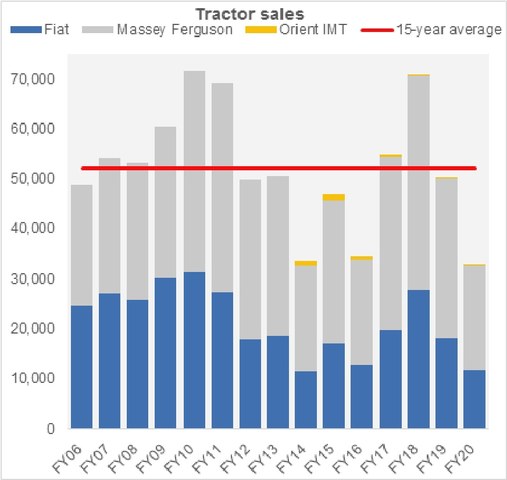

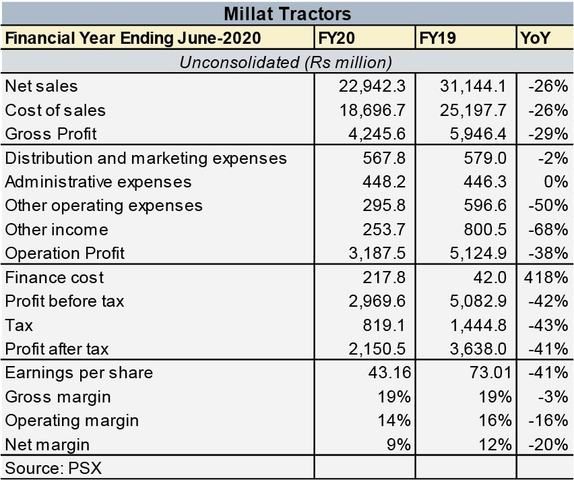

Despite the tractor industry trailing its lowest volumes in years, market leader Millat Tractors is turning a profit—down by Rs1.5 billion from last year. Volumetrically, Millat recorded a drop in sales of 35 percent but revenues did not fall by that much. Margins also surprisingly maintained on the same level as last year. It could have been far worse, given the sudden onslaught of the coronavirus.

The company which sources most of its materials and inputs locally remained almost shielded from the visible decline in market demand. Farmers are price sensitive and often delay mechanization if their buying power reduces due to inflationary pressures. High borrowing cost is also a major deterrent. With that in mind, Millat’s balance sheet looks pretty good.

The company’s revenue per unit sold (estimated using PAMA’s sales numbers) rose by 15 percent while its cost per unit sold grew by 14 percent. If rupee depreciation had a negative impact, it was offset by the higher price fetched on sales. The company also happens to be an exporter which provides it an advantage of diversified markets.

The company saw a slight increase in overheads—6 percent as a share of revenue in FY20 against 5 percent last year which put pressure on earnings. However, though comparatively finance costs have grown in FY20 against last year due to double-digit interest rates; as a share of revenues, the burden is small—about 1 percent resulting in having only a minor impact on the bottom-line.

Though profits fell by 41 percent, a number of factors are working in the company’s favor as it moves into FY21. Interest rates are down to single-digit (and the upcoming MPS is expected to remain steadfast at that level) which will bring down cost of borrowing for farmers. Cheaper financing will allow more farmers to borrow for tractors instead of buying on cash which is more difficult to do, especially for smaller farmers. In addition, the government announced an agriculture package for farmers to the tune of Rs50 billion—of which Rs2.5 billion is earmarked towards a sales tax subsidy on tractors. This package will certainly boost agri economy and farmers’ ability and means to mechanize. Thought risks such as the locust outbreak or the delay in sales tax reduction may limit demand. But if it grows and perseveres, Millat’s operations will blossom.

Comments

Comments are closed.