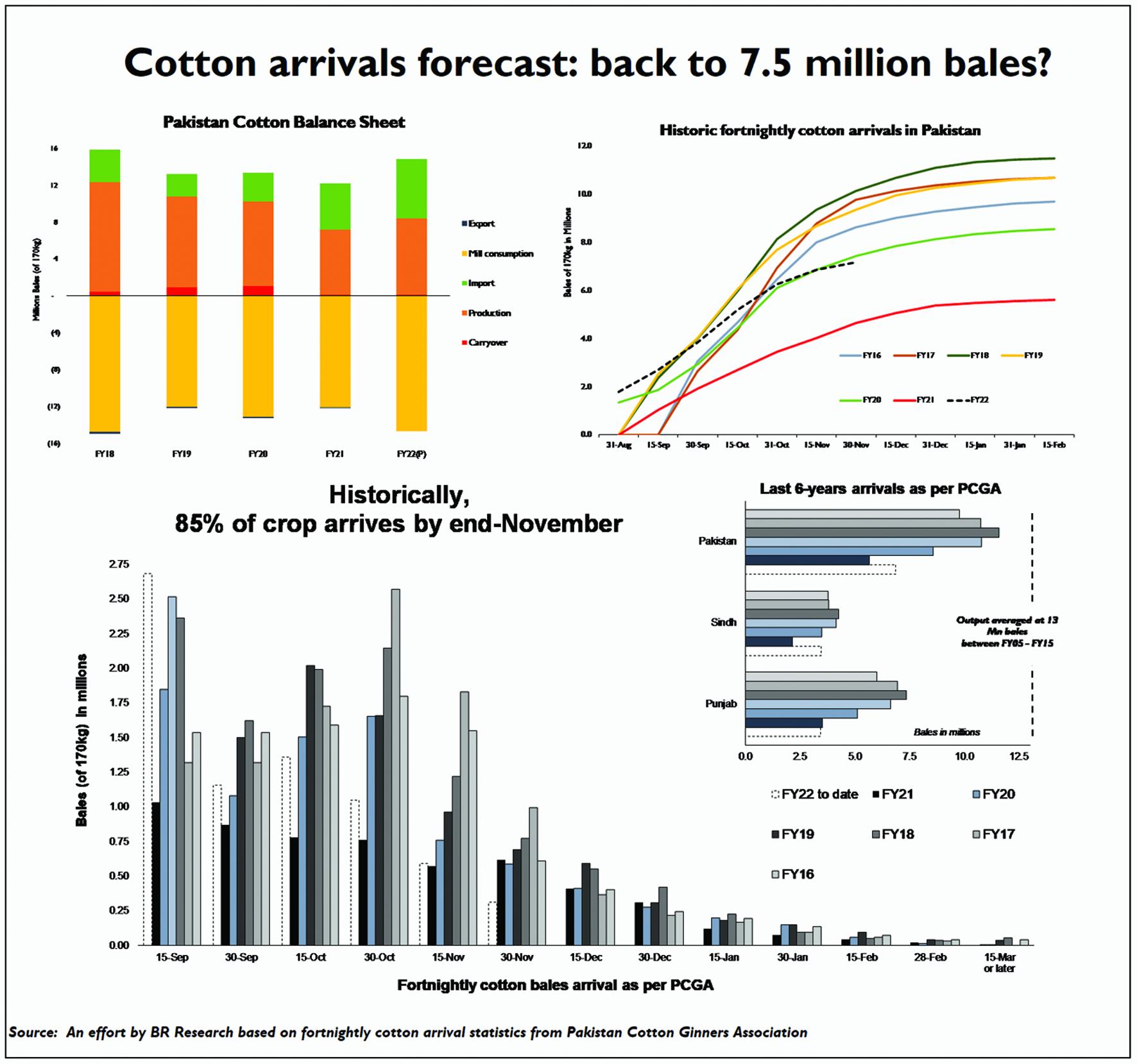

Finally, the premature celebration of fortnightly cotton arrivals has tamed down! Back in October 2021, fortnightly arrivals as reported by Pakistan Cotton Ginners Association (PCGA) were double that of last year. The rate has fallen precipitously since, with latest fortnightly data for November end reporting arrivals up only 54 percent over last year.

Is that performance not impressive still? Not particularly, considering that arrivals of 7.2 million bales (to date) are only higher compared to last year, and second lowest in at least 33 years. But more importantly, arrivals received during last fortnight were lowest since at least FY16, and half of the volume received during same period last year: dropping from 0.62 million bales to 0.31 million bales.

Although both cotton output and per acre productivity are showing signs of recovery, latest fortnightly arrivals position further strengthens the early peaking theory, proposed in this space since the current harvest season began. Historically, no more than one-third of seasonal cotton output is picked and sold to ginneries by September end. This trend has shown early peak during the ongoing season, with nearly half of total seasonal output received by September end.

The preponement of cotton arrival now means that forecast of seasonal output, which was earlier revised upwards thanks to euphoria over initial performance, may now once again be due for a downward revision. PCGA data indicates that arrivals in Sindh are now as good as over, and may in fact be reflecting cross-border flows from the Northern Province.

Meanwhile, even if flows in Punjab magically maintain at current level during December – of which there is little likelihood – that will only drag nationwide arrivals up to 7.7 million bales, barely close to the initial projection of 8.4 million bales by Pakistan Central Cotton Committee, and a far cry from second forecast of 9.4 million bales revised as recently as in mid-October.

This will once again throw import requirement of the kilter, which may now overshoot 6 million bales during the ongoing fiscal year. 6-month moving average of Cotton ‘An’ Index has climbed up to $2.36 per kg. Even if prices calm down in H2-FY22, raw cotton import bill shall remain upwards of $2 billion in FY22, unless 12-month average price for the year falls below $2 per kg (of which there is a fat chance).

Meanwhile, low carryover stock from last year along with projections of $20 billion in textile exports by the industry implies local supply may remain stretched to the hilt. This means higher yarn prices for remainder of the year. Expect renewed calls for resumption of duty-free yarn import, which if history is any guide shall be shot down again. By any metric, FY22 is the year of spinners. Rejoice!

Comments

Comments are closed.