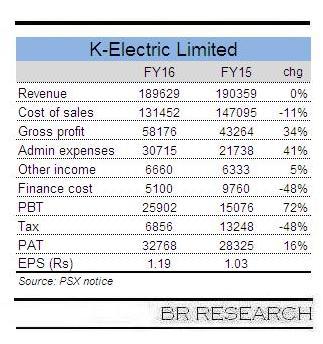

K-Electric made record after-tax profits in FY16. Why does it even matter now? KE announced its financial results for FY16 only yesterday. That is why. Wonder if much can be analyzed into and inferred from numbers reporting last year’s performance. But KE did make serious profits, continuing the trend that began in FY12, when the P&L turned green.

The EBITDA for the integrated company soared massively by 29 percent year-on-year. The improvement could be seen in almost all head of accounts, with an exception for high administrative expenses. Low oil prices and lower interest rates have both played their part in helping gross margins and lowering finance cost, respectively.

As the KE and Shanghai Electric deal hangs in balance, uncertainty is expected to continue to surround the whole scenario. KE has asked formally Nepra to formally review its multi-year tariff for KE, having voiced serious criticism in the media and other forums. To be fair to KE, some of its concerns hold fair ground and have been substantiated by sound arguments.

It is no secret anymore that KE’s revival, especially that of its financials, has been nothing short of exemplary in the past four years. It surely has not been achieved without bringing in efficiency, commitment and discipline – at most levels. Yes, there have been slippages too, as time and again have been pointed out by the regulator – and KE has paid the price too.

Cutting a long story short, Shanghai Electric deems the revised MYT for KE unfair and unviable in its current form. This column partially agrees that such a drastic cut in tariffs would be a tough ask for anyone running the affairs, Shanghai or otherwise. This may well be a significant change in terms of revenues, profitability, cash cycle, and viability. Such a drop in tariff would mean a dent of no less than Rs40-43 billion on the top line, and then it surely gets difficult to stage a comeback from there, as the net cash margins do not look sustainable.

That said, a middle ground needs to be found, as KE surely has come a long way from the dire straits of 2000s. There are some incentives for KE in the revised tariff too, such as allowing for Karachi’s law and order situation in the T&D losses.

Shanghai Electric had shown intent of investing a massive amount in excess of $9 billion in the company over the course of ten years. Karachi stands to benefit from the experience and expertise of Shanghai Electric, and it is in the best interest of all stakeholders that a solution is reached at - sooner. Losing should not be an option.

Comments

Comments are closed.