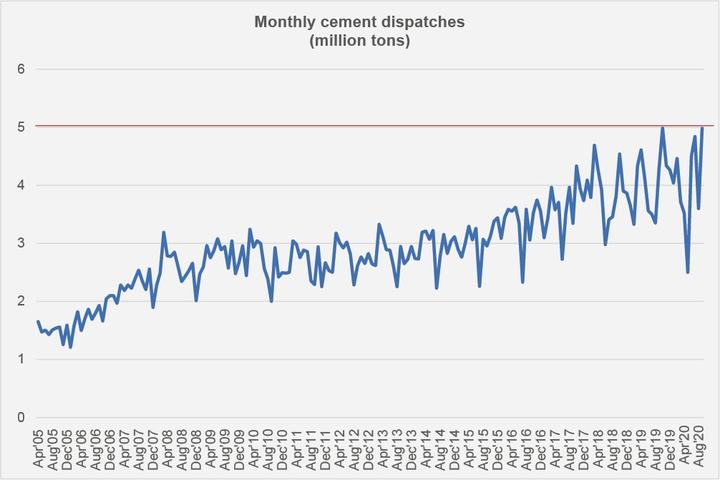

Demand for cement has finally started to roll in and with considerable aplomb. In September in fact, cement dispatches reached their highest in history, touching almost 5 million tons, comparable to this time last year when cement suppliers sold 4.98 million tons of cement in Oct-19. It has helped that the great recovery comes after a down-time when the country went into lockdown with most plants (and construction activities) being shut down for days.

Now that business has resumed, construction activity has once again picked up, this time with a much greater kick as the government-announced construction amnesty package has begun to yield its expected outcomes. This will only pick pace as the economy enters 2021 which will could prove to be a pivotal year for the construction industry at larger. Several dams are also entering construction phase which according to estimates will yield about 3 million tons of cement demand annually.

Cumulatively, in the first quarter, sales dispatches have grown a strong 20 percent, of which exports are channelling 20 percent share in the total dispatches; September recording nearly a million tons of cement being sent abroad. Granted this share has been growing since last year as presence of certain cement suppliers in clinker markets has grown, and despite cross-border sales recording nill sales on account of countervailing duties imposed by Indian government on Pakistani goods. Sales to Afghanistan have grown but not by too much.

Stronger demand will certainly bring back earnings lost during last year when a poor combination of low demand-low price retention scenario brought cement companies to their heels. Capacities across the industry have grown with major capex involved, in anticipation of the then-imagined CPEC-led demand. A lot more development is now planned by the government—including the contentious Karachi Transformation Plan. A good share of total demand will come from the private sector as the no-questions-asked policy of the government—in addition to substantive incentives—would welcome undocumented money into the documented economy. Such a money whitening scheme would be more beneficial for the economy, given it feeds into countless large and small productive sectors and would multiply economic activity. 2021 is the year to watch; and may even be the year to beat.

Comments

Comments are closed.