The market (banks) is demanding more. The government is not issuing international bonds whereas over reliance of deficit financing on commercial banks is increasing. It is a ‘net-injection’ money market driven by banks. Treasury offices are keeping a close eye on weekly SPI numbers and international oil prices. Seeing these heading north, the bids moved in the same direction.

The cut off yields for 3M and 6M papers increased by 7 bps and 6 bps to 7.25 percent and 7.55 percent. The 12M paper was outrightly rejected. Lowest bid was 10 bps above the last auction acceptance. That was not acceptable to the Q-block which in last few auctions was showing generosity in terms of acceptance.

But the market is craving for blood. The forward guidance given by SBP was offered to show market a direction. It seems that this has been taken lightly. Soon, market shall get to know what SBP means. It needs to take the signal seriously and perform accrual base mathematics to find optimal yield. Demanding higher rates and showing low interest in 1-year paper is market’s short sightedness – but what does one expect from a market that is dominated by commercial banks.

No rate hike in March – that is the writing on the wall. The question is what might happen by May, and afterwards. If there would be any increase, it would not be more than 50 bps, which can also be postponed. The world has changed since Covid. The global interest rates are expected to remain low for foreseeable future as the debt story is not good anywhere.

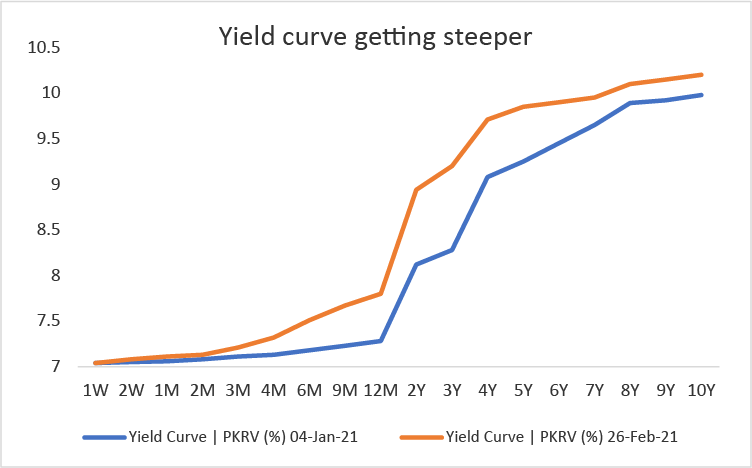

With low world rates, and manageable current account deficit at home, double-digits rates are no longer possible in Pakistan in the foreseeable future - irrespective of the IMF program. The inflationary pressures are from supply side such as food administration issues, global supply chain bottlenecks, and rationalization of energy tariffs.

There are no signs of wage-price spiral. The output gap is still in negative territory – as LSM is yet to reach the peak levels recorded in 2017-18. Economic expansion is ongoing although there are few signs of overheating anytime soon. The international oil prices could be of worry if the $60/barrel+ oil rates persist in the following quarters.

SBP is consistent in its forecast of inflation at 5-7 percent in the medium term. The full year inflation in FY21 shall remain around 8-9 percent, with lower number next year. Seeing this, the 5Y and 10Y secondary market rates at 9.84 percent and 10.2 percent are good to grab.

Within T-Bills, the market has shifted from 3M to 6M papers in the last two auctions. This implies that the market has already priced in no change in March. But there are doubts about May – not only on the increase, but also on the quantum of increase.

SBP must be more explicit in its monetary policy statement and post-policy analyst briefing about the future direction. It may take few more policy decisions for market to start taking forward guidance in the letter and spirit.

Comments

Comments are closed.