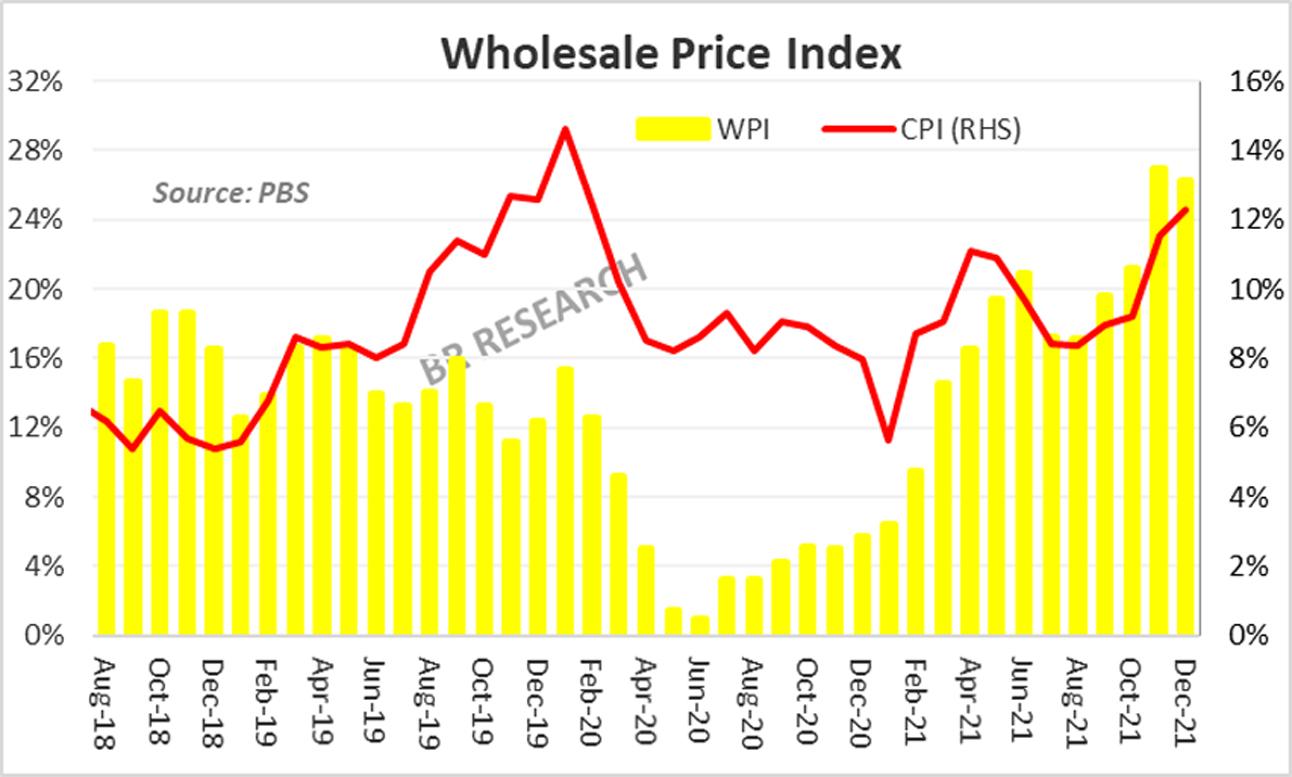

It was only a matter of time before the wholesale prices started to reflect at the retail level. The National CPI inflation for the past two months confirms just that. This space had highlighted the retail prices facing a significant upside risk when Wholesale Price Index (WPI) had gone up to 20 percent back in October 2021 (read: CPI faces WPI threat, published October 12, 2021).

The WPI increased by 26.2 percent year-on-year in December 2021, only marginally lower than the all-time high 27 percent registered in November. The double-digit CPI numbers that have followed may not necessarily be one-offs, as WPI has historically loosely indicated CPI. Recall that the previous Bull Run in wholesale pieces towards the end of 2018 had led to a multiyear high inflation north of 14 percent, with a few months lag.

Unlike the 2018 WPI spike, the current one has more contributors than just the electricity and gas subgroup. Transportable goods, textile, and farm produce have consistently shown high growth, and the base effect is still a few months away to pacify the upward trend. The increase in international oil prices is the most obvious and direct contribution to WPI, which feeds into transportation of goods that usually, reflects in prices with a lag.

Contrary to popular perception, petroleum related prices may not offer a respite anytime soon, even if the global crude oil prices were to go down from here. Recall that the government has an arrangement with the IMF that paves way for higher PL every month. All-time highs have been tested for petroleum prices, and there is very little chance of government reducing the prices anytime soon, even if there was room.

There is more that is coming in terms of gas and electricity tariffs. The electricity base tariffs are all set to undergo another upward revision sooner than later. A much more significant dent could be dealt by the gas prices, which have stayed frozen for over two years. The petitions of the two Sui companies suggest the increase could be reminiscent of 2019, which singlehandedly carried the WPI bull rally for a good six months.

The fiber crop prices have almost doubled from last year, whereas sugar and cotton crop outlook is also suggesting there could be more price increase in the offing. The recent fertilizer shortage and sky-high input prices will soon start reflecting in crop prices, once the produce enters the market. There appears to be no respite to WPI for the next quarter, and retail prices should follow suit.

Comments

Comments are closed.