hard to imagine Afghanistan’s palm oil imports are almost next to nothing – despite the difference in eating culture and market size. Pakistan continues to dole out the precious dollars for the Afghan brethren – as palm oil continues to be an “essential” commodity. (Likewise, there is almost no way Pakistan’s local refineries met all diesel requirement for the month despite reduced demand. In this case, we happen to be the recipients from the Western borders).

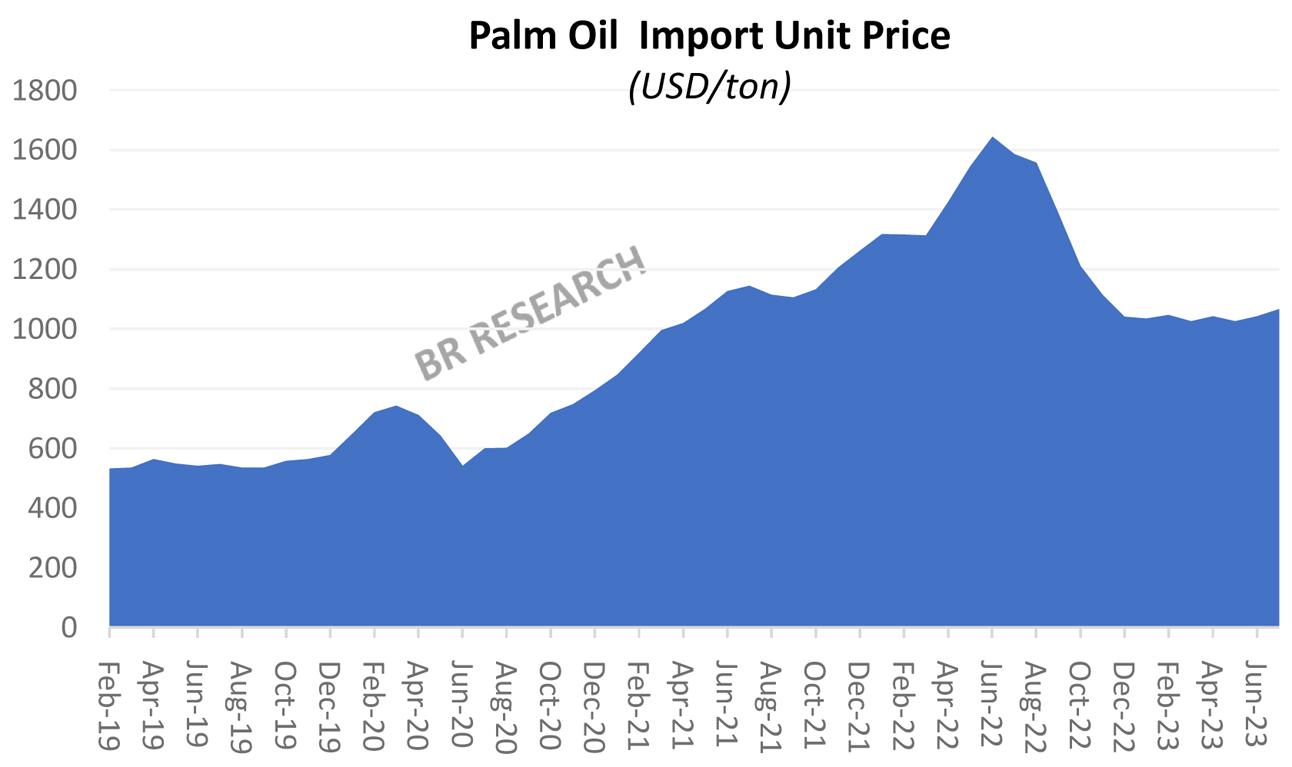

Back to palm oil. The price sin international market have remained relatively stable over the past few months –in fact lower today than the same period last year with much reduced volatility than FY22. Imported cost continues to hover a little over $1000/ton – and with the rupee losing fast against the greenback and petroleum prices at record highs, the retail prices are in for another round of increase, sooner than later.

Comments

Comments are closed.