Cement prices have started to respond to the demand lull the industry is experiencing in domestic markets. After months of slowly raising prices, cement prices are slowly coming down. In the past month, the Pakistan Bureau of Statistics (PBS) recorded weekly spot prices show a reduction of Rs4 per bag on average, but in various markets in the north, such as Islamabad and Peshawar, prices have declined by Rs10-20 per a 50-kg bag.

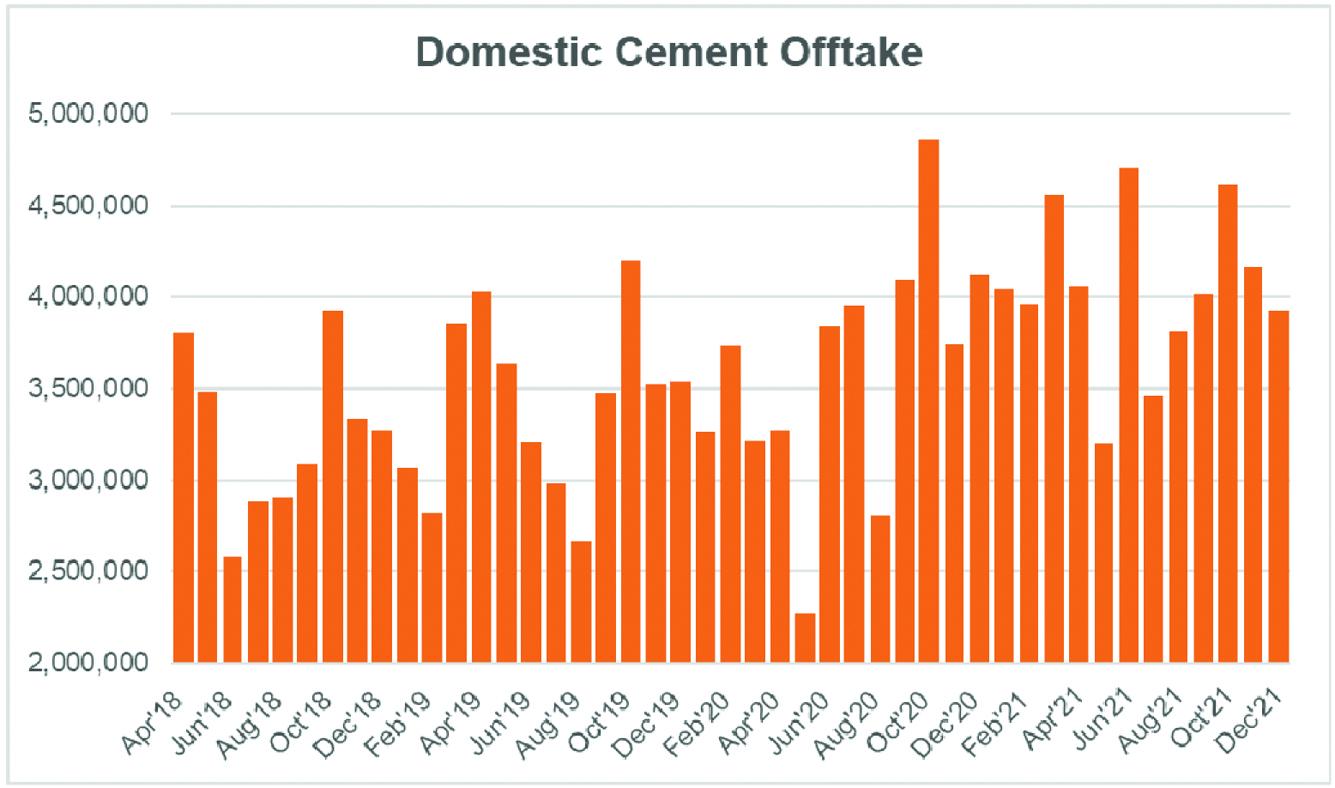

Cement offtake in the local markets has remained unimpressive. In 1H, cement dispatches grew only 2 percent, roughly selling at the same monthly rate as last year. Average monthly sales in dispatches stands at about 3.99 million tons. The industry’s expectations of growing at an annual rate of 8-10 percent seem out of context with ground realities which are getting tough. The main culprit being poor exports.

Exports have been having a real beating in previously and historically receptive markets (Afghanistan, South Africa, Sri Lanka, India) with reason ranging from political tensions to high freight rates to dampening economic outlooks (read: “Cement exports under pressure”, Jan 5, 2022). Exports thus far have fallen 30 percent in 1HFY22 with the share in total dispatches dropping to 13 percent in Dec-21 which is higher than what it was toward the start of the year but showing considerably year on year decline.

Domestic demand dictates the industry’s sales mix where exports share grows when domestic demand is weak. But if there aren’t accessible exporting markets available, and domestic demand does not rise to the occasion, this will put cement makers in a fix.

Last year, average monthly domestic offtake in the second half of the fiscal year stood at 4 million tons versus 3.9 million tons in the first half. Winter seasonality is certainly one factor for the slowdown as cold temperatures restricts mobility. Most hydropower and major infrastructure projects requiring cement are under construction in the northern part of the country where winter bites harder. These are the markets where prices have also visibly declined.

When the wind turns, construction in these areas will resume and demand will stabilize, depending upon which prices will shore back up too. But not too much! The aspirational growth expectations of 8-10 percent are unlikely to materialize this year. There is very little evidence to support thus far that a lot of new housing stock is added and construction projects by the private sector are being carried out under Naya Pakistan Housing Projects. If that were the case, domestic offtake would have been much, much higher. The peak offtake of 5.73 million tons for the industry happened in Oct of 2020 (of which 15% were exports). That was a long time ago.

Comments

Comments are closed.