Pakistan’s rice exports staged a comeback during Q1-FY22, rising against low base from Covid quarter during same period last year. Exports of all varieties have shown marked improvement, with basmati rice exports recording a particularly impressive performance, marching ahead by one-third in volume terms.

But beyond the obvious low base impact, rice exports are struggling to get off the rollercoaster ride they stepped on three years ago, failing to inspire confidence. Exports remains significantly lower than Q1-FY20, when impact of currency devaluation made commodity export temporarily very attractive. Since then, volumes have struggled to maintain momentum, with annualized basmati volume well-under million tons target, whereas non-basmati varieties are also trailing under peak performance.

Although rice exporters have pointed fingers at the oceanic container shortage, much more seems to be at play that explains below-par performance. Exporters are struggling to fetch attractive pricing in the global commodity market, as rice prices have turned out to be the only laggard in the ongoing global commodity price spiral.

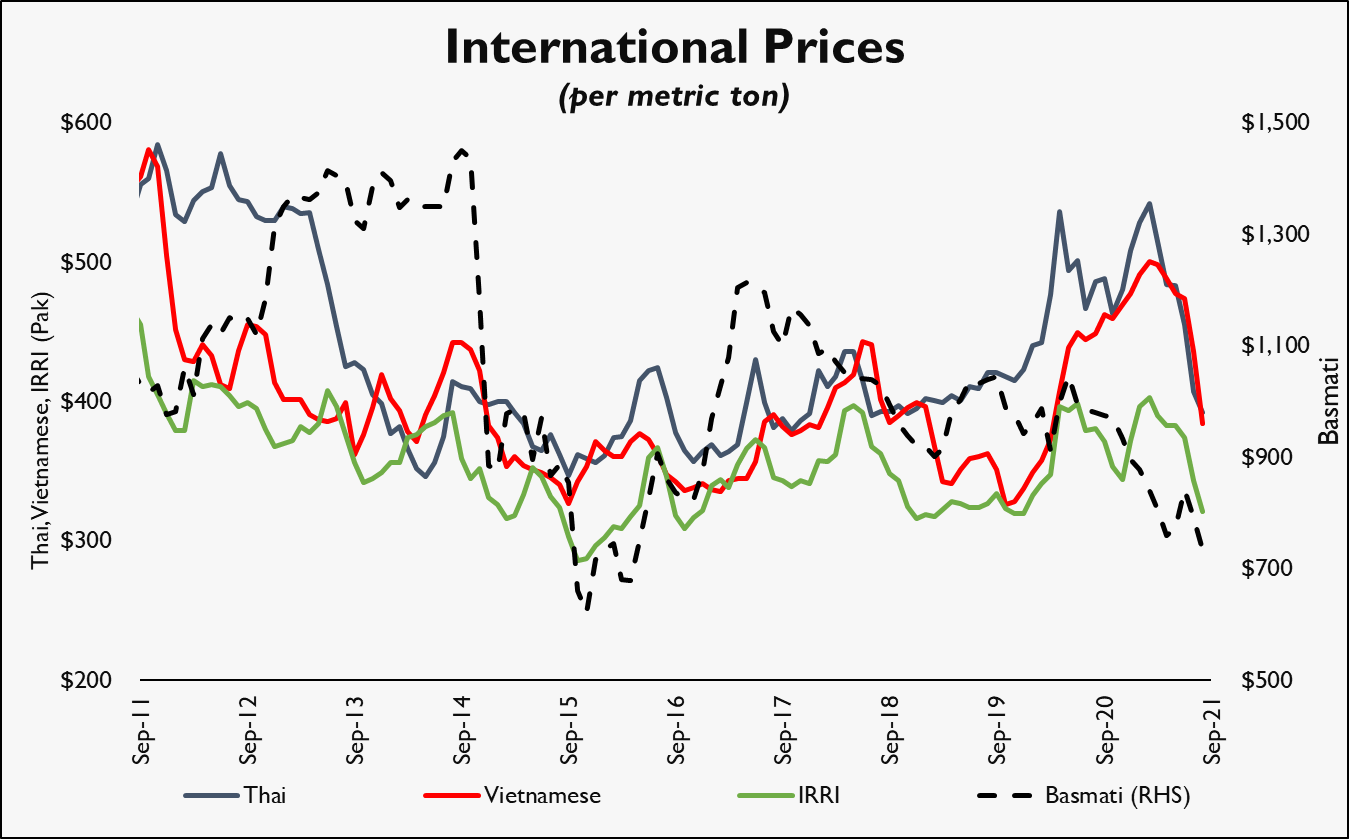

International prices of most rice varieties are trailing well below their pre-pandemic levels, and refusing to change gears from downward trajectory. Domestically produced rice varieties are also no exception to this global trend, which is an outcome of a glut in rice supply from East Asian countries.

It must come as little surprise to readers that Pakistan is a price taker in the international rice trade, especially due its tiny share in non-basmati varieties production. Since non-basmati varieties are mainly produced for export markets, export volume has demonstrated resilience (as suppliers struggle to sell in local market). But pricing has certainly taken a hit, in line with international trend.

In case of basmati, global demand remains steadfast at roughly 5 million tons per annum, of which 0.6 to 0.8 million tons originates from Pakistan. Exporters from India meet more than 80 percent of the global demand, and thus enjoy unchallenged pricing power.

News reports from across the border suggest that India’s basmati exports may remain restricted close to 4 million tons in the ongoing fiscal year, due to lower production forecast in its local markets. Pakistani exporters thus have a golden opportunity to maximize volume exported, but some risks to thesis persist.

Exporters insist that ‘ocean freight gone wild’ risks hurting prospects, as buyer destinations are not entirely averse to higher prices. Ex-farm prices have already adjusted upwards in response to lower production across the border, further diminishing mills’ margins. On the other hand, buoyant demand for local consumption means millers are happy to offload their output in the domestic market, especially if price of substitute cereals (such as flour) also rise.

Given the complex dynamics, the recent round of currency depreciation has offered some encouragement to exporters, which may be dampened due to change in macro-settings: the possibility of an upward correction in Rupee as a result of an agreement with IMF. If that happens, Pakistan’s rice exports breaching $2.5 billion in FY22 shall remain a mirage.

Comments

Comments are closed.